Brief technical analysis of the major stock indices followed by updates on most of the swing trade ideas posted over the past couple of months.

The video begins with analysis of the stock market via SPY & QQQ as well as both my short-term & longer-term outlook & trading plan for each. Next, updates on the following trade ideas, roughly in the following order on: SOXX, NVDA, INTC, MU (follow-up on coverage in yesterday’s video), COR, MCK, CAH, TLT, XLF, KRE, V, MA, AXP, PYPL, RKT, COOP, UWMC, UNG, DBA, DJP, WEAT, CORN, SOYB, & XLU. Towards the end of the video I cover the two big China ETF’s: FXI & PGJ. I also intended to update gold & silver but inadvertently left them out of the video so I’ve included those updates with charts below.

GLD broke below the 60m wedge yesterday but /GC has not triggered the confirming sell signal (as per yesterday’s post) of: “a solid break and/or 120-minute close below this bearish rising wedge pattern on the 120-minute chart”. 60-minute chart below:

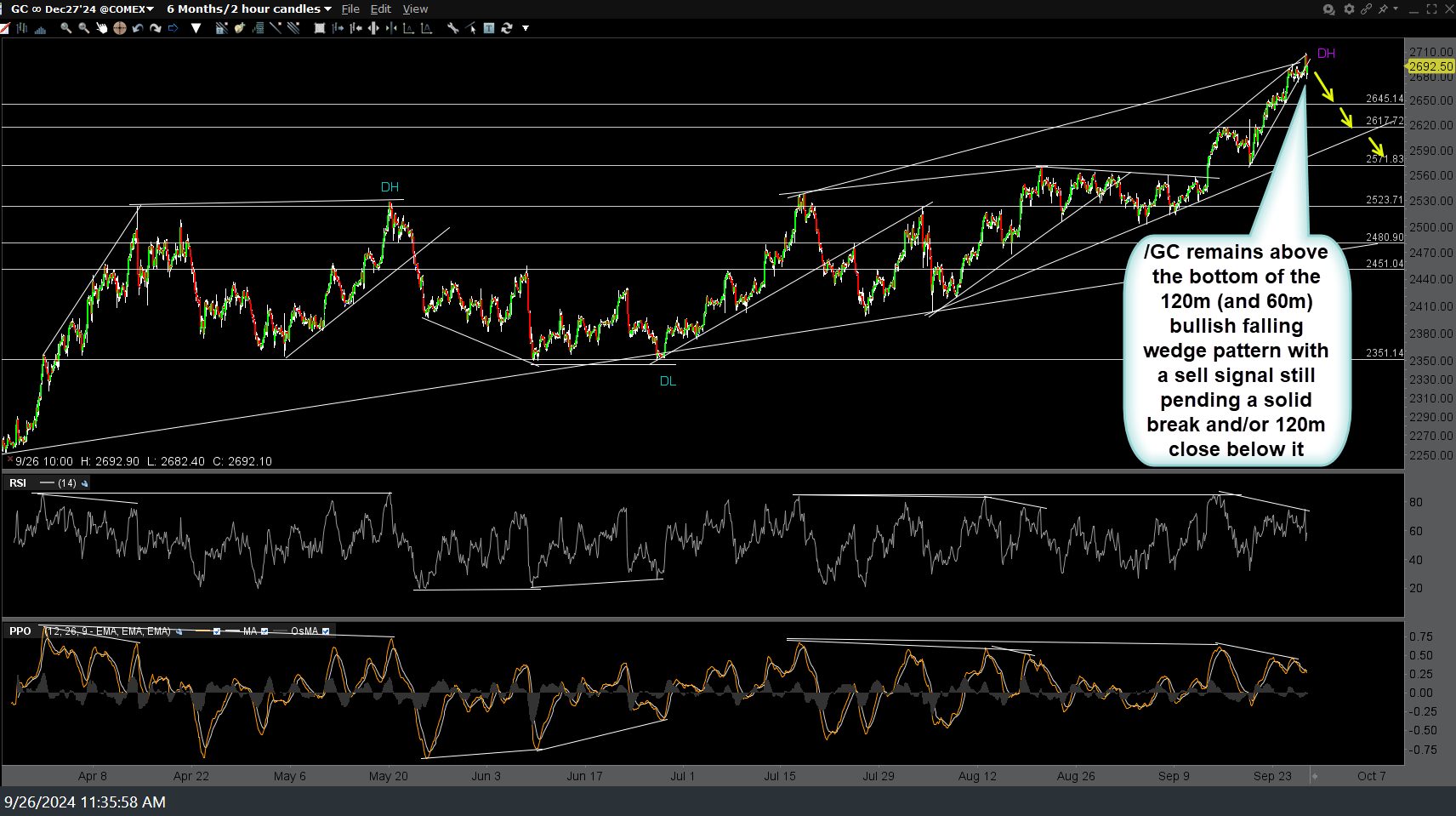

/GC remains above the bottom of the 120m (and 60m) bullish falling wedge pattern with a sell signal still pending a solid break and/or 120m close below it. 120-minute chart below:

No change in the technical posture of SLV as it is currently trading right where it was posted yesterday (literally 1¢ above). 60-minute chart below.