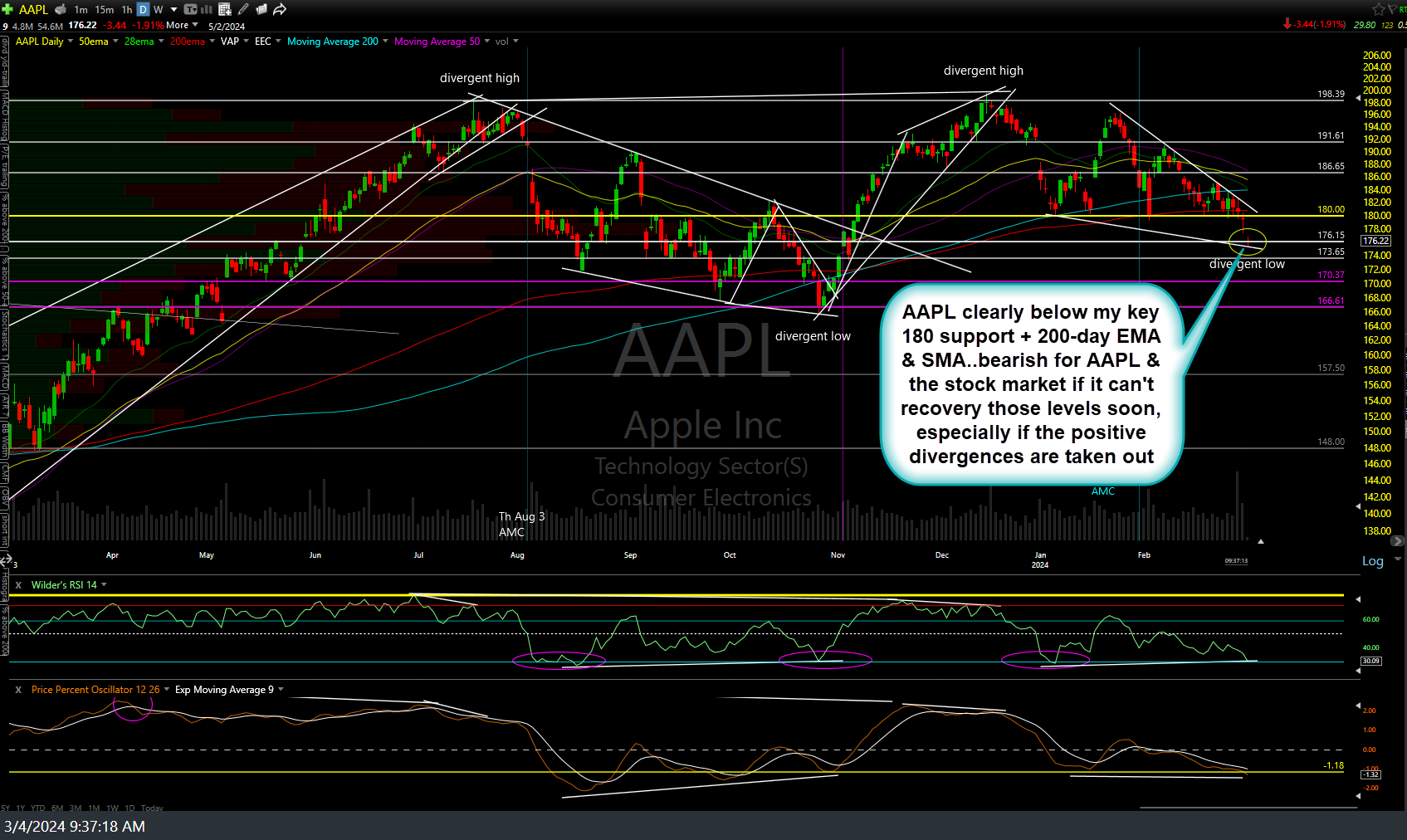

Here are a few of the things on my radar today. AAPL (Apple Inc) is trading clearly below my key 180 support + 200-day EMA & SMA… bearish for AAPL & the stock market if it can’t recovery those levels soon, especially if the positive divergences are taken out. Daily chart below.

IEF (10 yr Treasury bond ETF) was rejected where expected (bounce target/top of yellow zone) which keeps the stock market & many stocks (with confirming bearish technicals) on a sell the rips (into resistance) mode for now. 60-minute chart below.

TSLA (TSLA Inc.) is currently breaking below uptrend line in early trading with a solid close below likely to signal the counter-trend rally off the recent divergent low at support is over. Daily chart below.

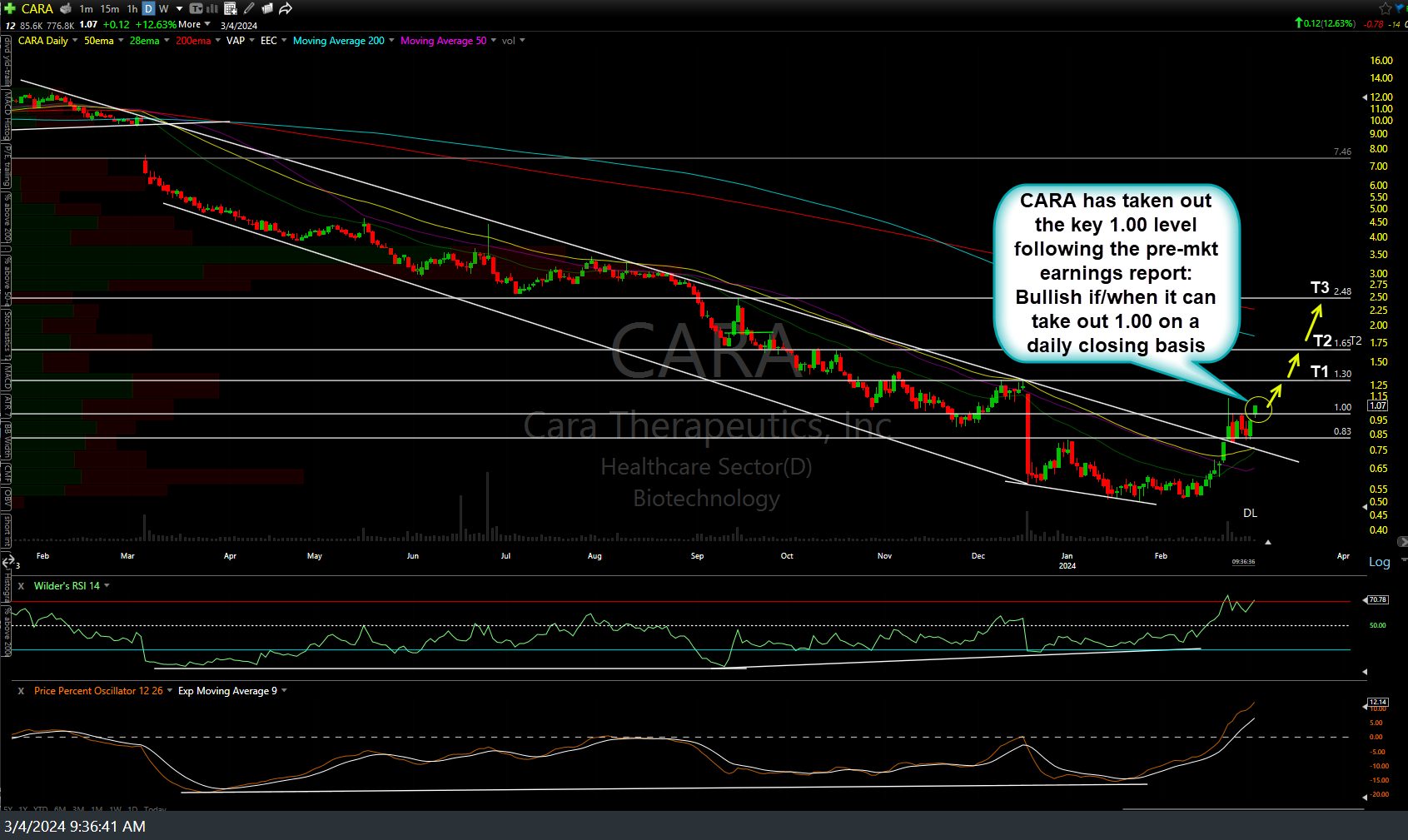

CARA (Cara Therapeutics) has taken out the key 1.00 level following the pre-market earnings report: Bullish if/when it can take out 1.00 on a daily closing basis. Daily chart below.

Other things to note today are the precious metals & miners longs (silver, SIL, GDX, etc.) which continue to rally & still look constructive. Ditto for the natural gas long swing trade. The DBC (commodity ETF) long also continues to rally off that 21.77ish support & is starting to punch thru the downtrend line (cover in last week’s video) so far today with crude oil still holding above the recent breakout level for now.

Should the breakdown in AAPL stick & IEF remains in the yellow zone or, even better, continues to fall into the recently revised orange zone (i.e.- below the recent lows on IEF), that should be net bearish for the stock market & vice versa (bullish) if AAPL can recover 180 and the 200-day moving averages (and/or IEF rallies solidly into the green zone).