The following video & chart images provide technical analysis & swing trade ideas on US Treasury Bonds, Crude Oil, VXX & the $VIX, followed by an update on XOP. Silver or Gold level access initially required.

$TNX 10-yr T-bond yield making what I suspect will prove to be a momentum-fueled overshoot of the key 14.17 resistance level, followed by a pullback to at least the uptrend line.

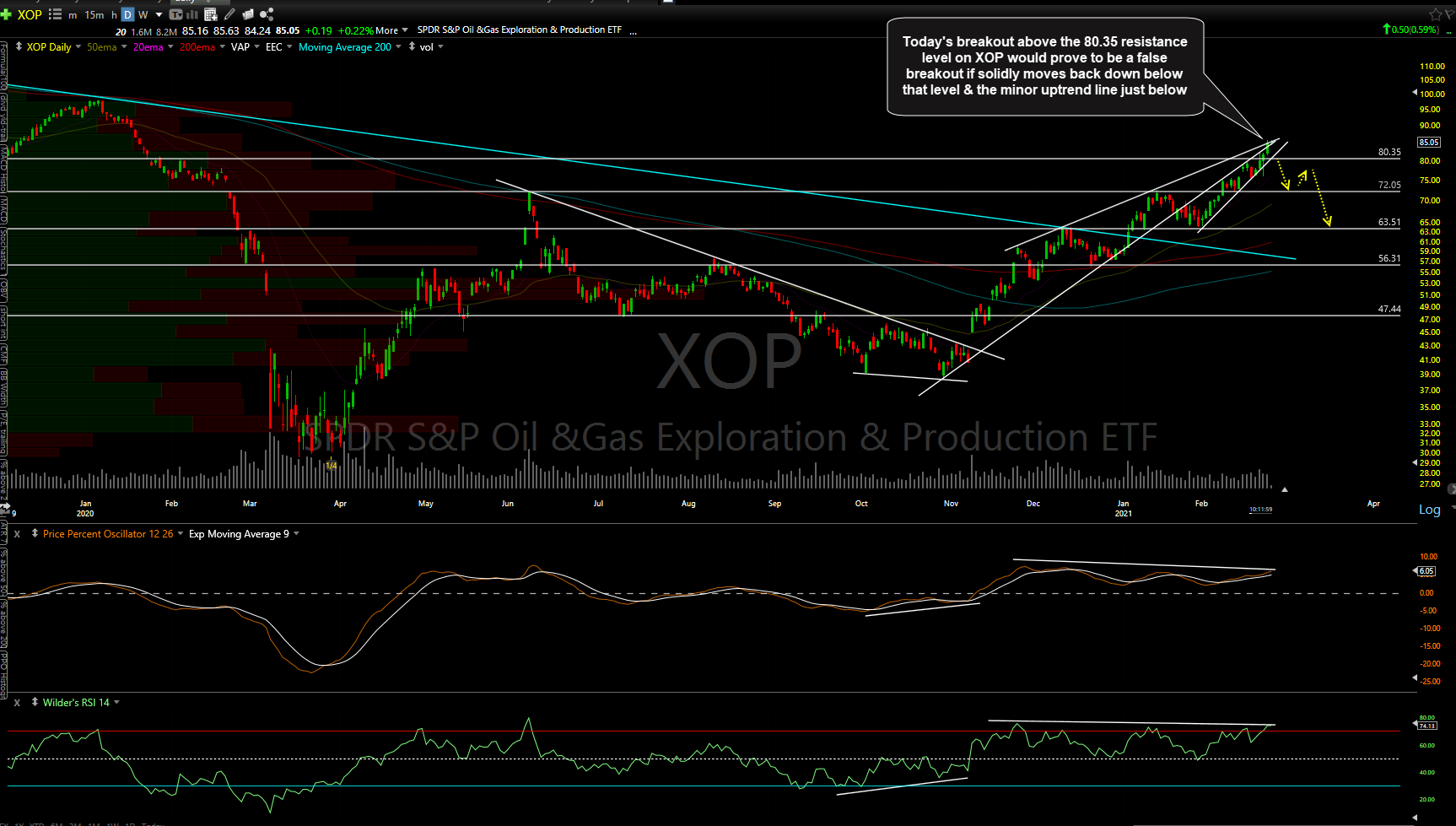

Today’s breakout above the 80.35 resistance level on XOP would prove to be a false breakout if solidly moves back down below that level & the minor uptrend line just below.

With crude oil & the US Dollar inversely correlated, should the positive divergences on this 60-minute chart of /DX play out for a decent rally, that will likely bring /CL down to my 58.90ish target.