/SB (sugar futures) has hit & taken out the first target/resistance of 0.1556 with a continued rally up to at least the 0.1589 level still likely. SGG or CANE are the sugar ETNs.

/ZW (wheat futures) has clearly taken out the 627.645 resistance level following yesterday’s downtrend line breakout, further increasing the odds of more upside in the coming days/weeks. WEAT is the wheat ETN.

So far, /GC has had the typical reaction off the initial tag of the 1759.75 target/resistance level with the next buy signal on gold to come on a solid break above it. GLD is the gold ETF & GDX the gold miners ETF.

/ZN (10-yr Treasury bond futures) broke below the minor uptrend line, triggering today’s pullback with the next buy signal still pending a solid break above the 133ish target/resistance level. IEF is the 7-10 yr T-bond ETF & TLT is the 20-30 yr T-bond ETF.

/NG (natural gas) still appears poised to run if it can clearly take out the 2.526ish level. UNG is the natural gas ETN.

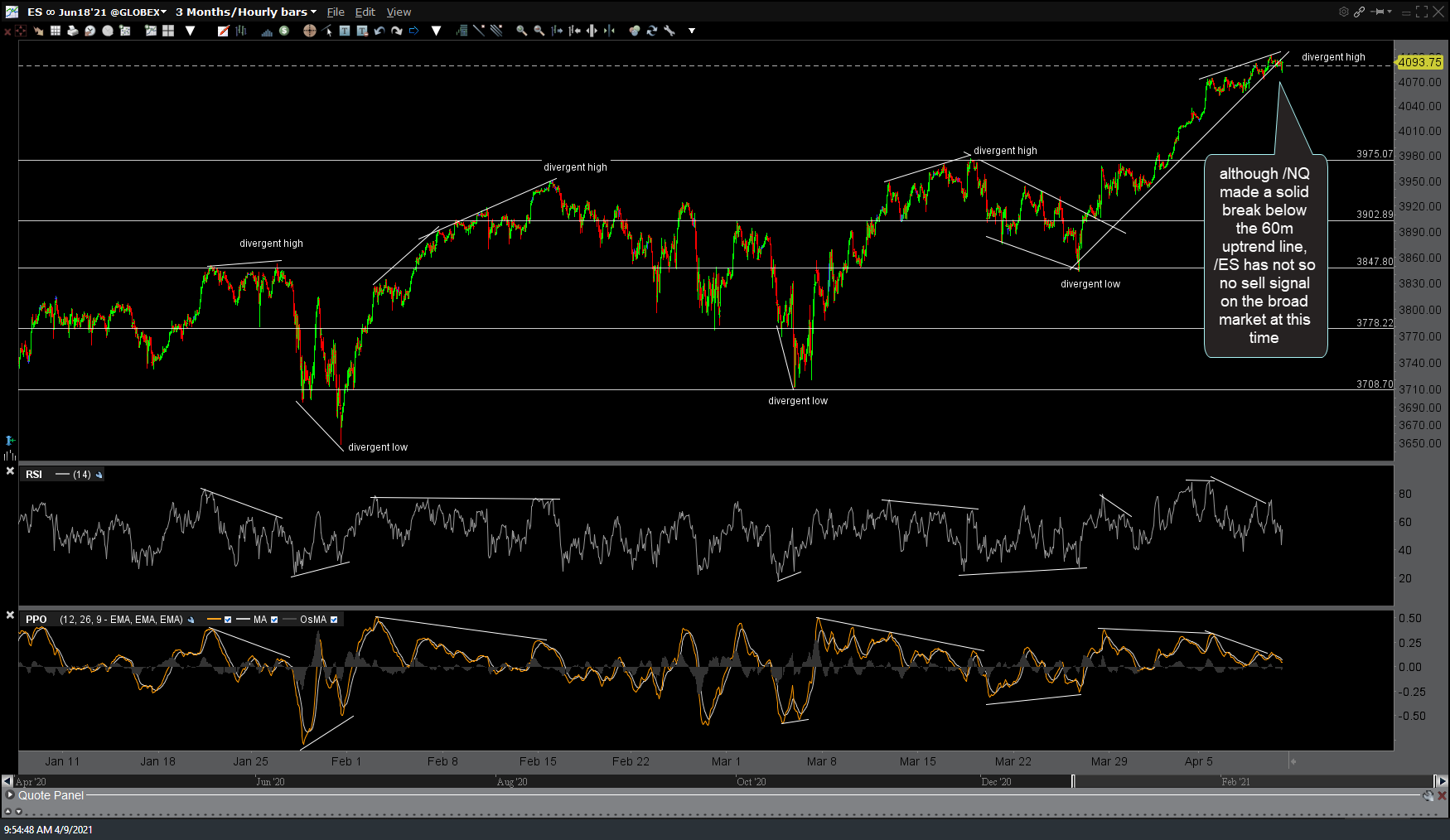

/NQ (Nasdaq 100 futures) has moved solidly below the 60-minute uptrend line although /ES has not, therefore, a sell signal on the stock market is still pending a solid breakdown in /ES (S&P 500), which appears likely to come today or early next week.