/ES (S&P 500 futures) continues to wedge higher with the divergences still well intact at this time. This new uptrend line isn’t very valid as there are only 3 reactions but worth watching for an impulsive break below as a potential sell signal. Should that occur, the 2955 level would be the next significant support to watch.

/NQ (Nasdaq 100 futures) also continues to wedge higher with the divergences intact but no sell signals at this time. I’ve added a minor uptrend line which may come into play although it would be preferable to get one more reaction to help validate that TL. The 7900ish level also remains key support.

/RTY small caps can’t seem to make up their mind whether the uber-dovish Fed is going to help them like the large-caps or not. /RTY & IWM has been erratic recently so the odds for a whipsaw signal are increased but watch for a breakout above or below the triangle pattern for clues to the next direction.

Regarding the equity market as a whole, I figured that I would share these comments that I posted as a reply in the trading room yesterday regarding the Fed’s recently full-on Dovish statements. In fact, the WSJ published a headline today titled The Most Dovish FOMC Minutes In Years. My reply was:

Short-term as in days to weeks, the negative divergences that were in place at last Wed’s reaction high in QQQ are still intact & much more often than not, divergences such as those end up playing out for a trend reversal so my expectation of a correction hasn’t abated at this time.

Also worth noting is the fact that QQQ is backtesting the trendline off the June 3rd lows today. Powell’s statement couldn’t have been more dovish so the big question is: Will this prove to be a knee-jerk reaction by those believing low rate can lift the stock market indefinitely despite the underlying fundamentals -OR- will the current trend of deteriorating macro fundamentals continue & derail the bull market, as has always been the case in the past.

Keep in mind that there is a scenario #3 which is quite bullish & that would be that the Fed has ‘effed-up & jumped the gun on rate cuts too early, should the recent economic weakness prove to be a brief aberration with the economy accelerating again soon along with a backdrop of lower-than-needed rates.

In response to that, someone else had commented: “exactly what a rate cut is intended to do: stimulate economic activity.” And while I will agree that is certainly an accurate statement, the key word there is “intended”. While that is the intended effect of a rate cut or rate cutting cycle, quite often, it isn’t the actual result as per my reply to that statement:

On Jan 3, 2001, the Fed cut rates by 50bp (1/2%) with the Nasdaq having it’s best day ever up to that point. That was the first cut in a new cycle. From that point, the Nasdaq fell 57%. In fact, investors would have done better had they held off buying stocks, tech or otherwise until the Fed started RAISING rates in 2004 (paraphrased quote from the WSJ).

Basically, that all loops back to my previous comments above in which there are basically three scenarios in play at this time:

- The economy continues to weaken, heading into a recession soon with the stock market to play a violent game of catch-up to the downside several weeks or months down the road.

- Yesterday’s bullish reaction to Powell’s more-dovish-than-expected comments was simply a knee-jerk reaction & very soon the bearish technical developments that have taken place since Q4 2018 as well as those potential bearish that have been building before & since then, such as the momentum & breadth divergences, will soon begin to play out in the form of the next major leg down.

- Or the recent deterioration in many economic indicators proves to be a brief aberration which would mean that the rate cuts were not necessary but will provide extra fuel for a continuation of the bull market as the macro fundamentals in the economy improve, quite possibly triggering a blow-off top in the market.

I still favor the second scenario but as they are all possible, I will let the charts be my guide as to how I position in regards to the broad markets. As of now, the R/R for the broad market still appears quite unfavorable on the long side yet we don’t have any sell signals to make a decent case for a swing/trend short position either. As such, I will continue to focus on alternative asset classes, sectors & stocks with the most bullish or bearish technicals while maintaining a diversified portfolio which segues into the next set of charts.

/ZB (30-yr T-bond futures) have taken out the 154’151 support & is coming up on the first uptrend line now. One could also short TLT or go long TBT (2x short long-term Treasuries ETF) in lieu of shorting /ZB.

/KC coffee futures continues to hold the 1.0534 on multiple test so far & continues to offer an objective long entry or re-entry here with a stop somewhat below. JO (coffee ETN) is a proxy for trading coffee & currently an official long trade.

We don’t have any hard buy signals on /ZW wheat futures yet although the R/R for a new long entry following the timely exit on the last official long on WEAT is now favorable anywhere from here down to but not much below the 492ish support level. WEAT is the wheat ETN which was recently an official long trade & also covered in yesterday’s Long Trade Ideas video.

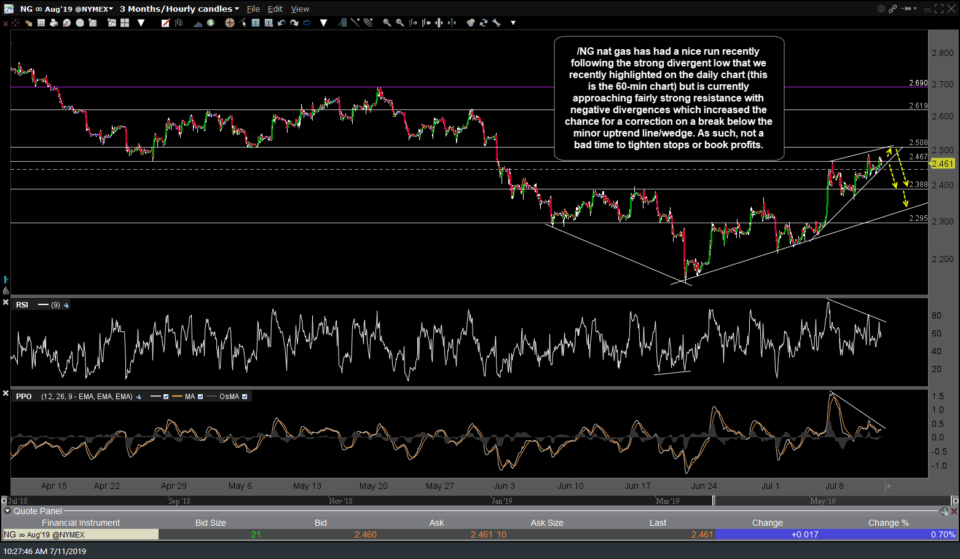

/NG nat gas has had a nice run recently following the strong divergent low that we recently highlighted on the daily chart (this is the 60-min chart) but is currently approaching fairly strong resistance with negative divergences which increased the chance for a correction on a break below the minor uptrend line/wedge. As such, not a bad time to tighten stops or book profits. UGAZ is the 3x long/bullish natural gas ETN which has been a proxy for this unofficial trade idea on nat gas & one could also try to game a pullback on either a continued push towards the 2.50ish resistance level and/or a break below the small wedge using DGAZ (3x short nat gas ETN).

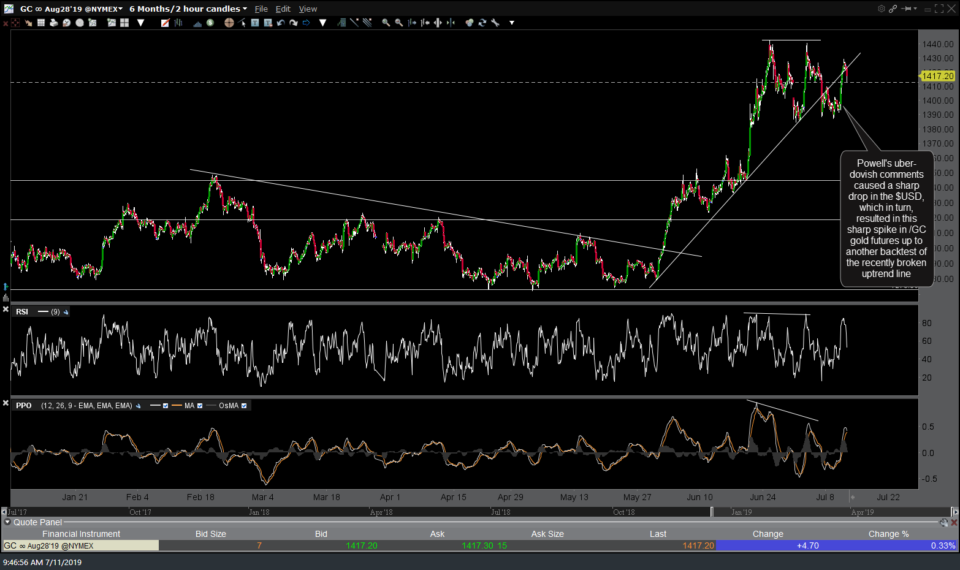

Powell’s dovish comments caused a sharp drop in the $USD yesterday which in turn, spiked gold & palladium (/PA) but only served to extend the existing divergences that were already in place.

Likewise, Powell’s uber-dovish comments caused a sharp drop in the $USD, which in turn, resulted in this sharp spike in /GC gold futures up to another backtest of the recently broken uptrend line.