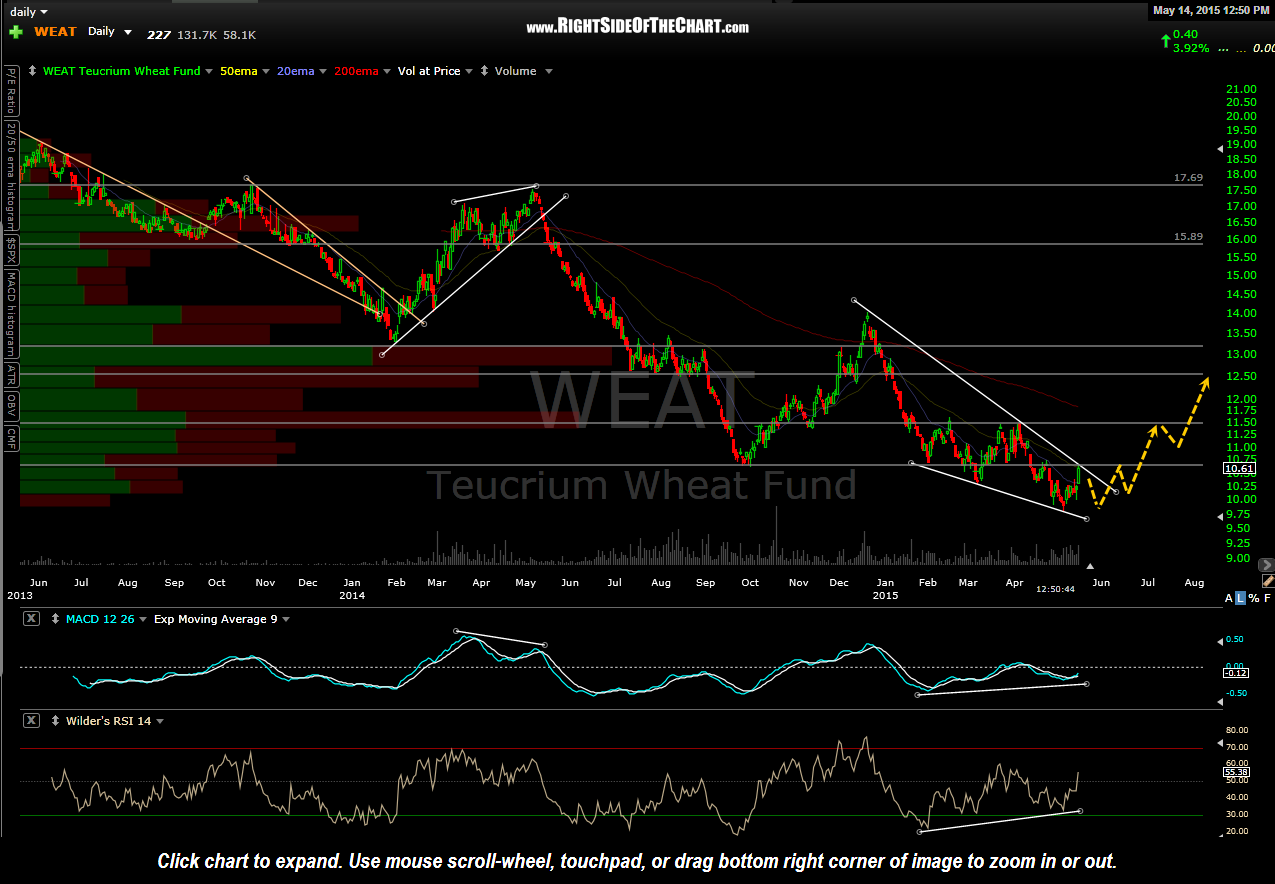

With the recent short on the energy sector and the addition of the JO (Coffee ETF) Long Trade Setup today, I wanted to reiterate my thoughts on the US Dollar as that will likely have an impact on both the success & timing of these trades. In addition to JO, I also plan to add WEAT (Wheat ETF) as a Long Trade Setup soon but as with coffee, I believe that WEAT, along with most other dollar sensitive commodities, may need one last thrust lower or at least some sideways price action before a meaningful & lasting rally.

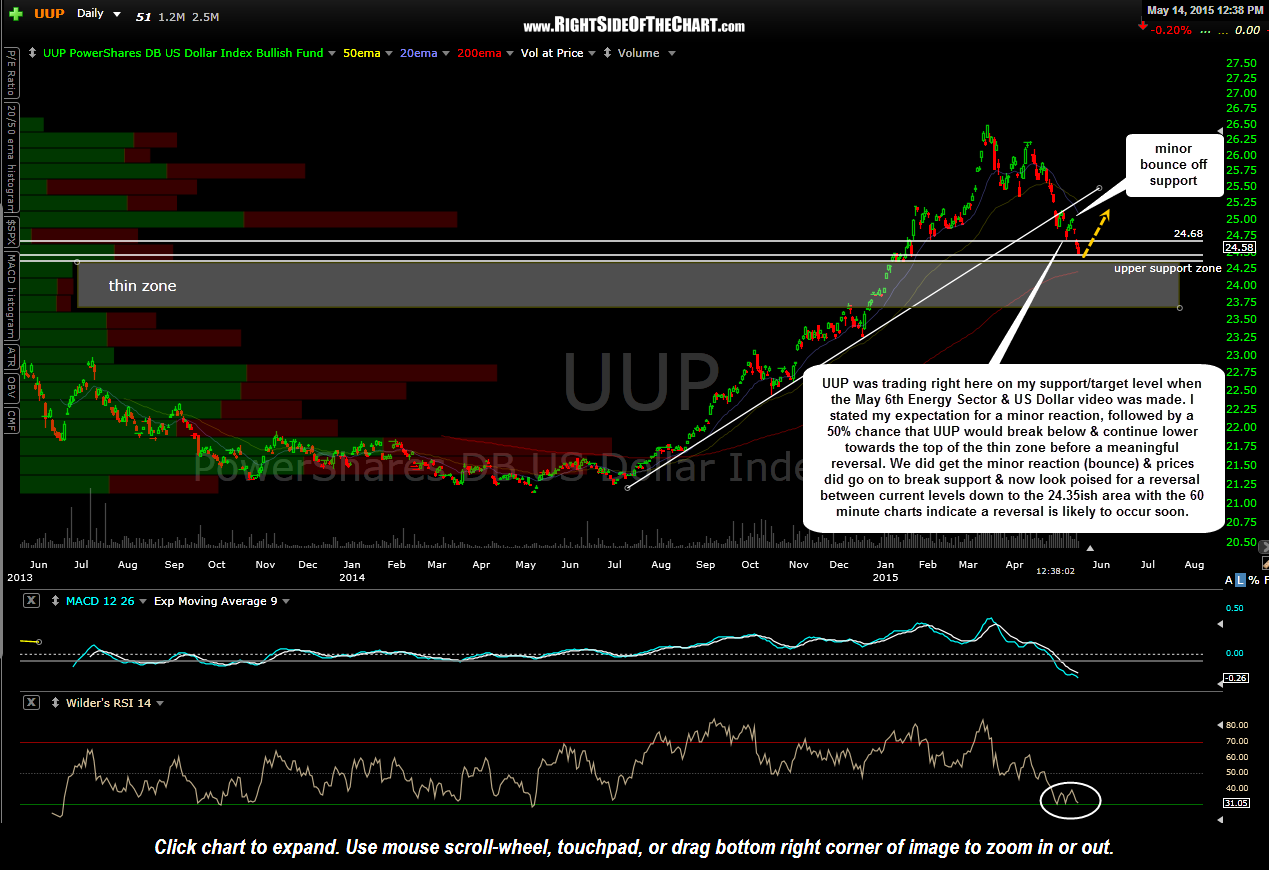

In the Energy Sector & US Dollar video that was published on May 6th, UUP (US Dollar Index ETF) was trading right on the minimum downside target level which was outlined back on the March 10th call for a correction in the US Dollar. In the video, I had stated my expectation for a minor reaction, followed by a 50% chance that UUP would break below & continue lower towards the top of the thin zone before a meaningful reversal. We did get the minor reaction (bounce) & prices did go on to break support & now look poised for a reversal anywhere between current levels down to the 24.35ish area.

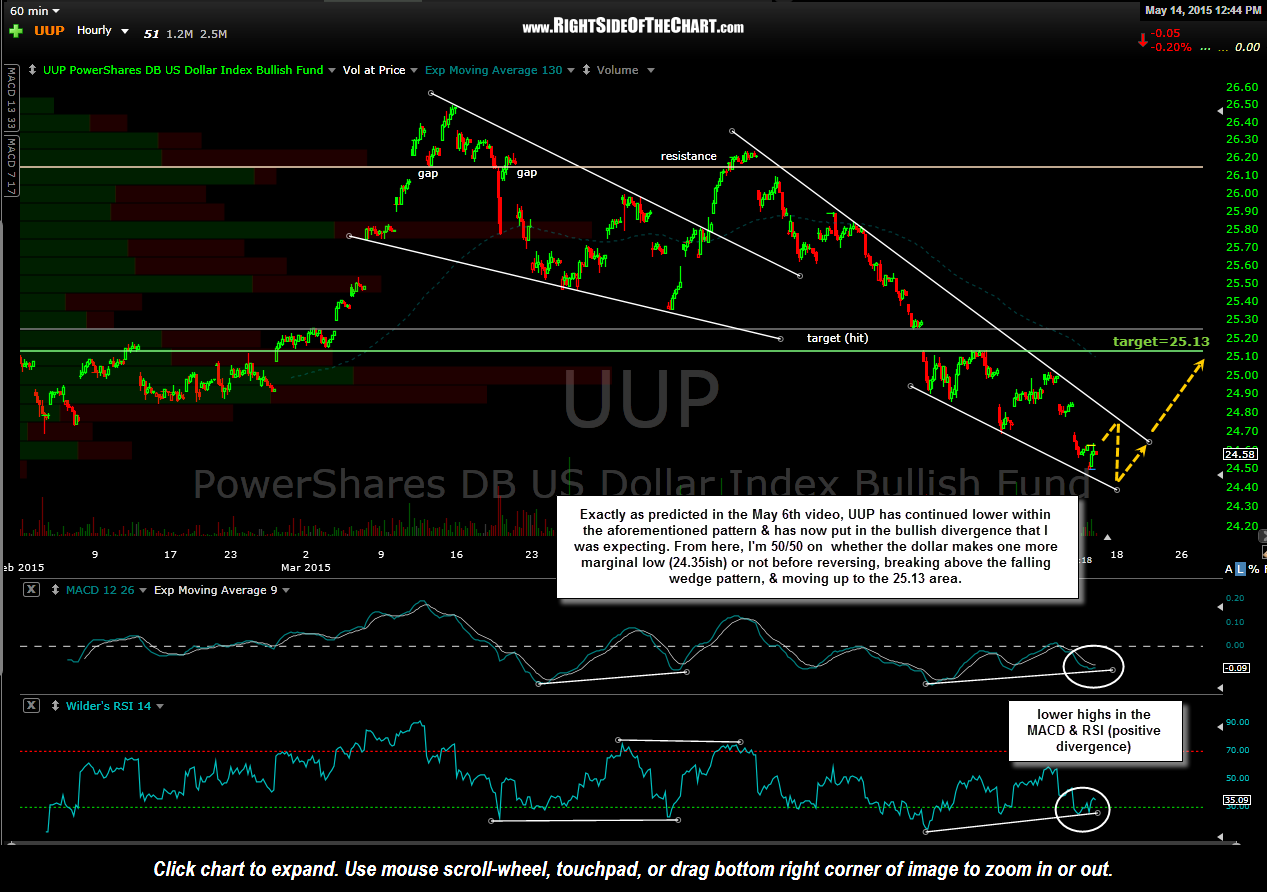

Not only is UUP playing out as expected so far on the daily time frame but the forecast laid out during that video for UUP on the 60-minute time frame is also playing out as predicted. UUP has continued lower within the aforementioned pattern & has now put in the bullish divergence that I was expecting. From here, I’m 50/50 on whether the dollar makes one more marginal low (24.35ish) or not before reversing, breaking above the falling wedge pattern, & moving up to the 25.13 area.

Should the US dollar reverse soon as expected, that would likely put pressure on the dollar sensitive assets such as oil & other commodities. That is one of the reasons that I am not adding WEAT as a Long Trade Setup just yet, despite the fact that price are currently trading at the top of that very bullish falling wedge pattern. Also note on the WEAT chart above that I have a horizontal resistance line that comes in right where the top of the wedge pattern comes in today as well, thereby providing dual, intersecting resistance levels that WEAT is current challenging. Even if WEAT were to take out those overhead resistance levels today or tomorrow, chances are that if my call on the $USD is correct, that breakout would likely fail soon or at the very least, WEAT would drift lower to backtest the wedge at a level below the breakout.

Regarding the ERX/XLE Active Short Trade, it is worth noting that nearly all of this morning’s strong gain on XLE have been slowly & steadily faded throughout the day. USO also continues to move lower after the recent backtest of the 60-minute rising wedge pattern. Should the $USD start to climb soon as expected, that would likely bring USO down to the next target around 19.28 and XLE down to the 78.20 final pullback target area.

Regarding the broad markets, there has been so much slop & chop lately that the near-term charts are about unclear as they get. The SPY has been tapping on the 212- 212.50 level since early February and could certainly made at least a brief spike should that level get taken out. However, all other major US indices such as the QQQ, MDY, & IWM are still well off their highs & despite any breakout to new highs in the SPY or another other US indices, the R/R for being long the broad markets still looks very unfavorable at this time.