In addition to investment grade bonds (treasuries, munis & BBB+ rated corporate bonds) which were covered in yesterday’s post, a few other potential bottoming plays that stand out at this time are gold, silver & the related mining stocks, cannabis stocks and some the major currencies (vs. the US Dollar) such as the Euro, Yen, Pound Sterling.

Essentially, other than the cannabis stocks, which have virtually zero correlation to the stock market or any currencies, including the US dollar, all of the above (gold, silver, GDX, major currencies & even the investment grade bonds) have a fairly strong correlation to the US Dollar. As such, my expectation for a reversal in all of these asset classes, all of which are in very clear & strong downtrends, hinges largely on a reversal in the US Dollar. (Translation: If my call on the reversal in the US Dollar soon is wrong, then my call on a reversal or at least a meaningful counter-trend bounce in those other asset class will most likely not pan out either).

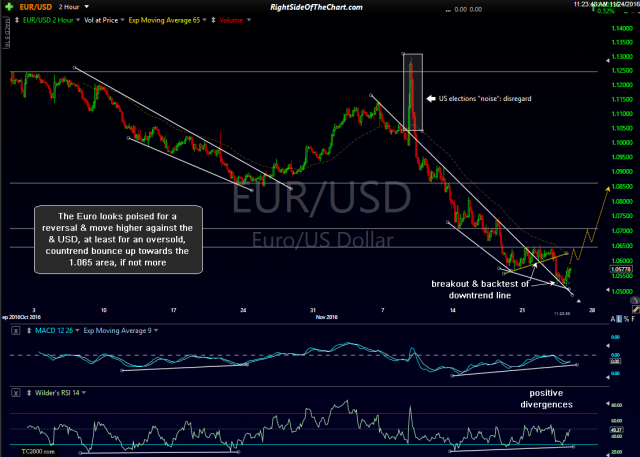

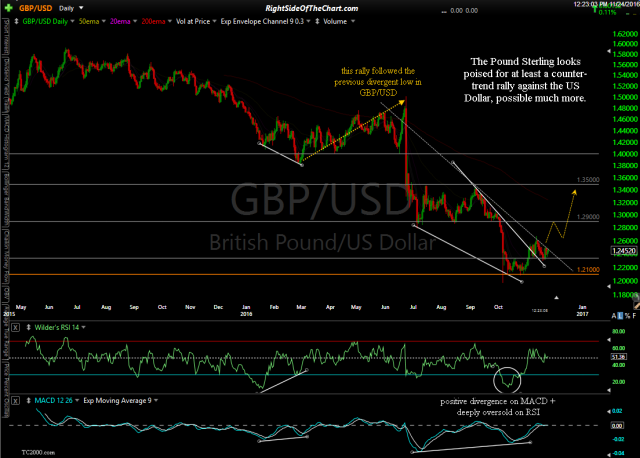

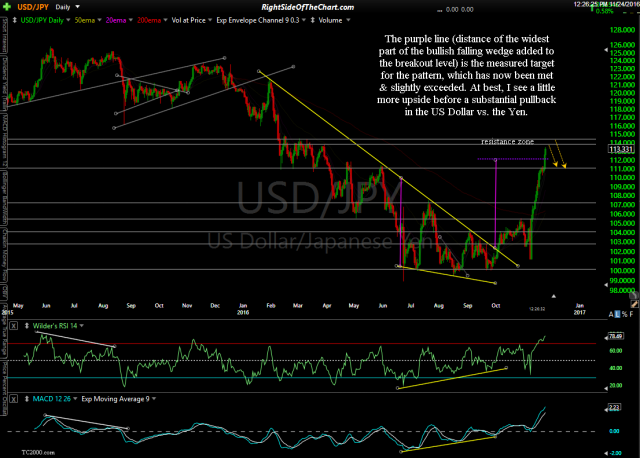

Starting with the US Dollar (via the Dollar Index, $DXY), this 1o-year weekly chart highlights some very powerful negative divergences that have been forming as the $USD has recently broken out to new multi-year highs. While weekly charts can help to formulate the longer-term outlook for an index, security, commodity or currency, it is best to move down to the daily & even intraday time frames in order to time your entries & exits on a position. The charts below (US Dollar vs. the Euro, Yen & Pound Sterling) make the case for an imminent reversal in the US Dollar which, at the very least, should produce a healthy counter-trend rally & possibly more.

- EUR-USD 120-min Nov 24th

- EUR/USD 2-day candles Nov 24th

- GBP/USD daily Nov 24th

- USD/JPY daily Nov 24th

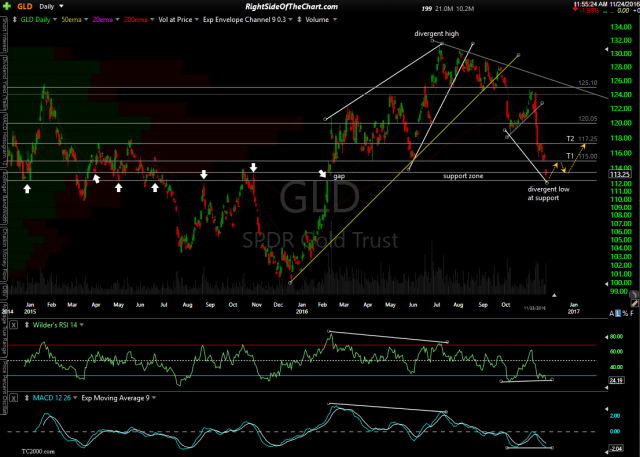

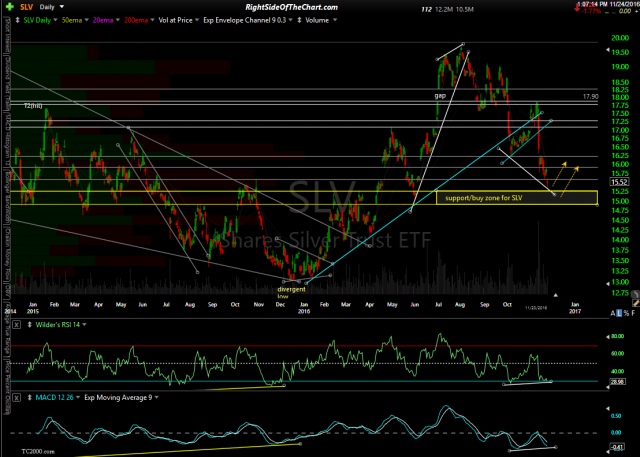

Should these scenarios play out, that would likely translate into a trend reversal (i.e.- rally) in gold, silver & the related mining stocks with those charts confirming the likelihood of a meaningful oversold rally/counter-trend bounce & possibly more, in the coming weeks to months. The daily chart of GLD, SLV & GDX highlight some objective “buy” or scale-in/support zones as well as some potential price targets.

- GLD daily Nov 24th

- SLV daily Nov 2th

- GDX daily Nov 24th

Unrelated to the US Dollar but on a similar theme of sharp, oversold sell-offs down to support, the majority of the cannabis stocks that were most recently highlighted in this video on Tuesday mounted some very impressive gains the following day (Wednesday) as the buyers stepped in with conviction at those highlighted support levels/buy zones. Too many charts to post but here’s the daily chart of VAPE as an example, with the stock exploding to post a 56% gain yesterday on high volume after kissing the previously highlighted uptrend line. My cannabis watchlist to the left (all of which were covered in the video) highlight yesterday’s gains along with the volume buzz which indicates that the volume on most of those trades were well above average (a bullish sign of confirmation).