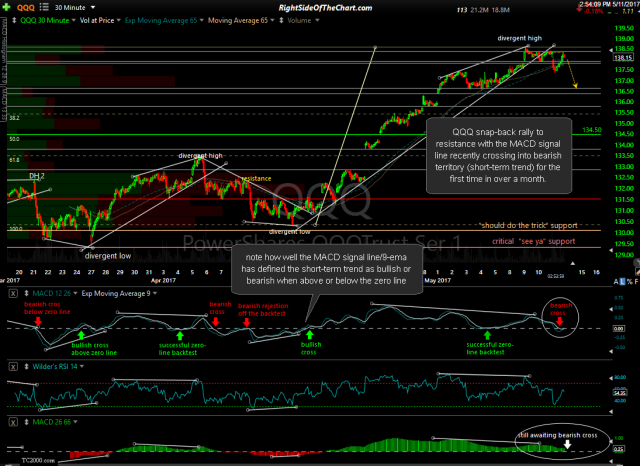

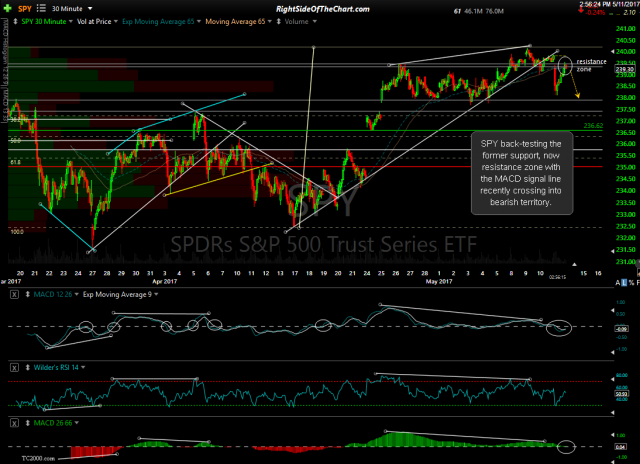

After a sharp drop in the first hour of trading, QQQ & SPY have experienced snap-back rallies into resistance with the MACD signal line recently crossing into bearish territory (short-term trend) for the first time in over a month. Note how well the MACD signal line/9-ema has defined the short-term trend as bullish or bearish when above or below the zero line. While these are 30-minute charts, my preference is to see both the MACD and PPO signal lines cross below their respective zero lines as well as bearish crossover of the 13/33-ema pair on the 60-minute time frames. As of now, we have a bearish cross of the 13-ema below the 33-ema on the SPY 60-minute with the PPO 9-ema having fallen exactly to the zero line (but not yet below) with both of those 60-minute trend indicators still somewhat comfortably in bullish territory (above their zero lines) at this time, again, on the 60-minute time frame.

- QQQ 30-minute May 11th

- SPY 30-minute May 11th

While I might normally use this bounce back to support & a few (but not all) short-term trend indicators flipping to bearish to add short exposure, one thing giving me pause is the fact that treasury bonds are not rallying nor are junk bonds (high-yield) selling off, as is often the case if the institutions were expecting a sell-off in the markets. We do, however, have gold moving higher today despite the US dollar trading slightly higher as well, which could be the result of a flight-to-safety bid. However, the fact that treasuries, the primary flight-to-safety vehicle for the ‘smart money’, are actually trading lower today is what is giving me pause at this time. As such, I’m sitting tight for now, waiting to see how things unfold over the next day or so although I remain net short by a wide margin at this time.