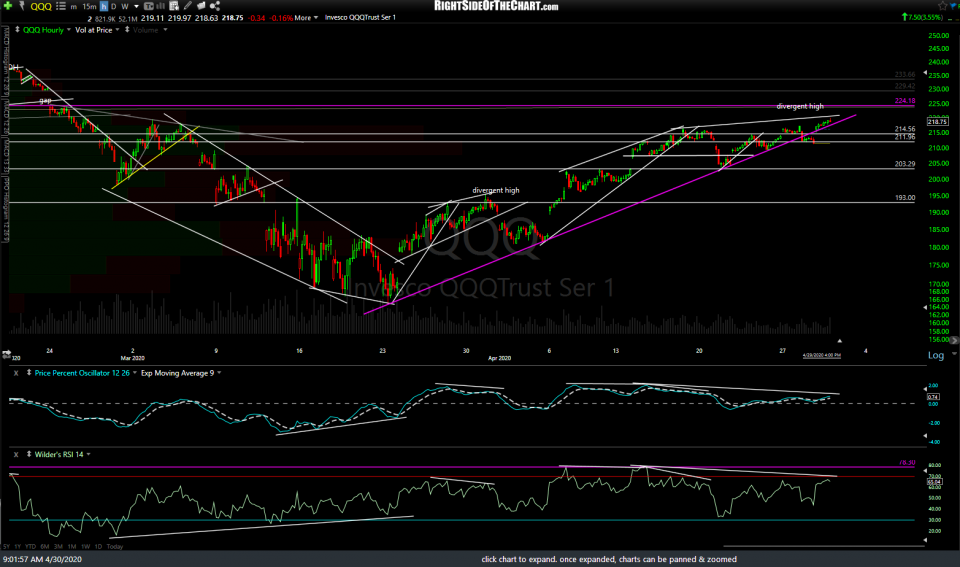

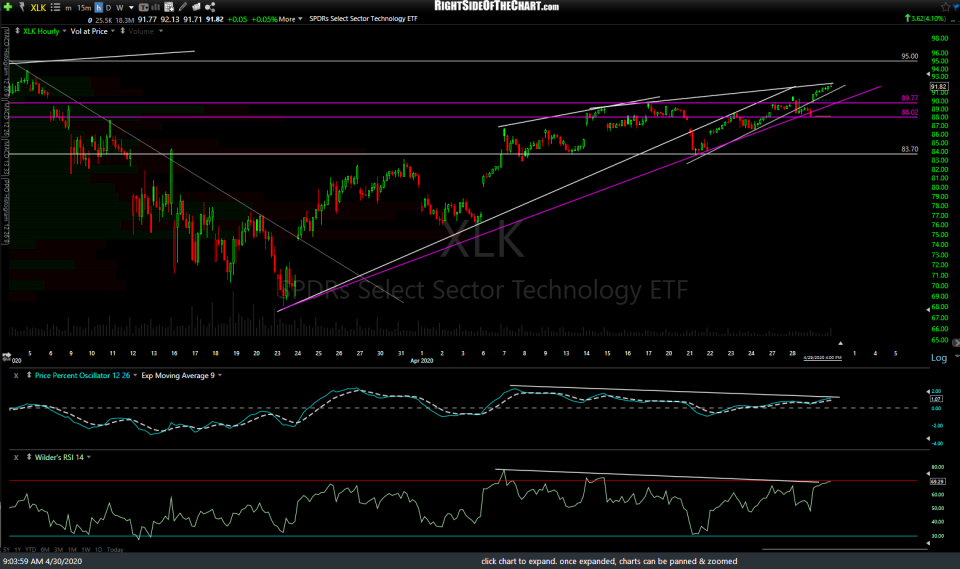

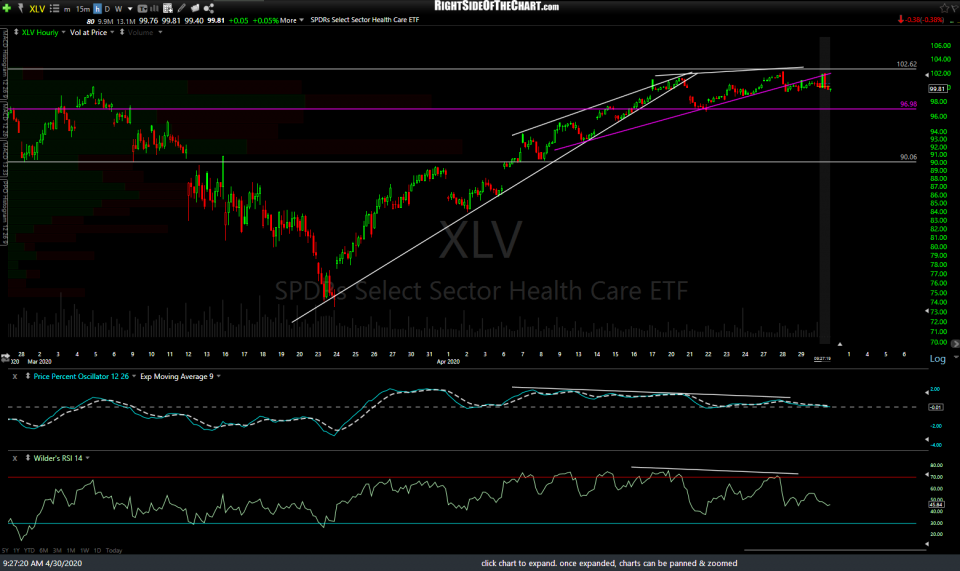

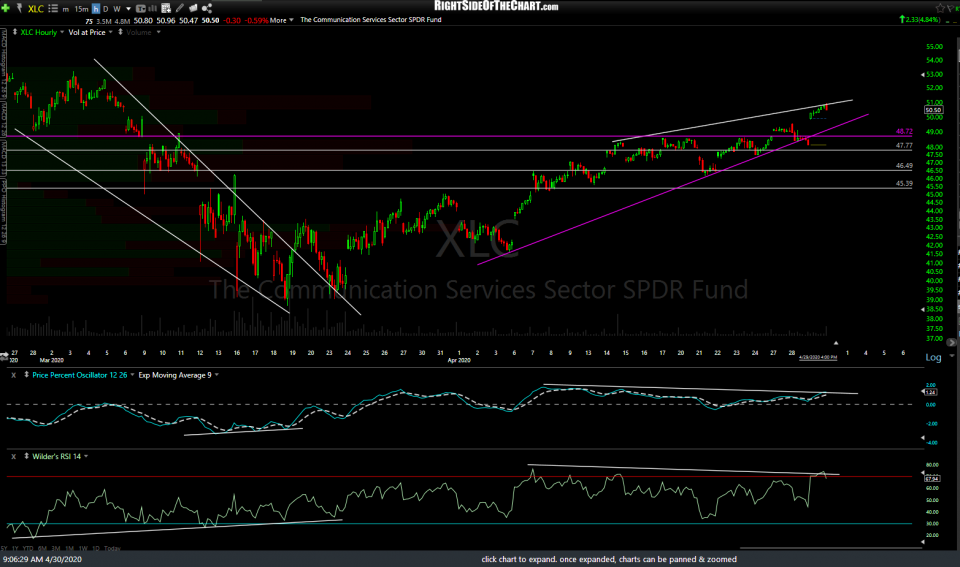

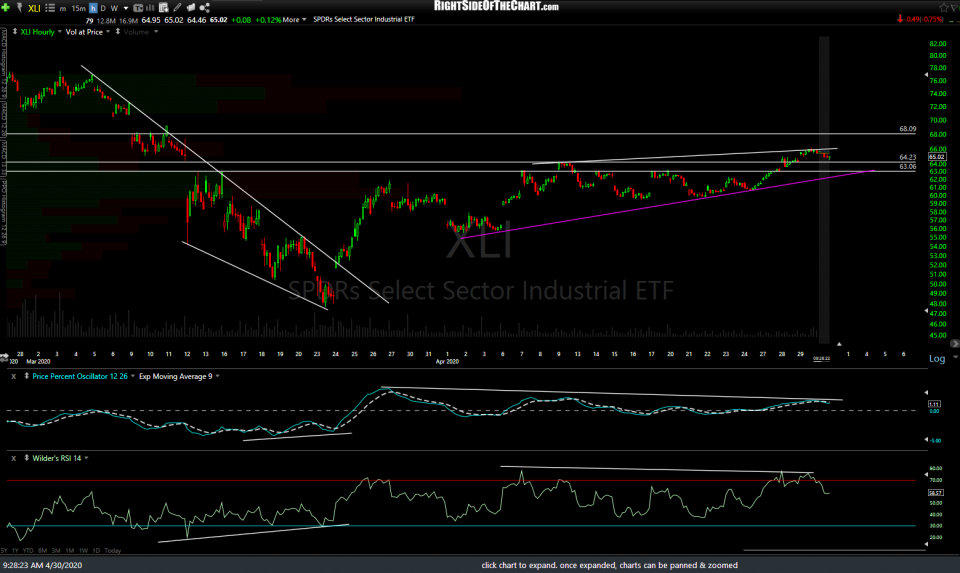

The magenta lines denote key support levels to watch on the major stock index & sector ETFs. The current trend remains bullish while nearly all indexes & sector continue to walk up the key uptrend lines off the March lows as negative divergences continue to build between price and the momentum indicators. Essentially, the more of those magenta lines that are taken out, the better the chance that the sell signal on the markets will stick. The support levels on the major index ETFs (SPY & QQQ) have the highest weighting followed by XLK (tech), XLV (health care), XLF (financials), and XLC (Communications). 3 of the 5 FAAMGs have now reported with the other 2, AAPL & AMZN, scheduled to report after the close today.

- QQQ 60m April 30th

- SPY 60m April 30th

- XLK 60m April 30th

- XLV 60m April 30th

- XLY 60m April 30th

- XLF 60m April 30th

- XLC 60m April 30th

- XLI 60m April 30th