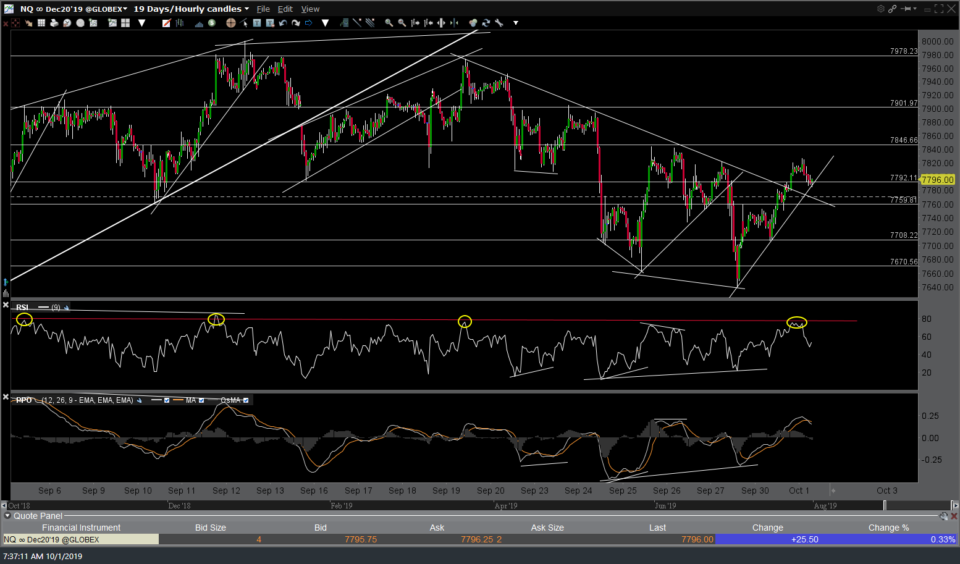

I still don’t have a strong conviction on the near-term direction of the market today but here are the 60-minute charts of /NQ & /ES, both of which have just pulled back to minor uptrend line support with /ES also backtesting the downtrend line, along with /RTY which is trading just shy of the lower downtrend line, also following a recent divergent low as with /ES & /NQ although the PPO just turned down at the zero line (trend is bearish when the PPO signal line is below, bullish when above). Best to wait & see how SPY & QQQ trade in the first hour or so of the regular session today as QQQ closed right below the 60-minute downtrend line yesterday & is currently trading slightly above it & below the 189.40 resistance level in pre-market as of now.

- NQ 60m Oct 1st

- ES 60m Oct 1st

- RTY 60m Oct 1st

/NG (natural gas) appears poised to rally up to the 2.389 & then the upper-most downtrend line on an impulsive breakout and/or solid 60-minute close above this steep falling wedge. Should it continue lower before breaking out, UGAZ has decent support around 13.00 that might offer the next objective long entry. However, UGAZ could be good for a quick 9% pop targeting just below the 16ish & downtrend line resistance if /NG triggers a buy signal soon.

- NG 60m Oct 1st

- UGAZ 60m Oct 1st

/SI silver has broken out above the 60-minute downtrend line after reversing off the 16.942 support & divergent low.

/GC gold continues to defend the 1468ish support, still offering an objective entry here with stops somewhat below & the next buy signal still pending a break above the downtrend line.

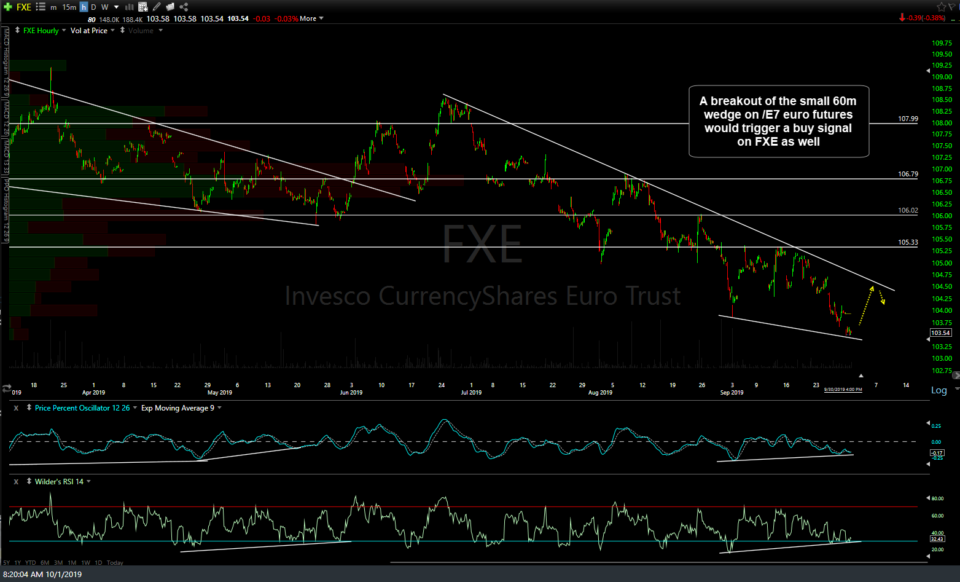

/E7 Euro futures will offer an objective long entry on a break above this small wedge pattern with targets at 1.1010 & the yellow downtrend line. A breakout of the small 60m wedge on /E7 would trigger a buy signal on FXE (Euro ETN) as well.

- E7 60m Oct 1st

- FXE 60m Oct 1st