/ES S&P 500 E-mini futures are trying to pop above the 2766ish R in pre-market. If it can break & hold above that level after the 9:30 opening bell, that should be the catalyst for a move up to test the downtrend line & 2800 R level.

/NQ (Nasdaq 100 futures) still has some work to do in order to rally up to & then break out above the 60-min downtrend lines although still possible with the bullish divergences intact for now. Arrow breaks mark resistance levels that /NQ will have to contend with should it bounce this week.

/RTY small cap futures need to break above the intersecting 1500ish + downtrend line resistance level to spark a tradable rally in the small caps (IWM). Whether or not these near-term bullish/bounce scenarios for the stock indexes pan out this week or not, it still appears that the R/R for adding new index shorts at this time is not very favorable IMO.

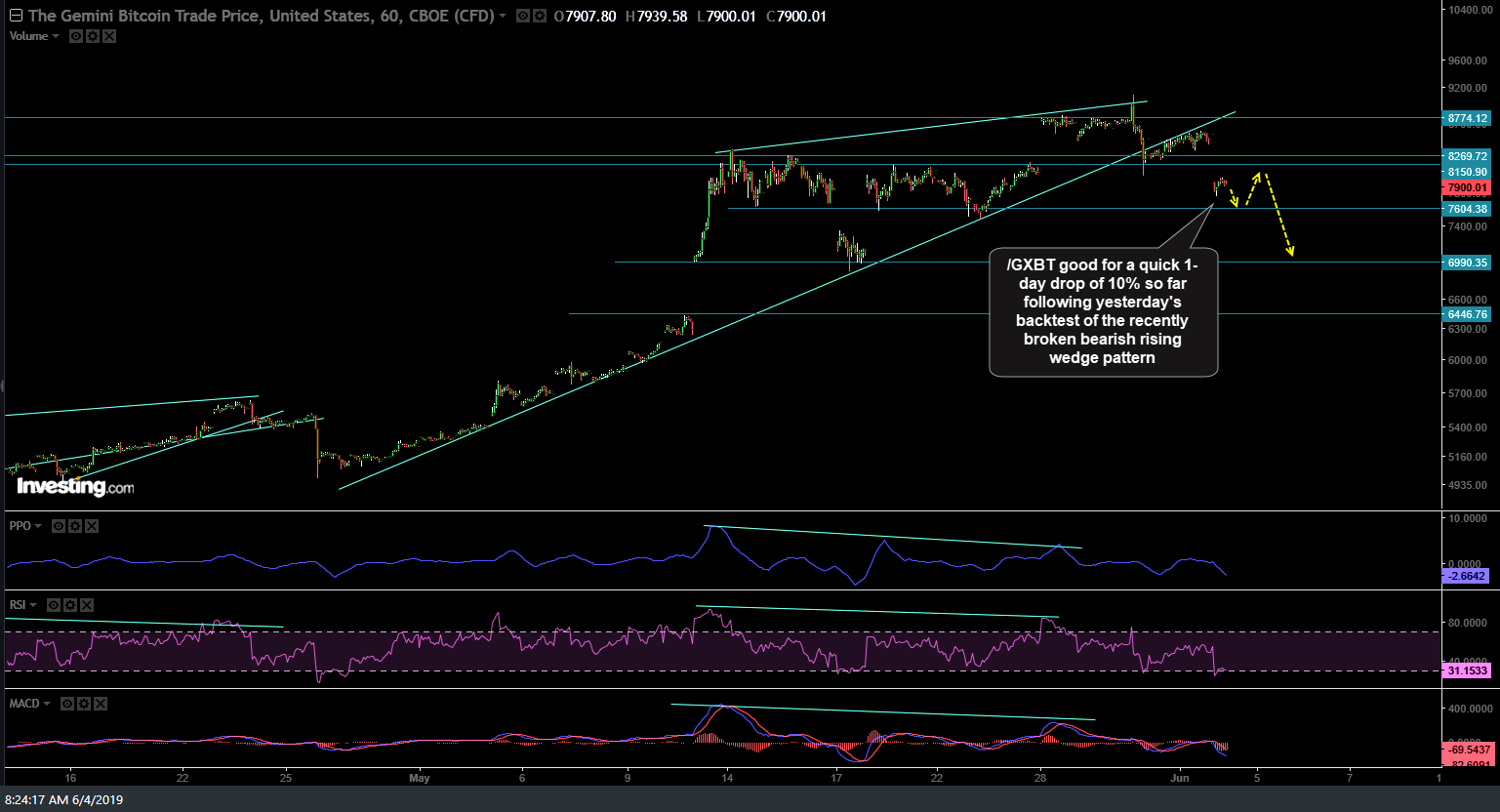

/GXBT Bitcoin futures good for a quick 1-day drop of 10% so far following yesterday’s backtest of the recently broken bearish rising wedge pattern. Yesterday’s 60-minute chart below followed by today’s updated 60-minute chart:

- GXBT 60-min June 3rd

- GXBT 60-min June 4th

/ZW wheat futures have stalled out at resistance with negative divergences in place, increasing the odds for a correction which is fine as the WEAT official trade was closed out at the highs yesterday when the final price target was hit. Although I am leaning towards a pullback in wheat prices in the near-term, I may look to add WEAT as another official long trade soon, should the charts confirm.

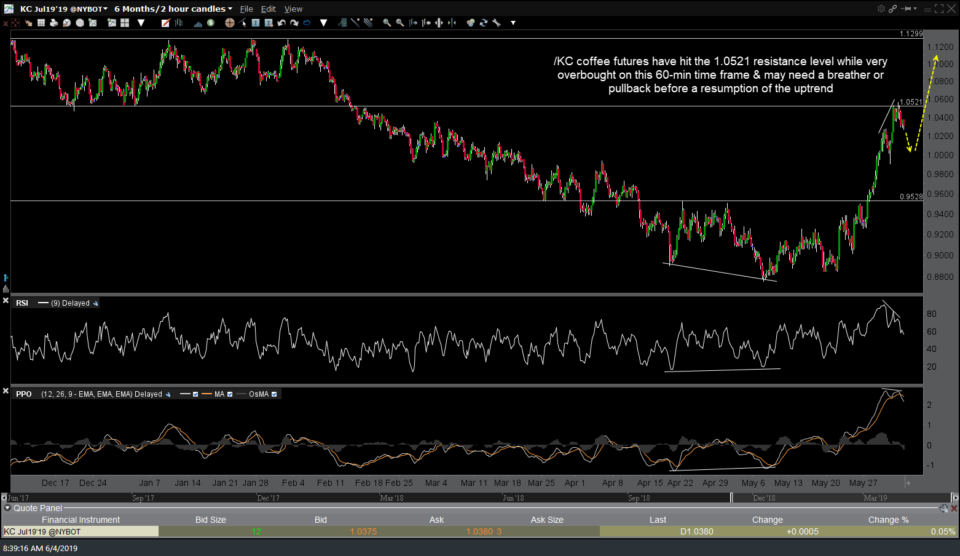

Likewise, /KC coffee futures have hit the 1.0521 resistance level while very overbought on this 60-min time frame & may need a breather or pullback before a resumption of the uptrend. JO remains an active trade with T2 hit yesterday, offering a chance for swing traders to book partial or full profits & while the odds for a pullback this week are elevated due to the aforementioned comments, I remain intermediate & longer-term bullish on coffee & feel that it may be best for longer-term swing or trend traders to sit tight (with the appropriate stops in place) & ride out any pullbacks as coffee is prone to sharp, unidirectional rallies that can slice right through resistance, divergences, & overbought conditions at times.

Negative divergences continue to build on /ZB 30-yr T-bond futures while they remain quite overbought, indication a correction is likely coming soon although that may or may not occur after one more thrust to a marginal new high. TLT is the ETF that tracks long-term Treasury Bonds.

EUR/USD is currently testing the top of the bullish falling wedge/downtrend line resistance. Should EUR/USD pullback off this run into resistance, that would most likely correspond with a pullback in gold (GLD) & the gold mining stocks (GDX). While a breakout above the wedge would be a bullish technical event, I am going to hold off on an official entry for a GLD and/or GDX swing trade for now as EUR/USD has significant resistance just overhead around 1.13056. As such, my preferred scenario, should EUR/USD break above the wedge this week, would be a rejection off the 1.13056ish level followed by a backtest of the wedge from above before a significant & tradable rally in both EUR/USD & gold.