Pretty much a round trip to nowhere in the markets today starting out with a wave of selling to take the indexes red followed by a reflective bounce back off the first support level/pullback target. SPY closed effectively flat around the HOD (high-of-the-day), a mere 15 basis points or 0.15 of 1% above yesterday’s high & right at the intersecting 200-day MAs once again (another failure to take them out), which leaves us right where we closed yesterday. Daily chart below.

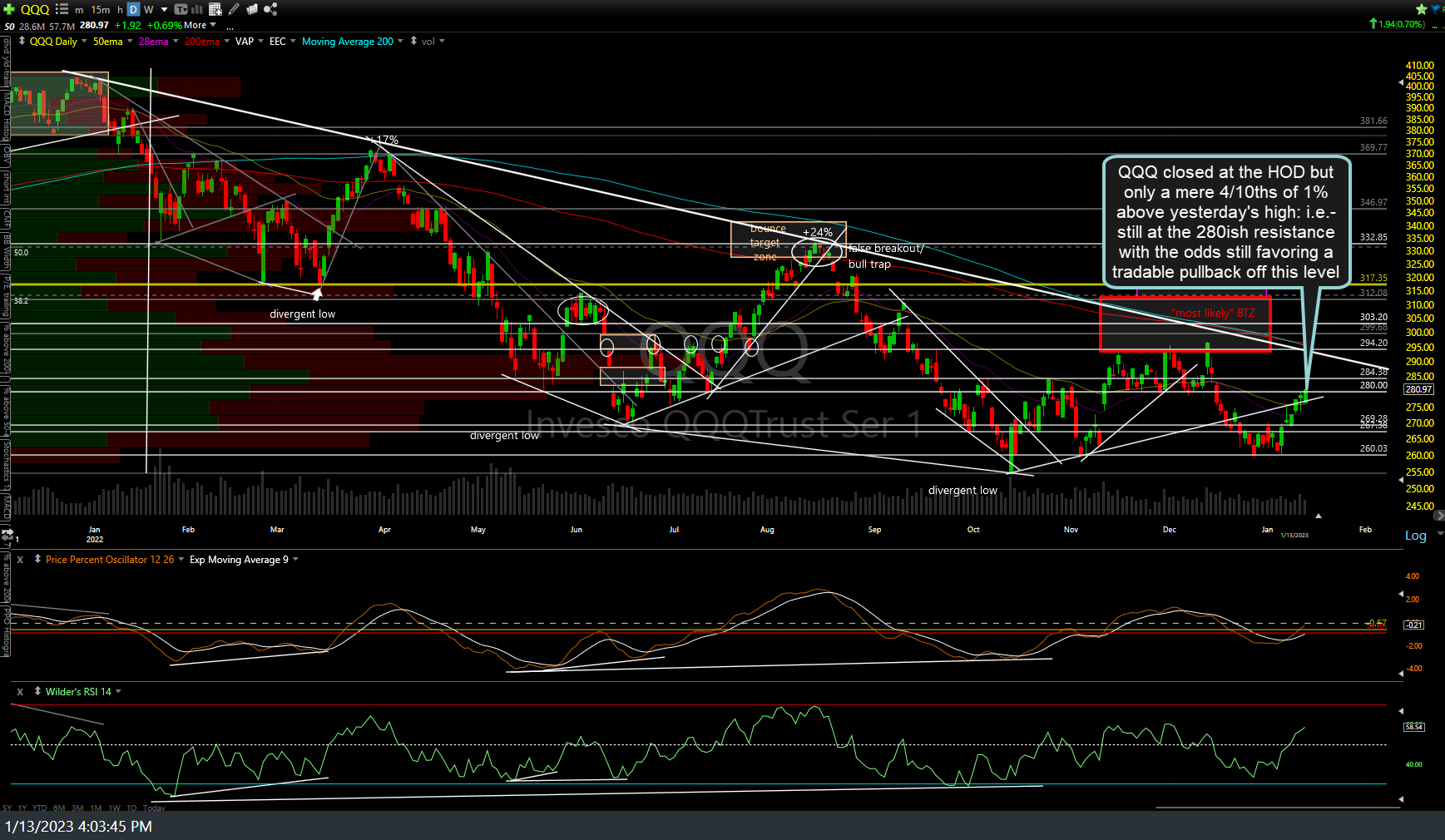

QQQ also closed right around its HOD which was only 4/10ths of 1% above yesterday’s high: i.e.- still at the 280ish resistance with the odds still favoring a tradable pullback off this level. All of the recently highlighted market-leading tech stocks (AAPL, AMZN, GOOGL, & TSLA) also closed basically flat today (+/-1%) at the same resistance levels they ran into yesterday. As such, my near-term outlook remains the same: The R/R in the very near-term skewed to the downside with a tradable pullback and/or more consolidation likely when trading resumes next Tuesday (markets are closed Mon for MLK Day).

Have a great weekend!

-RP