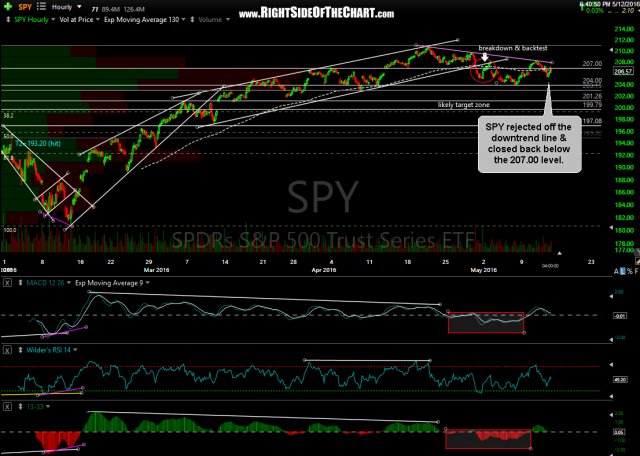

QQQ fell & closed back well below both the 106.80 level & the 130-period ema today, keeping the bearish case alive. The 13/33-ema trend indicator also flipped back to bearish after the brief whipsaw signal while SPY was rejected off the downtrend line & closed back below the 207.00 level. 60-minute charts:

- QQQ 60-minute May 12th

- SPY 60-minute May 12th

Both GDX & GLD continue to flirt with the bottom of their bearish rising wedge patterns where a breakdown on both appears imminent at this point. Confirming the bearish near-term outlook for gold & the miners is my continued bullish outlook for the US Dollar. UUP (dollar ETF) continues to move higher after a shallow pullback to the 24.25 support and appears to be moving above this bullish falling wedge pattern (120-minute chart) after the recent false breakdown/bear trap that was highlighted on the $DXY daily chart.

- GDX daily May 12th

- GLD daily May 12th

- UUP daily May 12th