U.S. Equity Markets

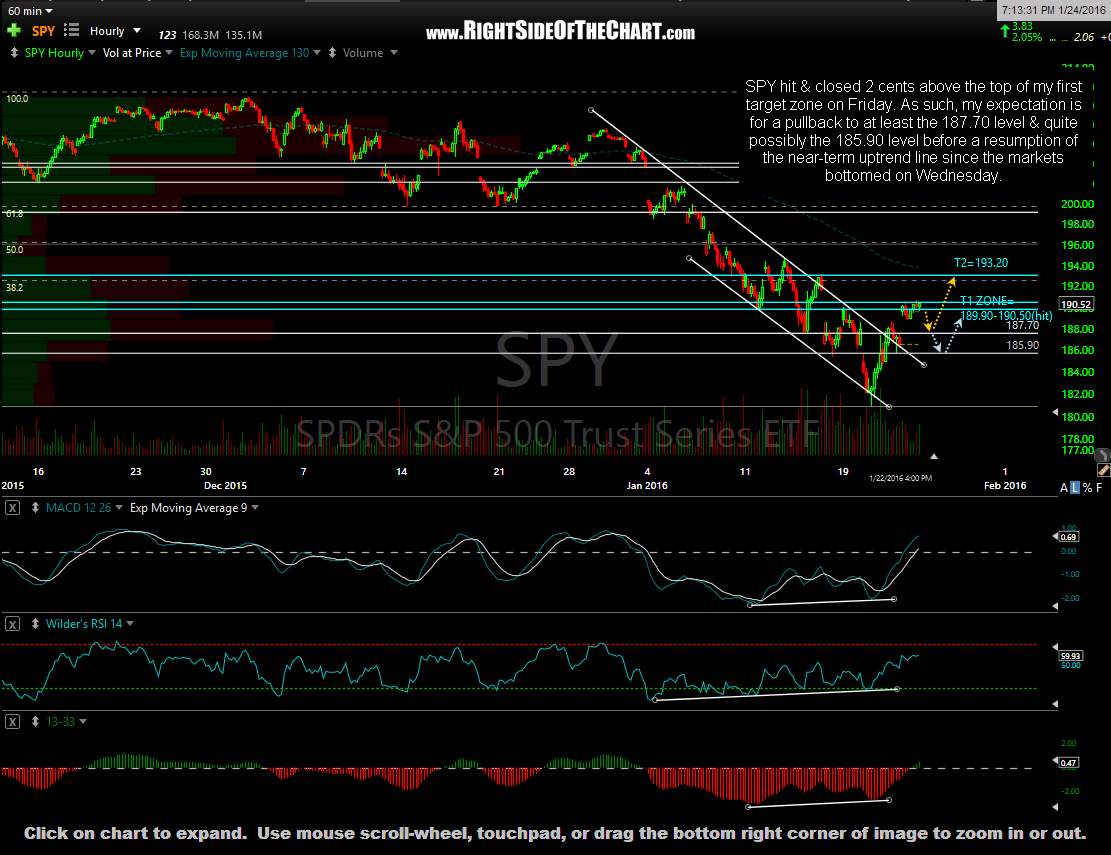

With my first bounce targets on SPY hit & nearly hit on QQQ, my expectation is for a pullback to begin early this week. My primary scenario for QQQ is a pullback to the 102.50ish level with an alternative scenario of a deeper correction down to the S2 zone (100.70-100.15) before a resumption of the near-term uptrend.

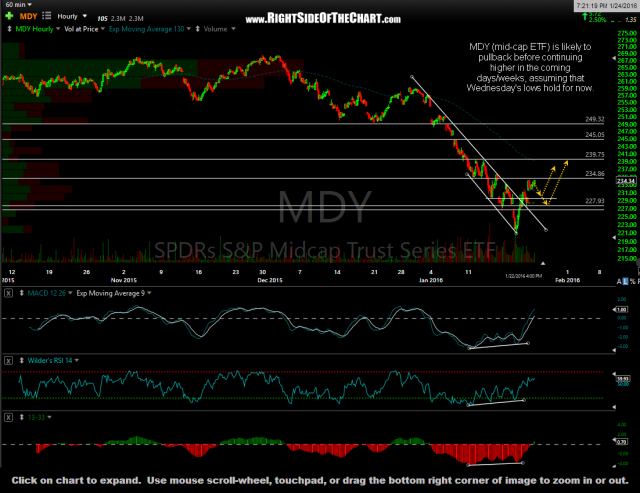

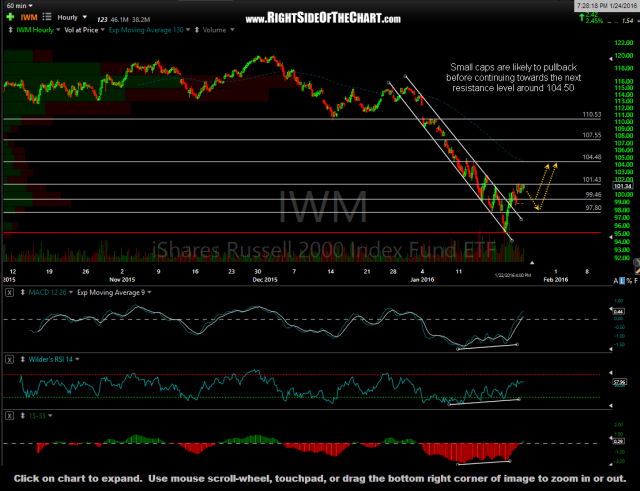

MDY (mid-cap ETF) is likely to pullback before continuing higher in the coming days/weeks, assuming that Wednesday’s lows hold for now & the small caps (IWM) are likely to pullback before continuing towards the next resistance level around 104.50. As with the SPY & QQQ charts above, these 60-minute charts list some near-term support & resistance levels in which might provide entry & exit levels (targets) for active traders.

- MDY 60-minute Jan 22nd close

- IWM 60-minute Jan 22nd close

When QQQ, SPY & APPL all hit my first price targets on Friday, I booked profits on nearly all the long exposure that I took off the lows on Wednesday & went home with a mild net-short position which I will only add to if the markets open up tomorrow at or around where they closed on Friday. I will most likely book full profits if & when the pullback targets listed above are reached, possibly reversing back into a net long position although I plan to keep my exposure relatively light for now, at least for the better part of this week as my confidence in the near-term direction of the market is not high enough to warrant positioning aggressively at this time.

Precious Metals & Mining Stocks

As posted earlier today (with the same daily chart included), on Friday, GDX (Gold Miners ETF) closed a hair above the key 13.00 support level which was recently broken on impulsive selling last week. Should GDX remain above this level & move higher next week, the bear-trap/wash-out scenario discussed in the Jan 20th video will be in play, sharply increasing the odds of a powerful rally in the miners in the coming weeks/months. note: Coverage for GDX & GLD started at the 10:30 mark in the video, which can be referenced by clicking on the link above.

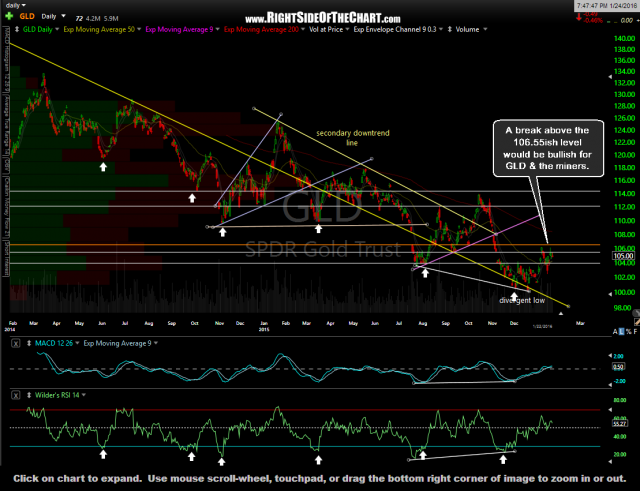

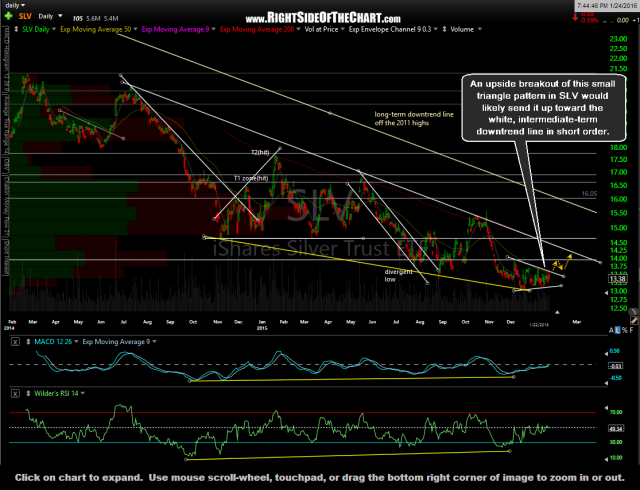

Regarding the metals, a break above the 106.55ish level would be bullish for GLD (Gold ETF) & the miners while an upside breakout of this small triangle pattern in SLV (Silver ETF) would likely send it up toward the white, intermediate-term downtrend line in short order.

- GLD daily Jan 22nd close

- SLV daily Jan 22nd close

Grains/Soft Commodities

It still appears that many of the soft commodities, grains in particular, are poised for a meaningful rally & quite possibly an end to the bear market that they’ve been in for a while now. Here’s the charts of some of my favorites, most appear poised to break out of well-defined patterns or trading ranges but aren’t quite there just yet.

- SOYB daily Jan 22nd close

- WEAT daily Jan 22nd close

- CORN daily Jan 22nd close

- SGG daily Jan 22nd close

- JO daily Jan 22nd close

In summary, after abruptly reversing from a net short to net long position just off the lows when the US equities bottomed on Wednesday, I was able to aggressiveLY ride the initial strong bounce off the lows, booking profits when my initial price targets on the broad markets & AAPL were hit on Friday with an expectation for a pullback early this week followed by a resumption of the near-term uptrend to follow soon. However, my exposure to the equities in general (i.e.- non-commodity or precious metal related stocks & ETFs) will be on the light side for the time being. I’m watching select commodities & the precious metal mining sector for confirmation to start actively engaging those sectors on the long side, with very mild exposure at this time as there is still some work to be done in order to firm up the bullish case. I’m still watching crude oil & the energy related stocks closely in order to determine if the end-of-week rally will prove to be just another short-lived bear market/short-covering rally or the start of a new uptrend that could last weeks or more. I’m leaning towards the latter and will follow up with additional commentary on the energy sector this week.