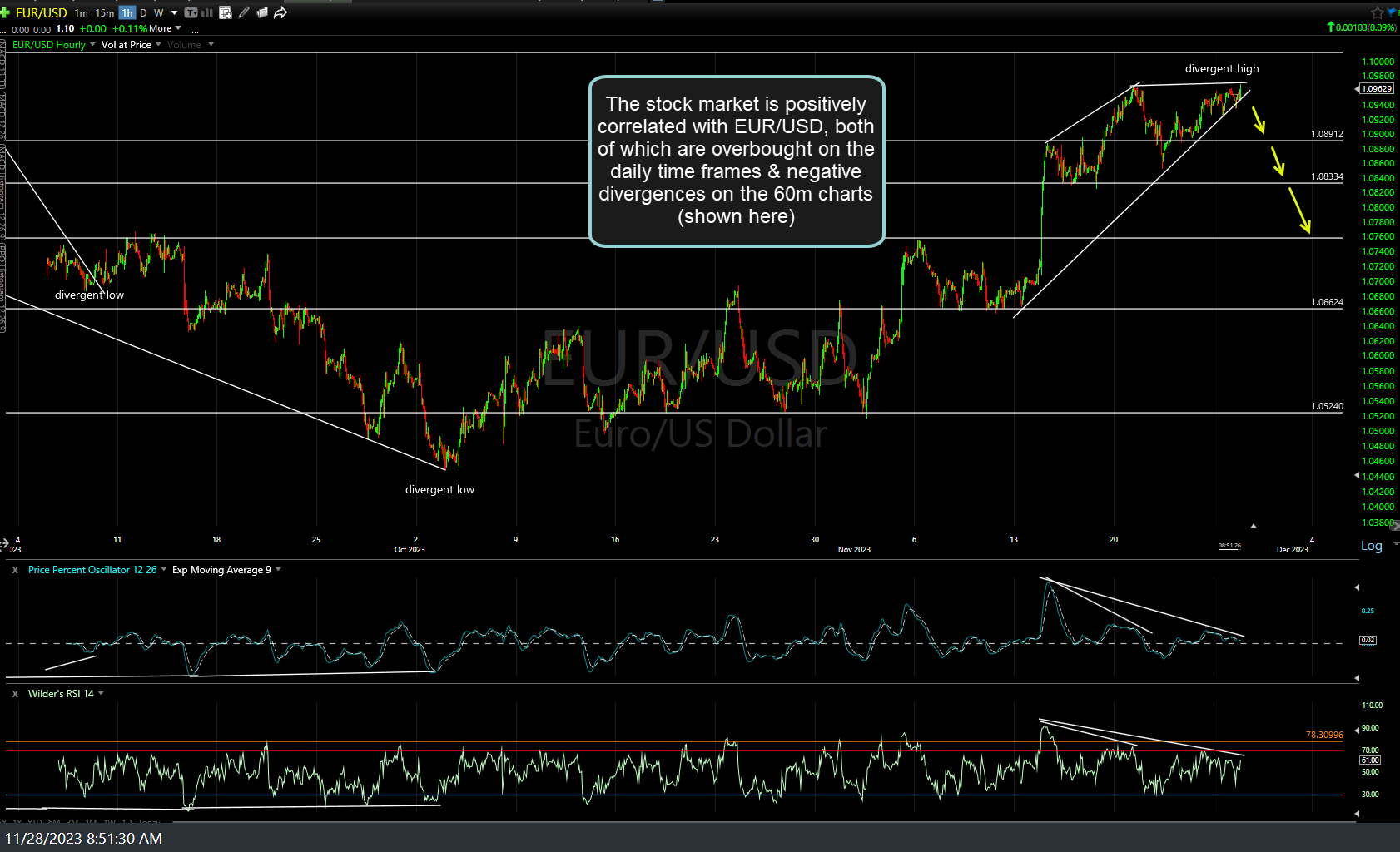

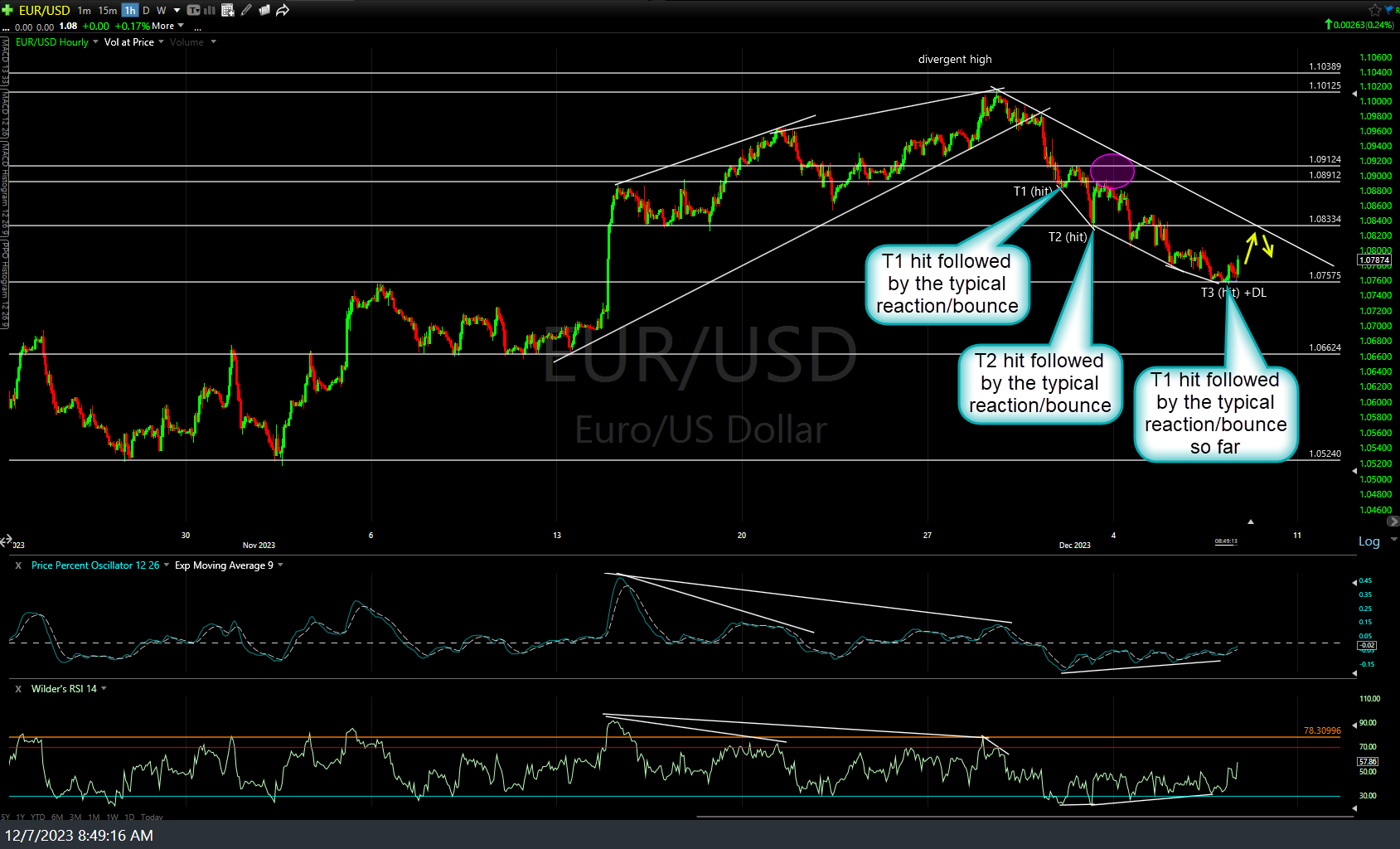

EUR/USD has just hit my third price target (T3 at 1.07575) followed by the typical reaction/bounce so far, as was the case when T1 & T2 were hit. As highlighted on numerous instances recently, the stock market & EUR/USD have a strong positive correlation & as such, any bounce in EUR/USD will most likely result in a bounce in QQQ & SPY. Initial (Nov 28th) and the updated 60-minute chart with my minimum bounce target below.

Keep in mind that I still have TLT & IEF at my final near-term swing targets/resistance with the odds of a reaction (pullback and/or consolidation) on Treasuries elevated at this time. As such, a substantial pullback in Treasuries (i.e.- rising yields) would most likely provide a headwind for the stock market although we could see stock rise if Treasuries only trade sideways or slightly lower as I’ve highlighted the recent decoupling from the strong positive correlation between Treasuries & the stock market in recent trading sessions. Again, the scope/magnitude of the moves in EUR/USD & bond yields will most likely determine just how far equities will rally with the EUR/USD (assuming the rally off T3 continues).