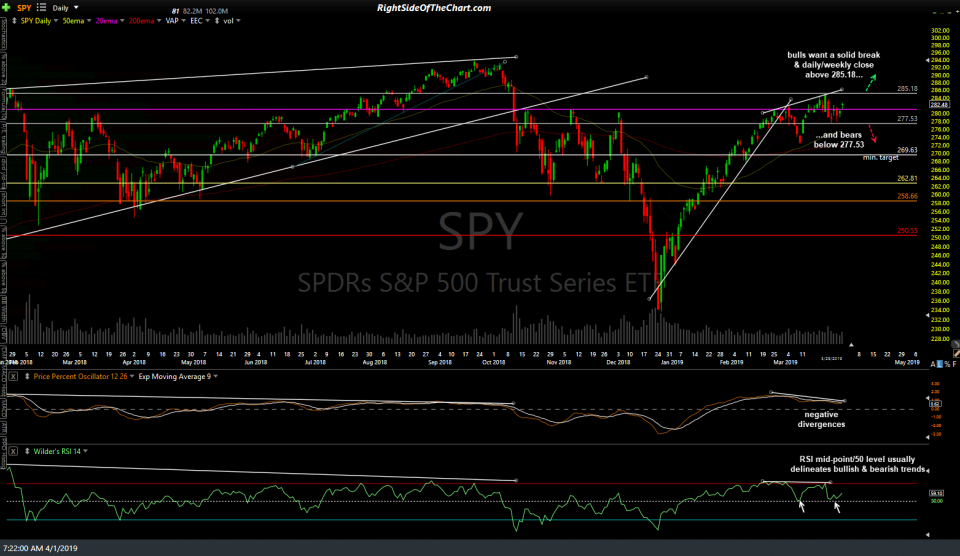

Here are some of the charts that I’m watching today & more so, this week. Still waiting for a solid weekly close above or below the key 282 resistance level on SPY while a solid intraweek break and/or close above 285.18 or below 277.53 could provide an early clue as to which way that key 282ish level is likely to resolve as SPY now enters the 6th consecutive week of testing that very significant resistance level.

- SPY weekly April 1st

- SPY daily April 1st

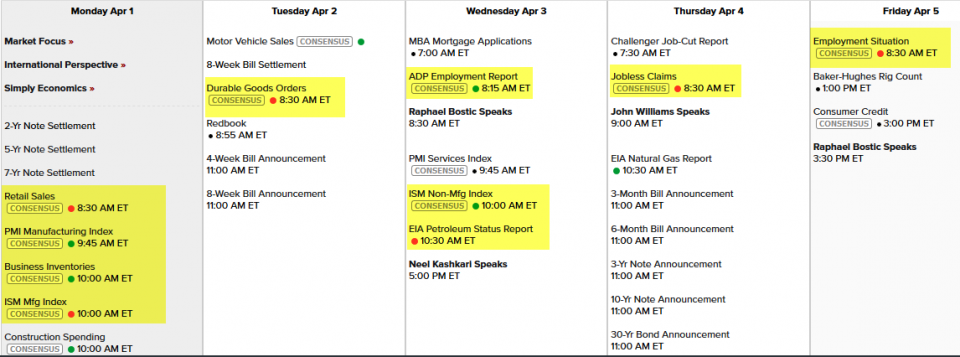

Volatility & whipsaw signals are likely this week with a slew of potential market-moving reports on the economic calendar this week (highlighted in yellow).

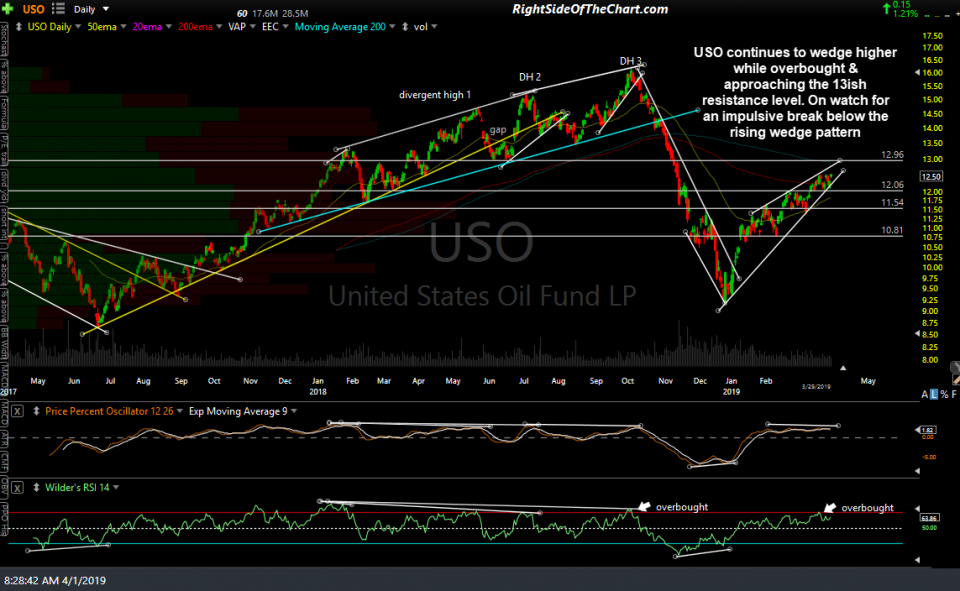

USO (crude oil ETN) continues to wedge higher while overbought & approaching the 13ish resistance level. On watch for an impulsive break below the rising wedge pattern. Also, keep in mind that crude oil remains highly correlated with the stock market & as such, whether on not this rising wedge goes on to breakdown & play out for a tradeable correction will likely depend on how the 282ish resistance level on SPY is resolved.

GLD (gold ETF) continues to backtest the primary downtrend line/symmetrical triangle pattern following the recent breakout while awaiting a breakdown in the $USD to trigger the next leg up to the 130 area.

Likewise, EUR/USD (the Euro/US Dollar forex pair) continues to drift lower within the large bullish falling wedge pattern as the positive divergences build. Awaiting a solid break & close above the pattern for the next sell signal on the $USD, which should be bullish for gold. (When EUR/USD rises, the US Dollar is falling).

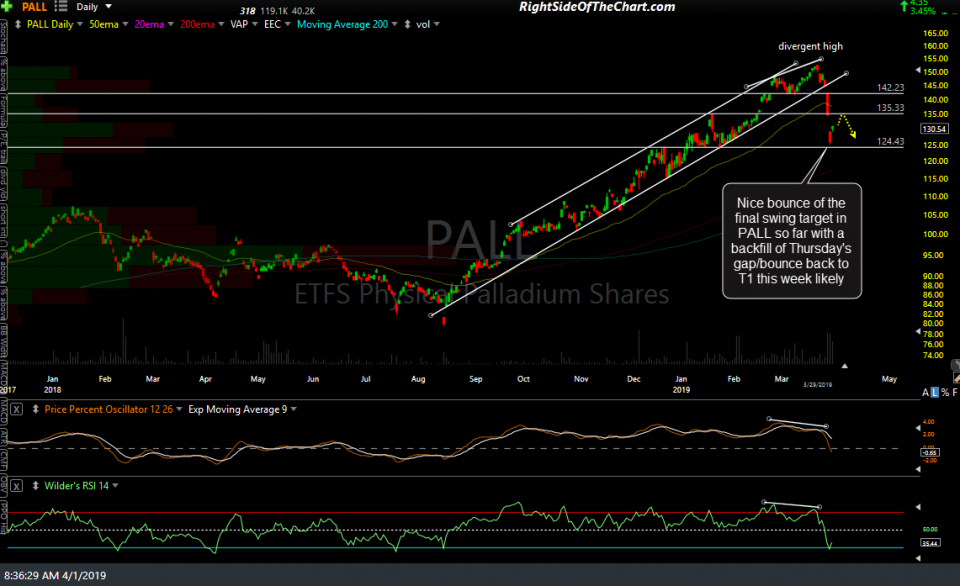

Nice bounce of the final swing target in PALL so far with a backfill of Thursday’s gap/bounce back to T1 this week likely. Previous & updated daily charts of PALL (palladium ETF):

- PALL daily chart March 27th

- PALL daily chart March 28th

- PALL daily April 1st

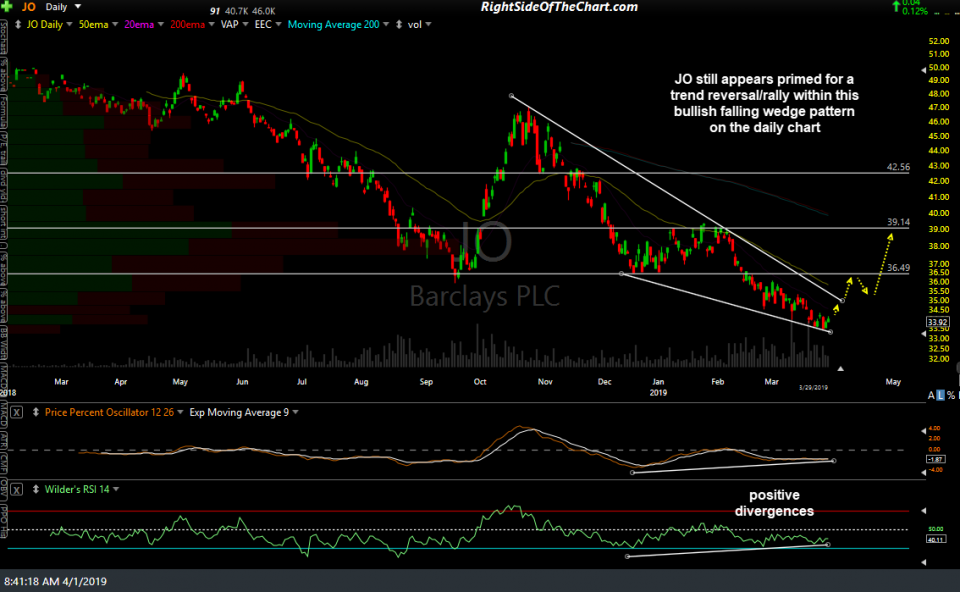

JO (coffee ETN) still appears primed for a trend reversal/rally within this bullish falling wedge pattern on the daily chart while the JO active long swing trade is still hanging on by a thread but still looks promising & will look even better if it can pop above this minor downtrend line on the 60-minute chart.

- JO daily April 1st

- JO 60-min April 1st

BAL (cotton ETN) offered another objective long entry on the pullback to R1 following last week’s kiss & reversal off T1. Next buy signal to come on an impulsive break above 47.05.

WEAT (Wheat ETN) is taking a healthy breather to work of the near-term overbought conditions from the rally that followed the recent breakout & backtest of the 60-min downtrend line/channel.