Negative divergences continue to build as /NQ (Nasdaq 100 futures) tests the 7980ish resistance level which is the same level that it reversed at back just over a month ago with comparable divergences in place. The near-term trend since Oct 3rd remains bullish & although there are not any sell signals at this time, the R/R the major indices on the long side is quite unfavorable. A near-term sell signal would come on a break below this minor 60-minute uptrend line.

/NG natural gas is backtesting the minor uptrend line/60-minute price channel as well as the 2.432 R level from below while the near-term trend (higher highs & higher lows) still remains bullish for now. However, the weekly nat gas inventory report at 10:30 today is likely to either confirm the uptrend with a break above yesterday’s highs or call it into question with a break below one or more of the recent lows.

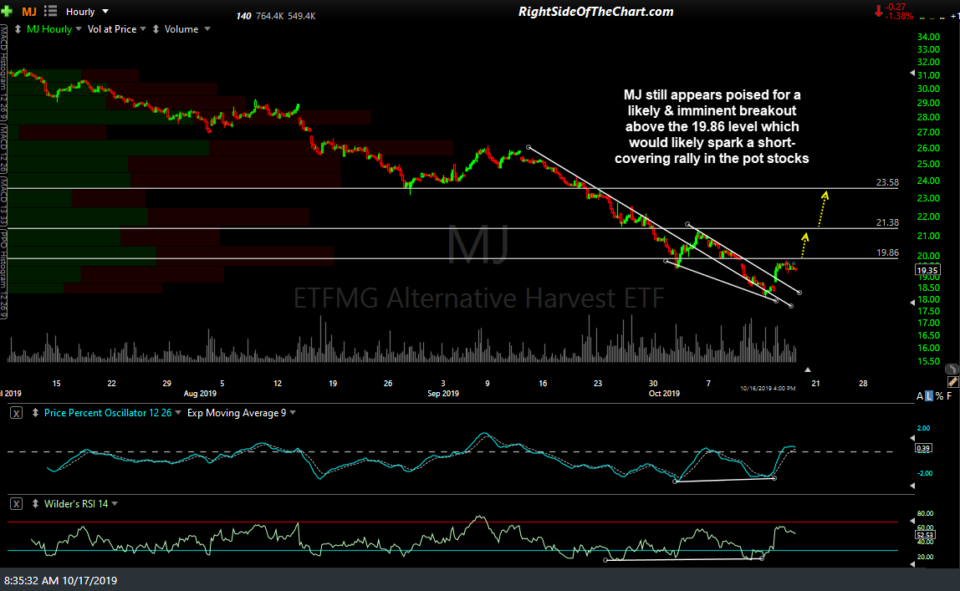

MJ still appears poised for a likely & imminent breakout above the 19.86 level which would likely spark a short-covering rally in the pot stocks.

Other potential trading opps at this time include GBTC (Bitcoin Trust), many the various trade ideas covered in the recent Specialty & Generic Drug stocks video & BYND (Beyond Meat), all as potential longs.