Following yesterday’s breakdown below the previously highlighted 60-minute bearish rising wedge pattern (sell signal #1) and subsequent backtest, /NQ (Nasdaq 100 futures) went on to trigger sell signal #2 on a break below the 7722 support in the earlier today, hitting & so far reversing off the first support/target of 7670.50.

Ditto for /ES (S&P 500 futures) with sell signal #2 triggering on a break below the 2935 support that was highlighted yesterday, followed by an impulsive leg down to hit minor support around 2912. Hard to gauge exactly how far the index futures might bounce off these support levels following the impulsive leg down from the break of those supports although I can say that the downtrend off the Sept 12th highs solidly remains intact for now.

Wash. Rinse. Repeat: /GC (gold futures) once again reverses off the key 1492 support level. GLD is the gold ETF.

/PA palladium has been more resilient than gold, silver & even the closely related platinum in recent months although it now appears poised for a drop of at least 3% should it break below this minor uptrend line with the other PM’s pulling back as well. PALL is the palladium ETF.

/CL (crude oil futures) is backtesting the 60-minute downtrend line following the recent divergent low. Although I’m only luke-warm on the trade idea, crude does offer an objective long entry with stops somewhat below. USO (1x long) and UWT (3x long) are among several crude ETN proxies for a bullish bet on crude prices. Also, keep in mind that crude & the stock market has been highlight correlated recently (i.e.- they both tend to rise & fall together), something to consider with your overall position sizing & diversification/asset allocation if also carrying a position on the equity indexes.

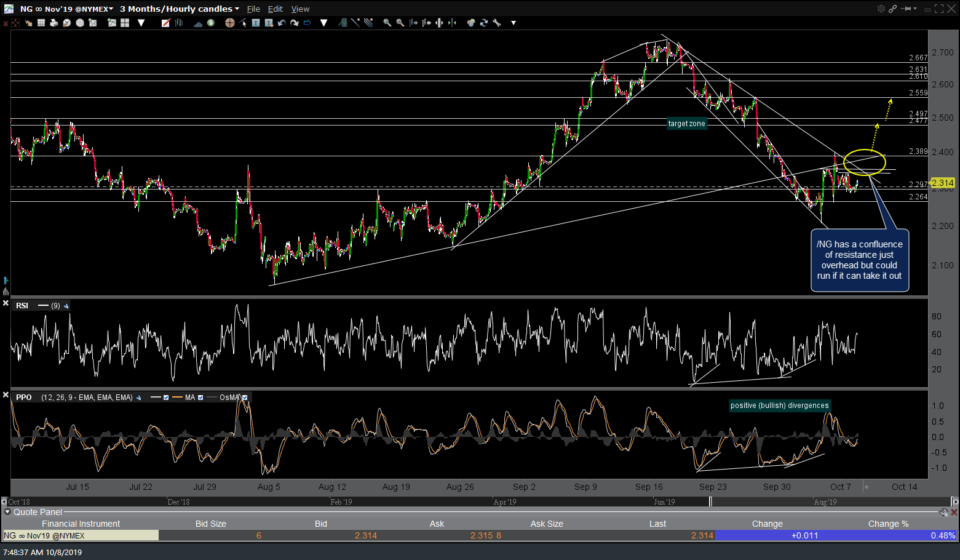

After recently putting in a divergent low, which is potentially bullish, /NG natural gas has a confluence of resistance just overhead but could run if it can take it out. UNG (1x long) and UGAZ (3x long) are ETN proxies for a bullish bet on natural gas.