/NQ (Nasdaq 100 futures) reversed following Friday’s breakdown & backtest of the 60-min rising wedge & will likely hit at least the 7760.50ish support/target if it takes out the minor yellow support line/Friday’s low.

/ES (S&P 500 futures) reversed following Friday’s breakdown & backtest of the 60-min wedge with the next sell signal to come on a break below the 2955ish support/target.

Following the recent rally into the 1.1610 target/resistance level, divergent high, overbought conditions & 60-min wedge breakdown, /KC (coffee futures) has hit the 1.0534 pullback target, so far bouncing back to the 1.0845 former support, now resistance level. Previous (Friday’s) and today’s updated 60-minute charts below:

/PA (palladium futures) look poised for a correction back down to the 1455ish level with a sell signal to come on a break below this minor uptrend line/60-minute rising wedge.

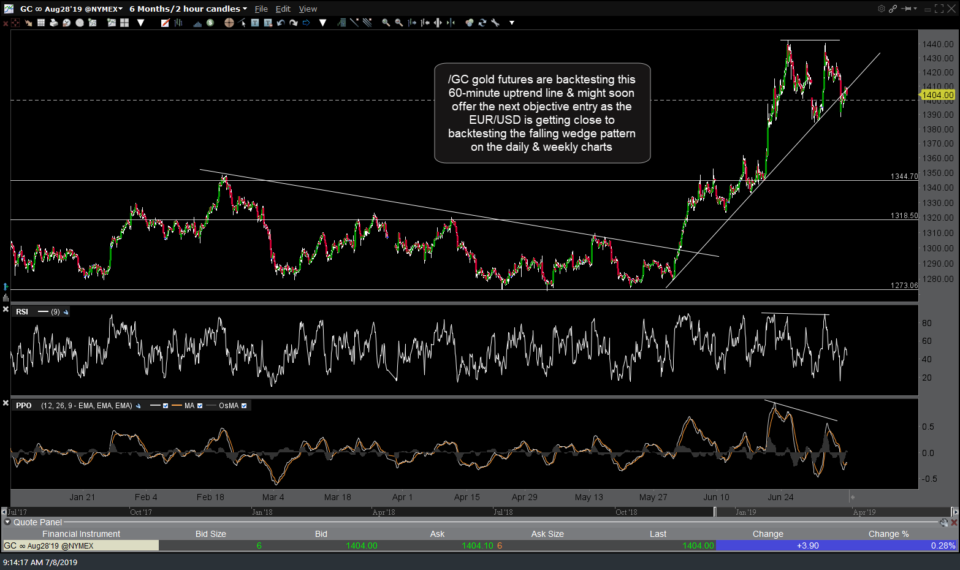

/GC (gold futures) are backtesting this 60-minute uptrend line & might soon offer the next objective entry as the EUR/USD is getting close to backtesting the falling wedge pattern on the daily & weekly charts. Additional analysis on gold to follow later today.

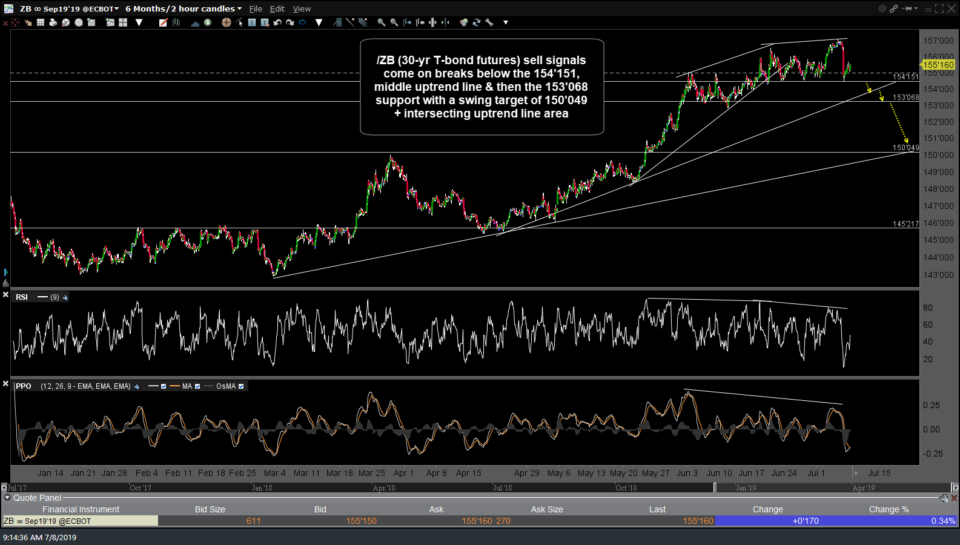

/ZB (30-yr T-bond futures) sell signals come on breaks below the 154’151, middle uptrend line & then the 153’068 support with a swing target of 150’049 + intersecting uptrend line area.