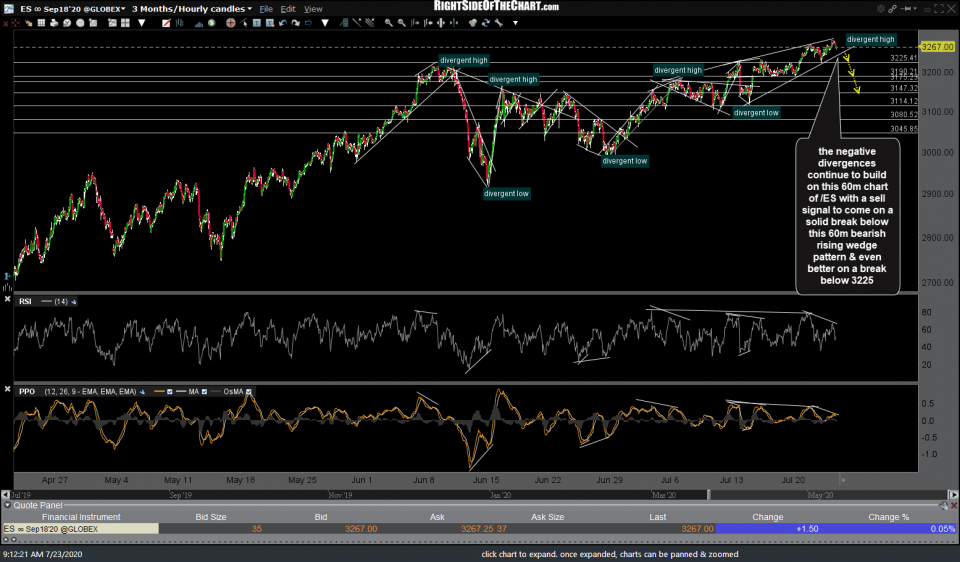

The negative divergences continue to build on this 60m chart of /ES (S&P 500 futures) with a sell signal to come on a solid break below this 60-minute bearish rising wedge pattern & even better on a break below 3225.

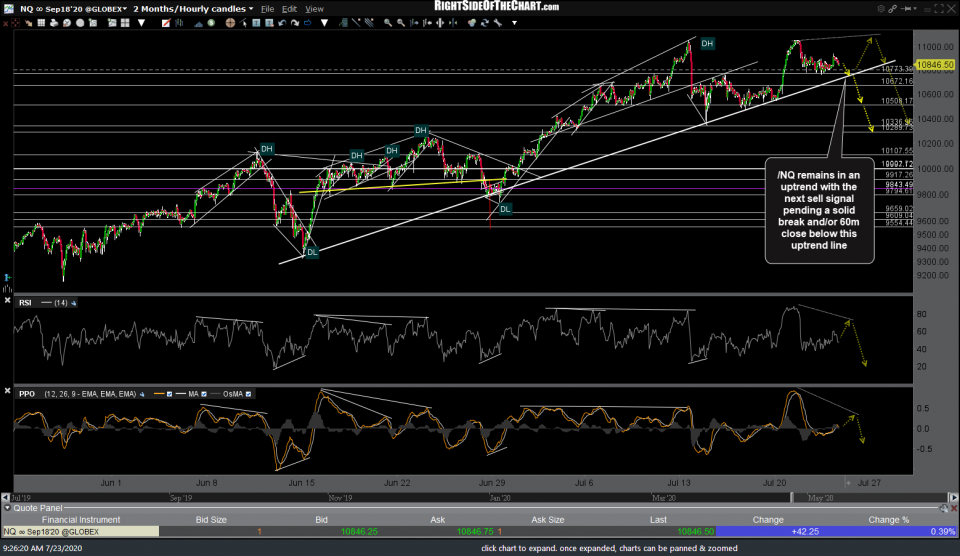

/NQ (Nasdaq 100 futures) remains in an uptrend with the next sell signal pending a solid break and/or 60-minute candlestick close below this uptrend line.

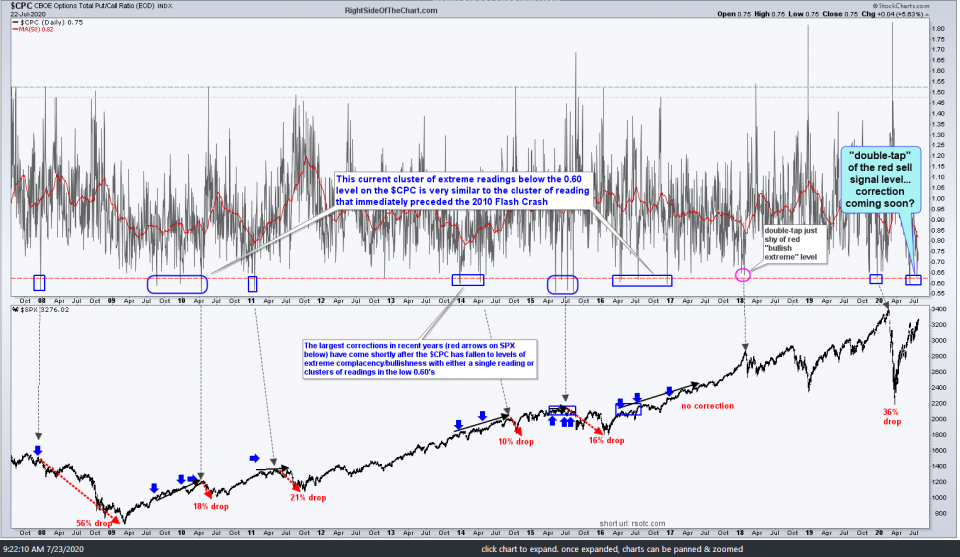

As highlighted in one of the recent videos, we have a “double-tap” of the red sell signal level on my $CPC (total put/call ratio) chart… correction coming soon or will this time be different?

I’m still awaiting a solid break below this 60-minute uptrend line for a sell signal on /GC (gold) although I’ve just added a minor trendline just above it that would likely bring gold futures down to the larger trendline, if/when broken. Previous & updated 60-minute charts below.

Assuming a breakdown from around current levels, /SI (silver) appears poised for a 13%, potentially swift drop back down to at least the 19.835ish level, pending a solid break below this steep 60-minute uptrend line.

I’m still awaiting a solid break and/or 60-minute close above this downtrend line for a buy signal on /NG (natural gas) although the only difference since my previous update on the setup from July 15th (first chart below) is that 1.786 resistance level now becomes the first target.