Sell signal on /GC gold still to come on a break below this 60-minute uptrend line, despite the recent ‘pre-central bank rate decisions’ whipsaw as the negative divergences persist.

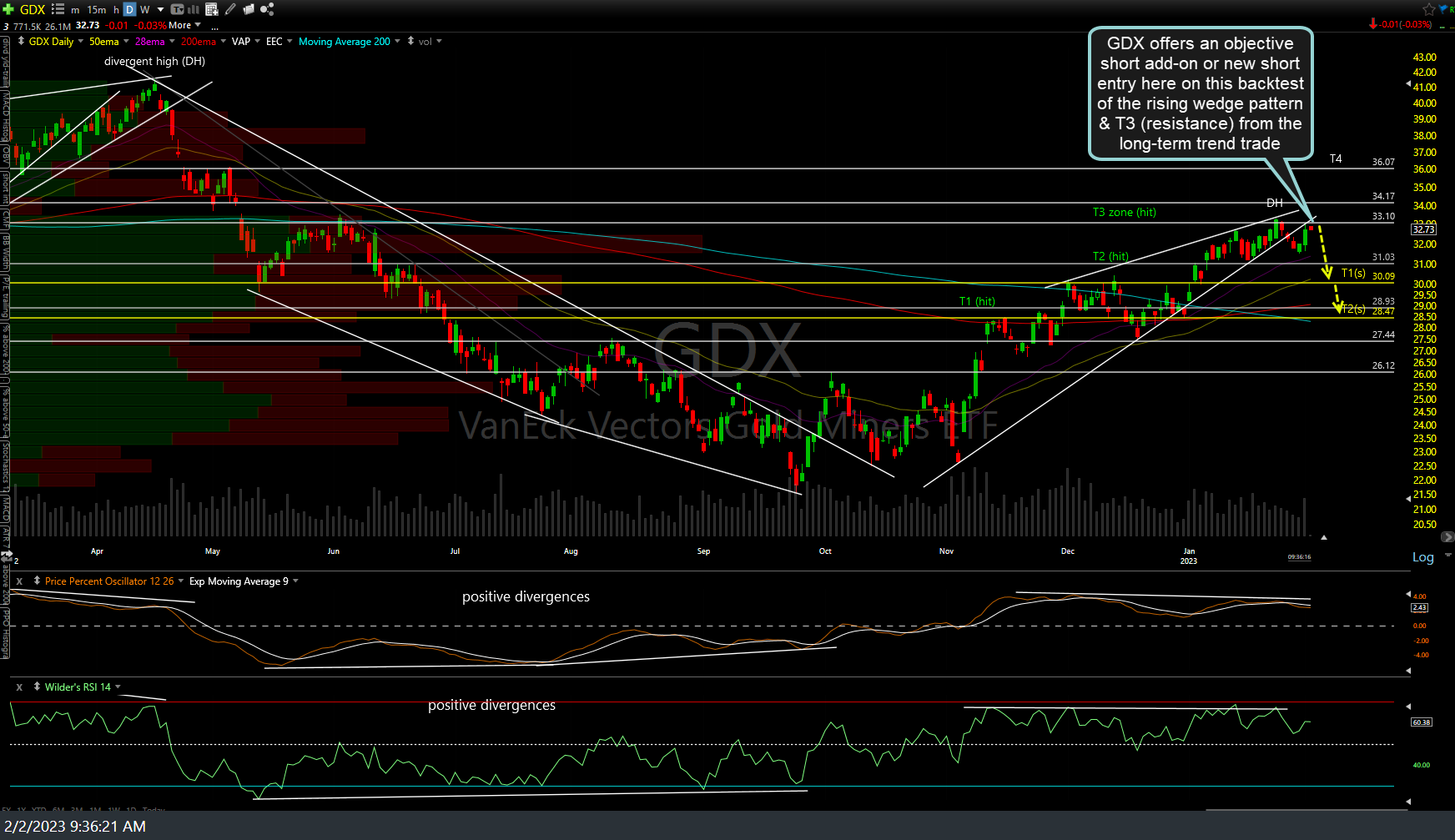

GDX offers another objective short add-on or new short entry here on this backtest of the rising wedge pattern & T3 (resistance) from the long-term trend trade. One could also wait for a solid break below the aforementioned uptrend line in gold futures & GLD before initiating or adding to a starter short position on the miners. Daily chart below.

$VIX closed right on the uptrend line & still within the bullish falling wedge pattern with the positive divergences still intact with tonight’s big 3 tech earnings likely to determine which way this one break. A solid breakout & rally above the pattern would be bearish for the stock market with a solid break & continued move below the uptrend line bullish for the market.

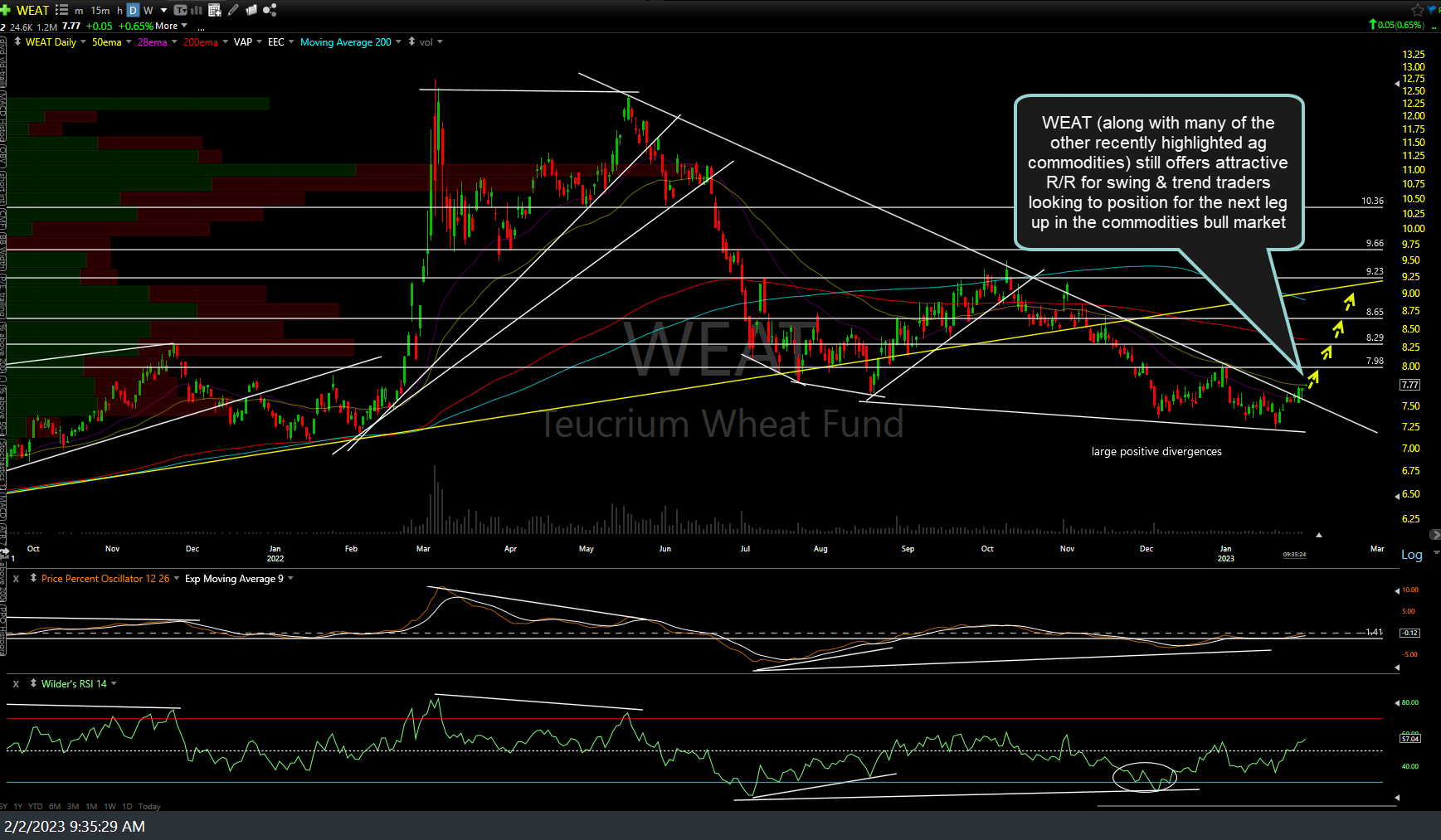

WEAT (wheat ETN), along with many of the other recently highlighted agricultural commodities, still offers an attractive R/R for swing & trend traders looking to position for the next leg up in the commodities bull market. Daily chart below.

Although I remain in ‘black out’ mode, abstaining from actively trading the indexes yesterday & today due to the big 3 tech earnings tonight (AAPL, AMZN, & GOOGL), I plan to do a video update on the equity markets before the close today & if I had to venture a guess, I think we’ll see a fairly hard fade of today & yesterday’s post-FOMC rally as nervous longs take profits before the close in front of the big earnings reports tonight.