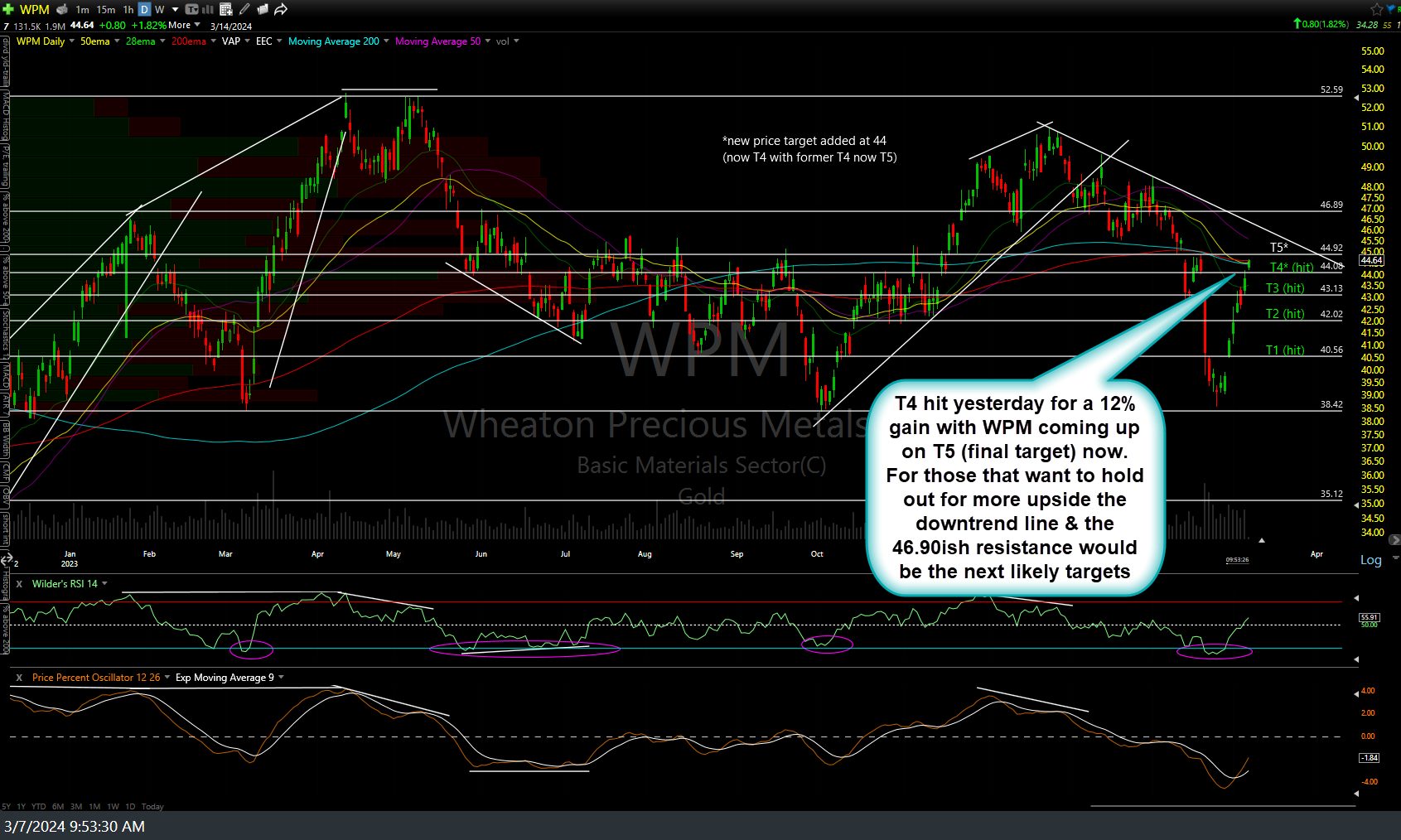

Here’s a few of the things worth noting today. WPM (Wheaton Precious Metals) hit the forth price target (T4) for a 12% gain since highlighted as one of my top picks in the mining sector in last Tuesday’s trade ideas video with WPM coming up on T5 (final target) now. For those that want to hold out for more upside the downtrend line & the 46.90ish resistance would be the next likely targets. However, EUR/USD has just rallied into resistance & as highlighted yesterday, SLV (silver ETF) hit resistance & is still stalling out at that resistance (the 22.21 price target) so far today. As such, while the precious metals & miners are still coming off very constructive (bullish) charts with strong momentum, the R/R for staying long or adding to existing long positions is no longer very favorable although I will be on watch for potential objective entries/re-entries on pullbacks. Updated daily chart below.

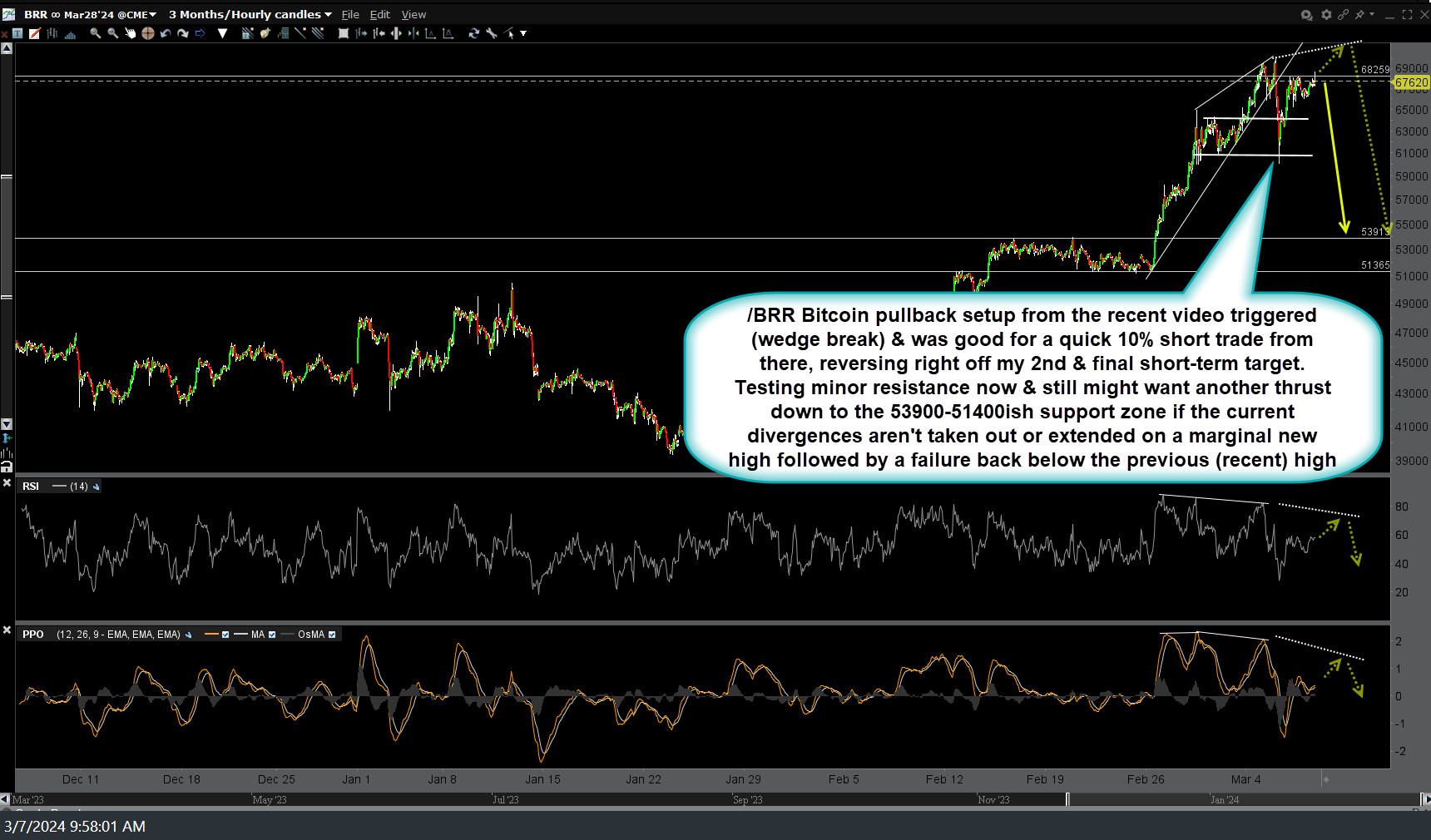

@heinz requested an update on Bitcoin which I last highlighted as a short setup on in Tuesday’s video (screenshot from that video while drawing the targets first chart below). The (/BRR Bitcoin futures) pullback setup from the video triggered (wedge break) & was good for a quick 10% short trade from there, reversing right off my 2nd & final short-term target. Testing minor resistance now & still might want another thrust down to the 53900-51400ish support zone if the current divergences aren’t taken out or extended on a marginal new high followed by a failure back below the previous (recent) high. Previous & updated 60-minute charts below.

Nearly all of the market-leading tech stock FKA as the Mag 7 (ex-AAPL & TSLA) as well as all the top sectors in the S&P 500 remain on or above my initial key (yellow) support levels, with solid breaks of the majority of those key yellow uptrend lines and/or price support levels still needed to provide the FIRST high-probability swing/trend short sell signal in 2024. Even better if those breakdowns came with a reversal in EUR/USD and/or IEF moving back down into & especially below the YELLOW ZONE although breakdowns of the majority of recently highlighted key stocks & sectors are much more important & all that is required for a high-probability sell signal for a swing/trend short trade.