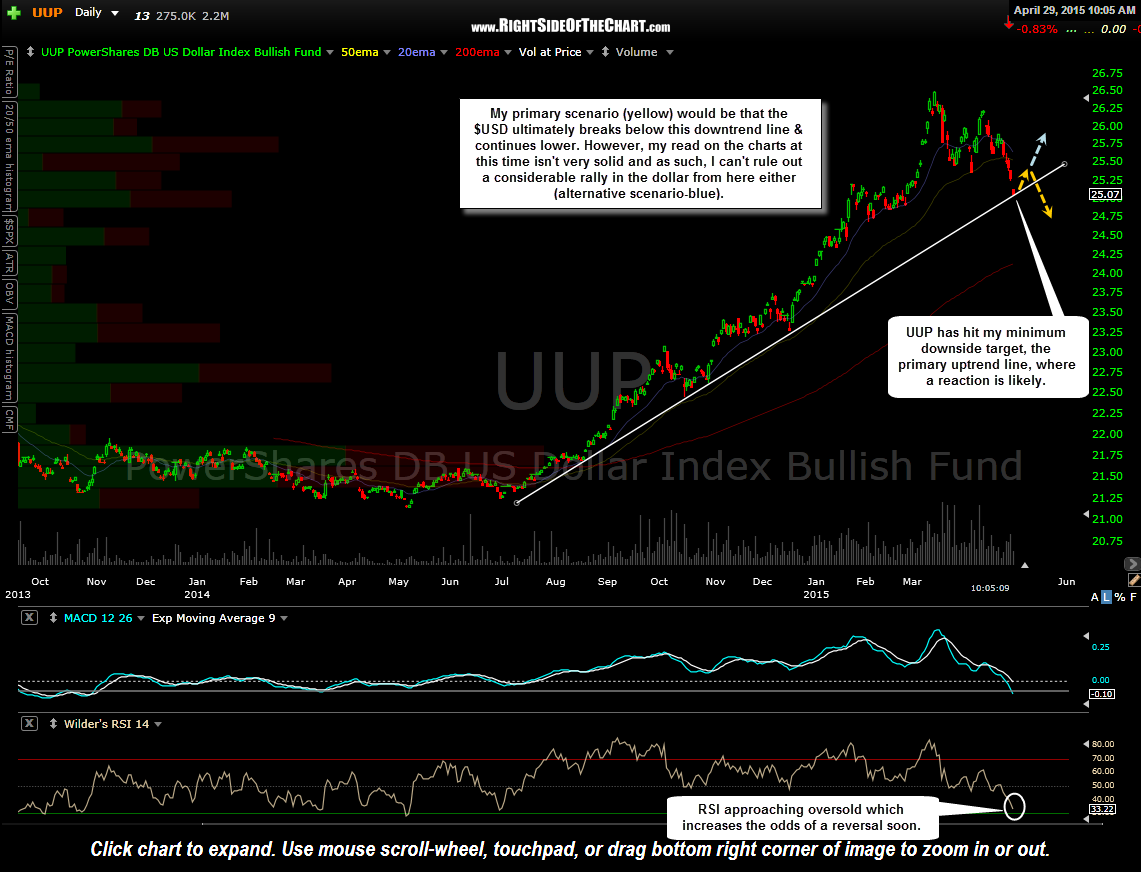

UUP ($USD Index etf) has now hit the minimum downside swing target first posted back on March 10th (the short-term target was hit yesterday with the difference between the two explained in yesterday’s UUP update).

What this means is that the odds for a reaction (bounce and/or consolidation) on this initial tag of that primary uptrend line are quite elevated at this time. Also note that the RSI 14 on the daily time frame is approaching oversold levels which have typically preceded short or intermediate trend reversals in the past. While I wouldn’t be surprised to see the precious metals & miners ignore any bounce in the $USD for a few days, should any bounce in the dollar prove to be very sharp or prolonged, that would likely put pressure on dollar sensitive assets such as the precious metals & oil. To be clear, I remain longer-term bullish on most commodities and precious metals but the near-term risk-reward is not as favorable as it was over the last several weeks and as stated yesterday, I have begun to reduce exposure to my precious metals & mining positions with the intent of adding that exposure back in the near-future unless something changes.

As far as where the dollar goes from here, my primary scenario (yellow) would be that the $USD ultimately breaks below this downtrend line & continues lower. However, my read on the charts at this time isn’t very solid and as such, I can’t rule out a considerable rally in the dollar from here either (alternative scenario-blue). Hence, I plan to still hold some long exposure to the metals & miners as well as some other commodity related longs (energy, rare earth stocks, select agricultural commodities, etc…) for now while bearish & substantially short US equities.