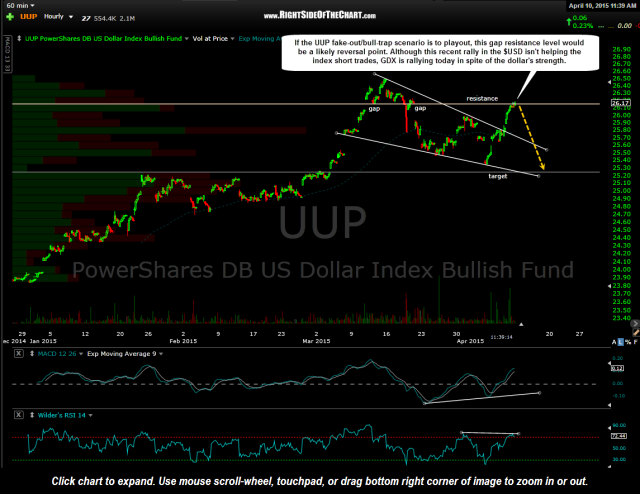

Exactly 2 weeks after the last update on the 60-minute chart of UUP (US Dollar Index etf), my initial short-term target has been hit with the $USD moving sharply lower since then. My minimum final downside target, which was first posted in the March 10th Correction In The Dollar Imminent post remains the primary uptrend line on $USD/UUP, which at this point is only about 1% below current levels. While a brief reaction (i.e.- bounce and/or consolidation) here is somewhat likely, I favor a move to my primary downside target (daily uptrend line) in the coming days. That previous 60 minute UUP chart (April 10th) and today’s updated 120 minute UUP chart are below:

- UUP 60 minute April 10th

- UUP 120 minute April 28th

My thoughts are this: That primary uptrend line is only about 1% below current levels. Such key support levels often act as magnets, sucking prices in as they approach from above. Add to that the fact that UUP fell all the way to within pennies of my initial short-term pullback target before reversing in early April. I have found that such reversals slightly above resistance often serve to act as that “initial tag” that I often refer to, where a reaction (bounce and/or consolidation) usually occurs. As that near miss earlier this month may have already served the purpose of the initial tag of support (as a decent bounce ensued), I wouldn’t be surprised to see only a very minor reaction on the tag of this horizontal support level this time around, especially considering that major uptrend line lies just below. Charts below are the previous $USD daily chart from March 10th followed but the updated daily charts of the $USD & UUP.

- $USD daily March 10th

- $USD daily April 28th

- UUP daily April 28th

With what I believe to be minimal (+/- 1%) downside on the dollar from here and the fact that SLV has hit my short-term target on the 60-minute chart earlier today & has stalled there since, I have booked some (but not all) profits on my precious metals & mining trades, with the intent of re-entering on the next objective entry. That objective re-entry would be preferably a pullback but I’m also willing to buy back at higher prices, should the charts convince me to do so.

On a related note, I tweeted out earlier today that the GDXJ Long-Trade Setup had triggered an entry. GDXJ remains an Active Long Trade an just as with GDX and many individual mining stocks, GDXJ still looks good from an intermediate & longer-term perspective. As an active trader & being that I had quite a bit of leveraged exposure with NUGT & SLV calls, I am only concerned about temporarily lightening up my exposure as the R/R is not as favorable in the very near-term as it was in the last few weeks. Longer-term traders & investors should not be overly concerned with short-term market timing other than to strategically add to or exit positions at pre-determined buy/sell ranges.