UNG (natural gas ETN) has just hit the second price target for a ~14% gain from the Dec 13th entry. Consider booking partial or full profits and/or raising stops if holding out for any of the additional targets. Previous & updated 60-minute charts below.

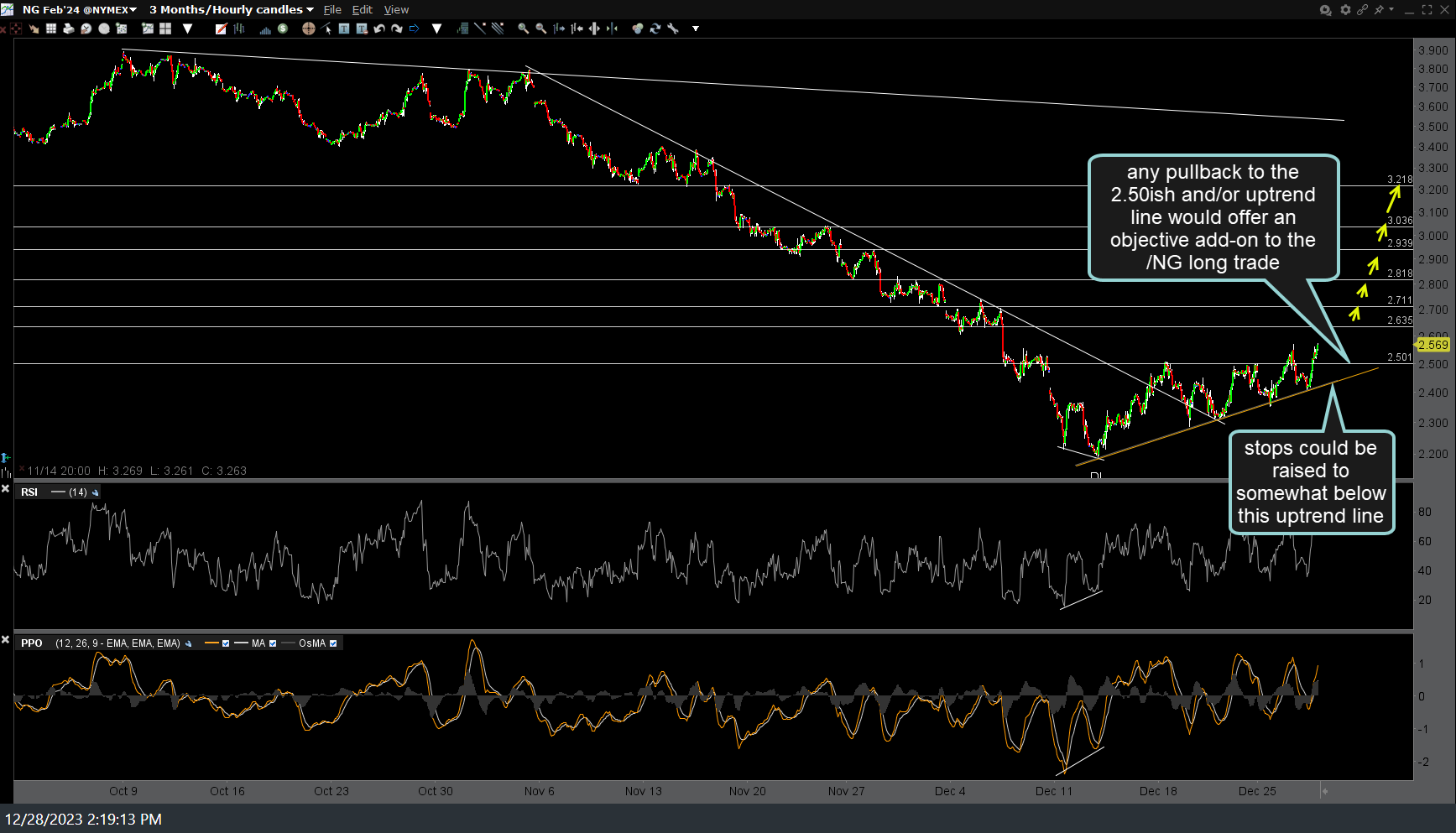

Likewise, any pullback to the 2.50ish and/or uptrend line would offer an objective add-on to the /NG (nat gas futures, or UNG) long trade & stops could be raised to somewhat below this uptrend line on the 60-minute chart below.

/CL (crude futures or USO, crude ETN) offers an objective add-on or new entry on this pullback to the 72.50ish support after reversing just shy of T3 (with divergences). 60-minute chart below.

I also posted the updated 60-minute charts of /ES (S&P 500 futures), /NQ (Nasdaq 100 futures) and QQQ (Nasdaq 100 ETF) in the comment section below the video posted earlier today. Those charts can be viewed by clicking here.

Also, EUR/USD is starting to crack below the recently highlighted 60-minute bearish rising wedge pattern, albeit by a relatively small margin at this time. However, something to monitor as a solid breakdown & subsequent drop in EUR/USD would most likely bring the stock market as well as the precious metals down with it.