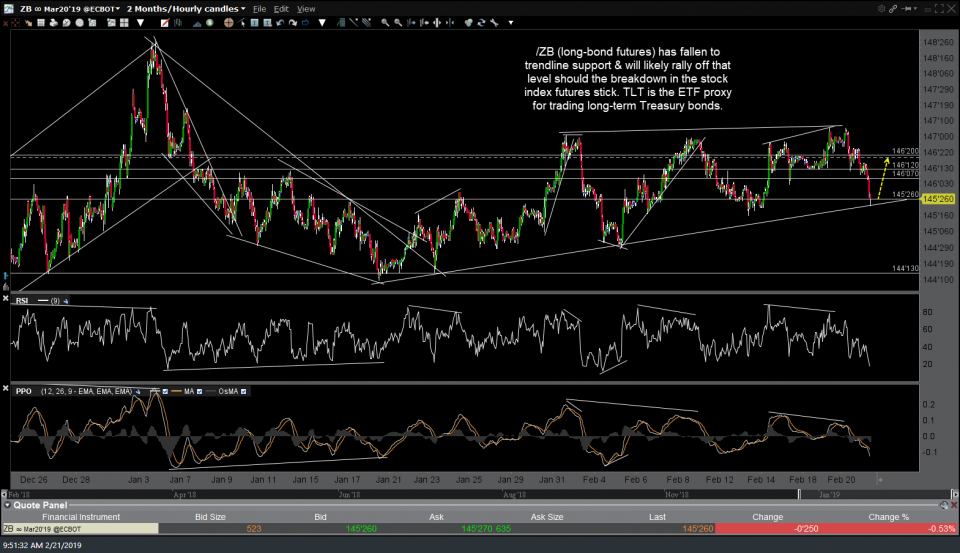

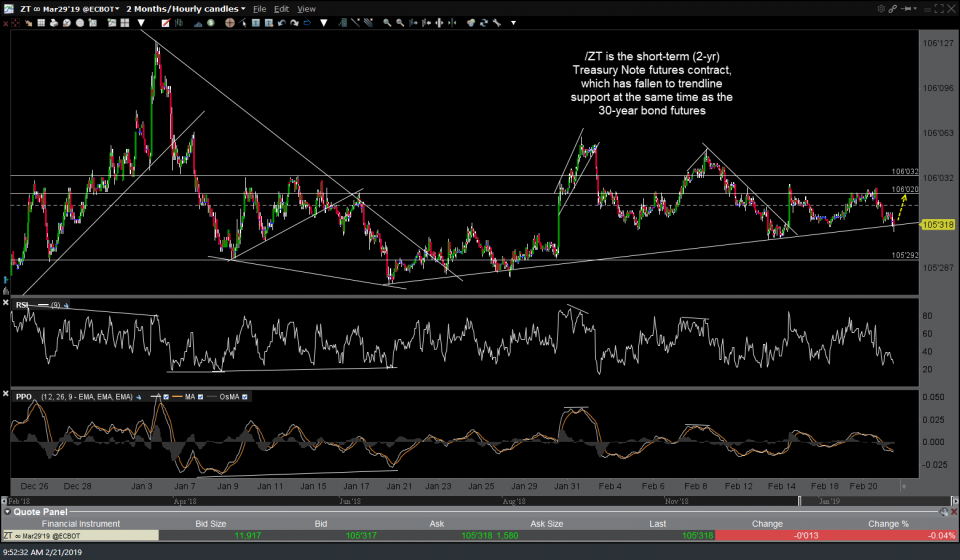

As /ES (S&P 500 Index E-mini futures) has fallen to the bottom of the recently highlighted bearish rising wedge pattern, with a sell signal pending a solid & impulsive break below that level, US Treasury bond futures, not by mere coincidence, have fallen to 60-minute trendline support as well.

- ZB 60-min Feb 21st

- ZT 60-min Feb 21st

- ES 60-min 2 Feb 21st

- ES 60-min 2 zoom Feb 21st

This aligns with my expectation of an imminent breakdown in the equity indexes (/NQ Nasdaq 100 futures have already broken down, just awaiting /ES to confirm) as Treasury bonds are likely to catch a flight-to-safety bid if/when the stock indexes correct. As such, a long on Treasury bonds, which can be done through these futures contracts or any of the Treasury bond ETFs such as TLT (20-30 year Treasurys), IEF (intermediate-term Treasuries) or SHY (short-term Treasuries), would likely prove to be a highly correlated trade with the stock indexes (i.e.- they both work or the both fail).