USO (crude oil ETN) rallied sharply off the recent pullback to my primary uptrend line & has spiked back into the ORANGE ZONE. The last time (first daily chart below) that I highlighted USO popping into my ORANGE ZONE at the start of April, QQQ immediately fell by ~8%.

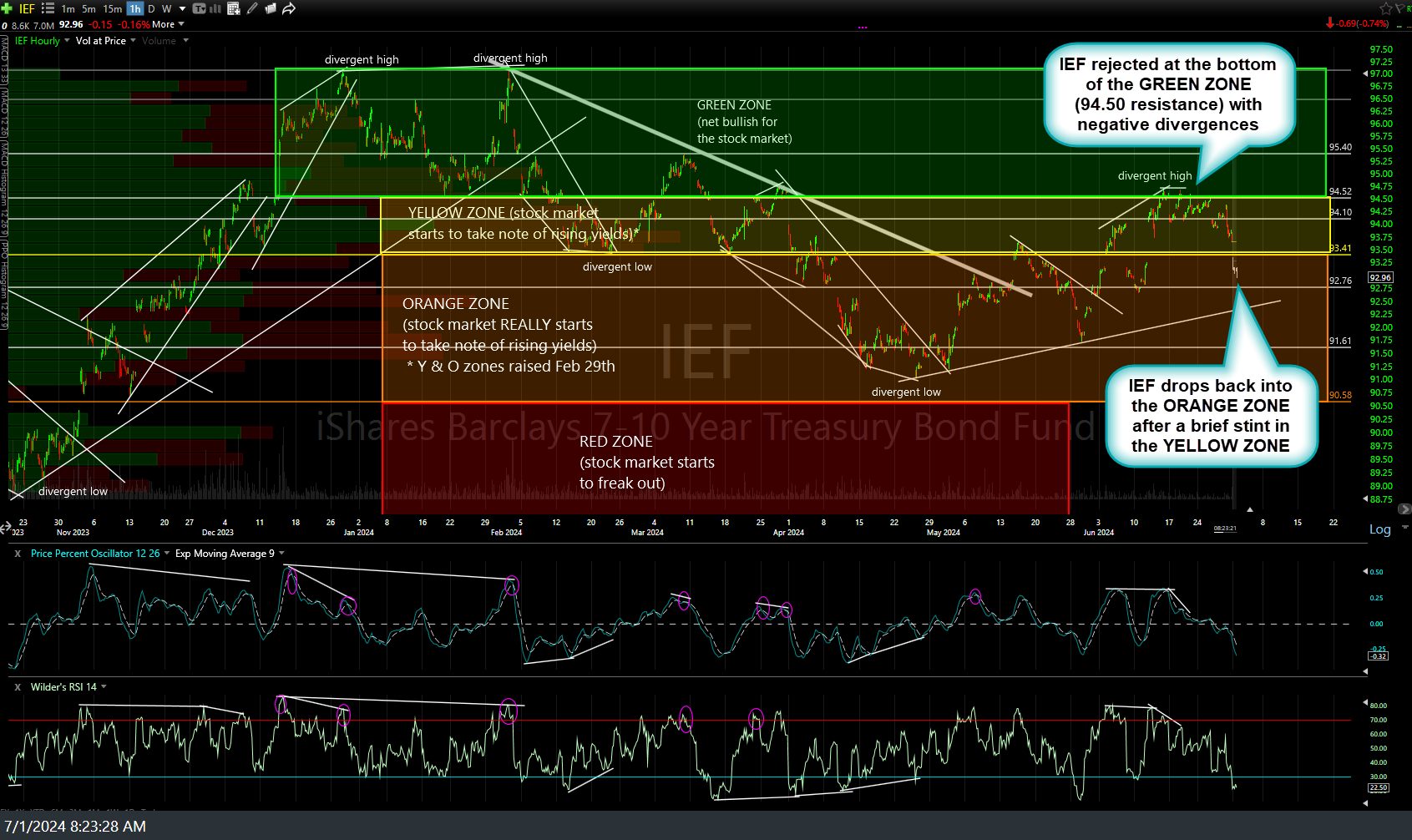

Likewise, IEF (7-10-year Treasury bond ETF) has also dropped back into its comparable ORANGE ZONE after a brief stint into & rejection off the top of the YELLOW ZONE (94.50ish resistance). As with crude oil, I also posted that a correction in the stock market was likely (with the biggest correction of the year immediately following) as IEF had fallen back into its ORANGE ZONE. Previous (April 2nd, 3rd, & 5th) and updated 60-minute charts (with the pre-market trades in white candlesticks) below.