Here are some key technical levels & potential developments that I’ll be watching for today & possibly into next week. EUR/USD (€/$) continues to move lower following the recent breakdown & backtest of this 60-minute trendline with the pair now approaching my minimum pullback target.

While I’m slightly leaning towards that 1.62ish level containing this pullback, with a resumption of the rally in the Euro/correction in the US Dollar to resume from there, I’d put slightly lower odds on a continued move down to the 1.15306 area before the next significant rally in the Euro/correction in the Dollar gets underway. Of course, this would have a near-direct impact on gold prices, which still have the potential to be in the process of a major bottom, hence my hyper-focus on the US Dollar in recent weeks.

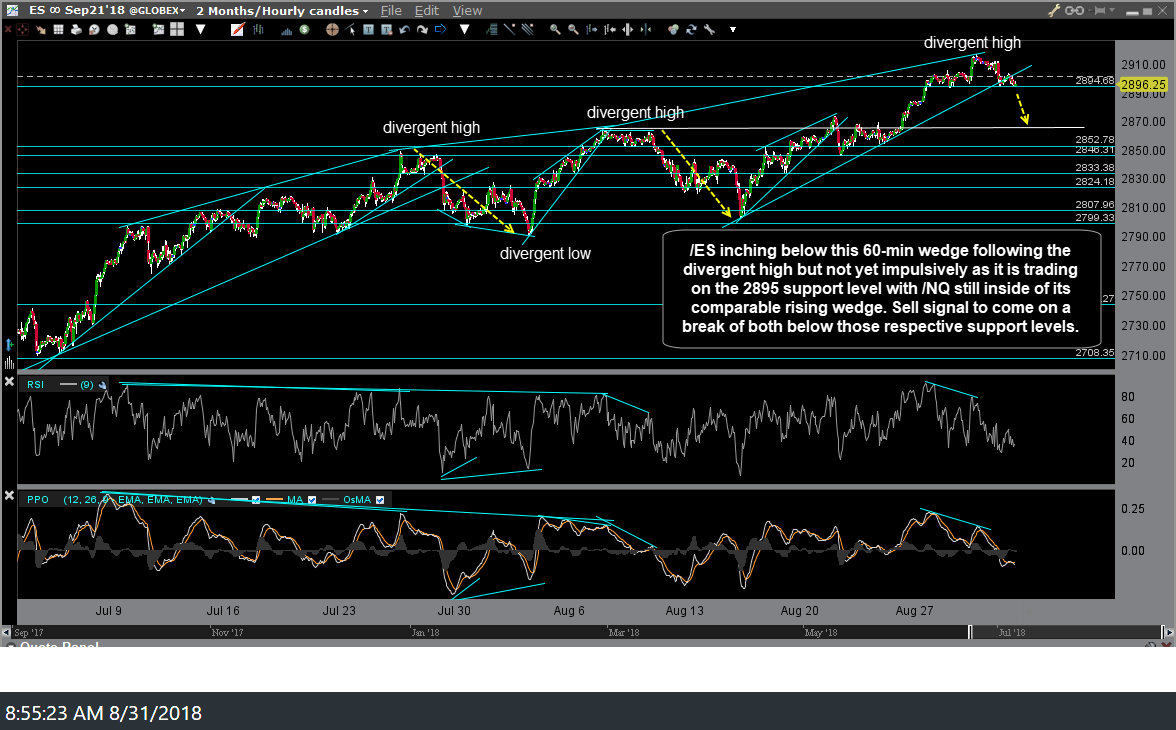

Moving onto the US Equity markets, /ES (S&P 500 E-mini futures) is inching below this 60-min wedge following the divergent high but not yet impulsively as it is trading on the 2895 support level with /NQ still inside of its comparable rising wedge. Sell signal to come on a break of both below 2895 on /ES as well as the uptrend line on /NQ. Arrows indicate minimum pullback target levels.