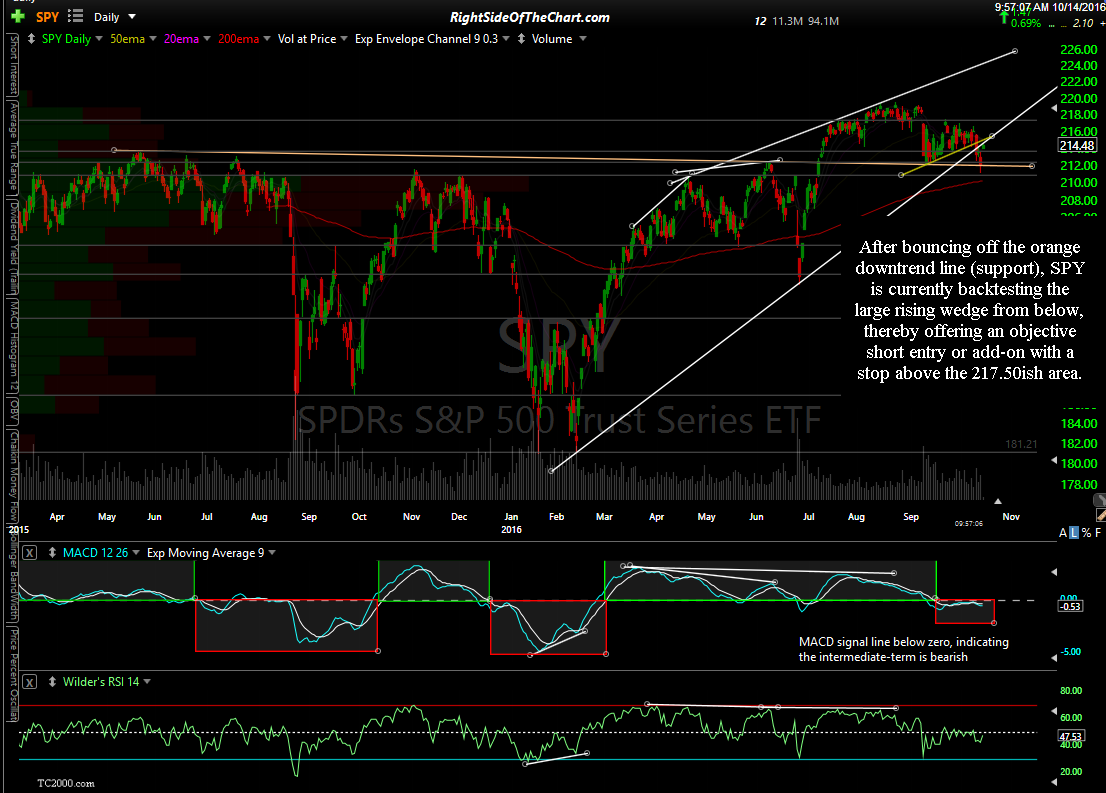

After bouncing off the orange downtrend line (support), SPY is currently backtesting the large rising wedge from below, thereby offering an objective short entry or add-on with a stop above the 217.50ish area (still only an unofficial trade idea, as with any broad market index tracking ETFs).

Now let’s look at the leading index, the Nasdaq 100/QQQ while from a top-down approach. The Nasdaq 100 has been the leading index for years & we all know that tech (the technology sector) is what drives the Nasdaq 100. Therefore, to get a good feel on where the Nasdaq & hence the US stock market is headed, we need to have a good read on where the tech sector is headed & the best way to do that is to figure out where the semiconductor sector is headed as the semiconductor sector is often used as a leading indicator for the tech sector. As of now, QQQ is still trading solidly below the recently broken uptrend line & has yet to even come close to backtesting it, which it may or may not do before moving sharply lower in the coming weeks/months.

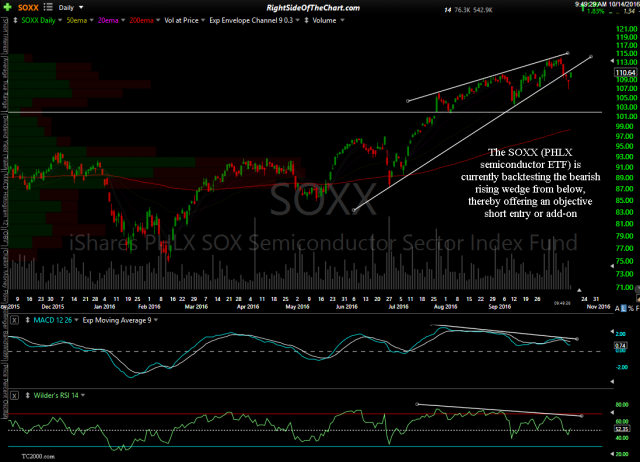

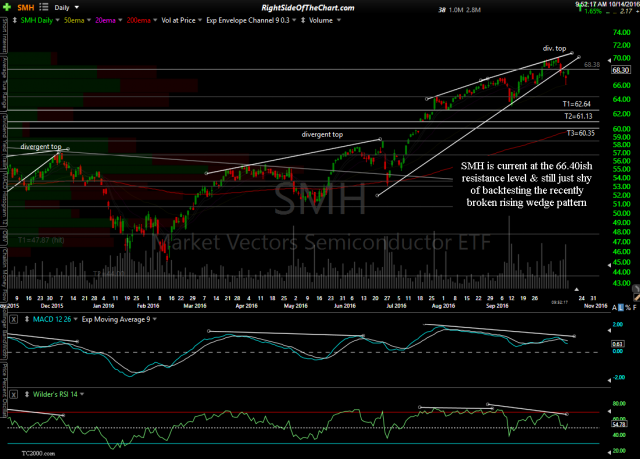

The SOXX (PHLX semiconductor ETF) is currently backtesting the bearish rising wedge from below, thereby offering an objective short entry or add-on while SMH (Market Vectors Semiconductor ETF) is current at the 66.40ish resistance level & still just shy of backtesting the recently broken rising wedge pattern.

- SOXX daily Oct 14th

- SMH daily Oct 14th

In a nutshell, it appears that all US stock indices have recently broken below key uptrend lines following divergent highs that indicator a major trend reversal is likely although as mentioned yesterday, there is still some work to be done to firm up the bearish case, namely a break below those key support levels that were highlighted yesterday on many of the top 10 components of the $NDX as well as the key 116 support level on QQQ (a break of which would likely coincide with a break of those same key support levels highlighted on the leading stocks in the $NDX).