I’m back from the hellish emergency passport renewal process on the other side of the state with analysis to resume as normal tomorrow & just wanted to get a few updates on some of the recent core trades as I’m finally able to catch up on the charts.

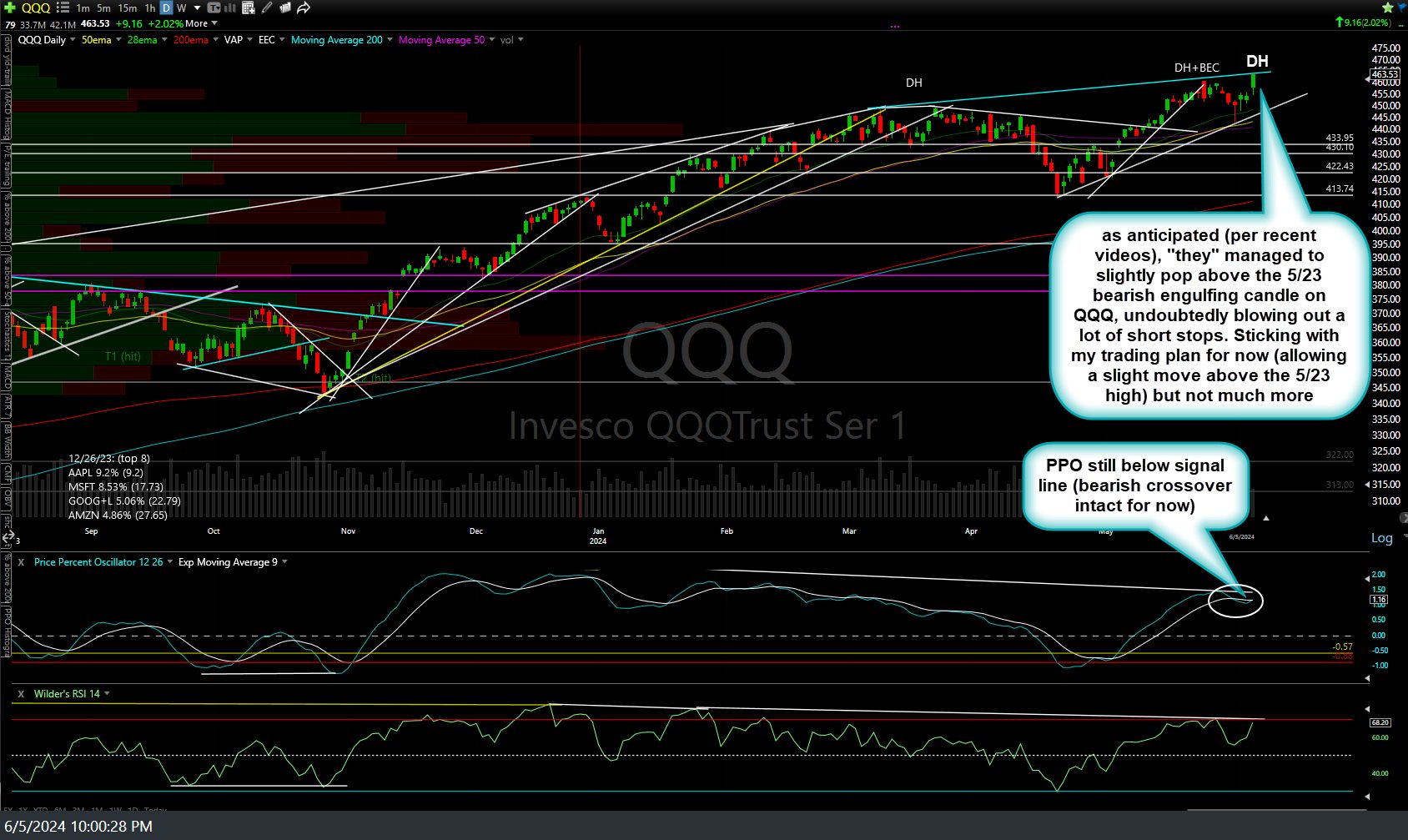

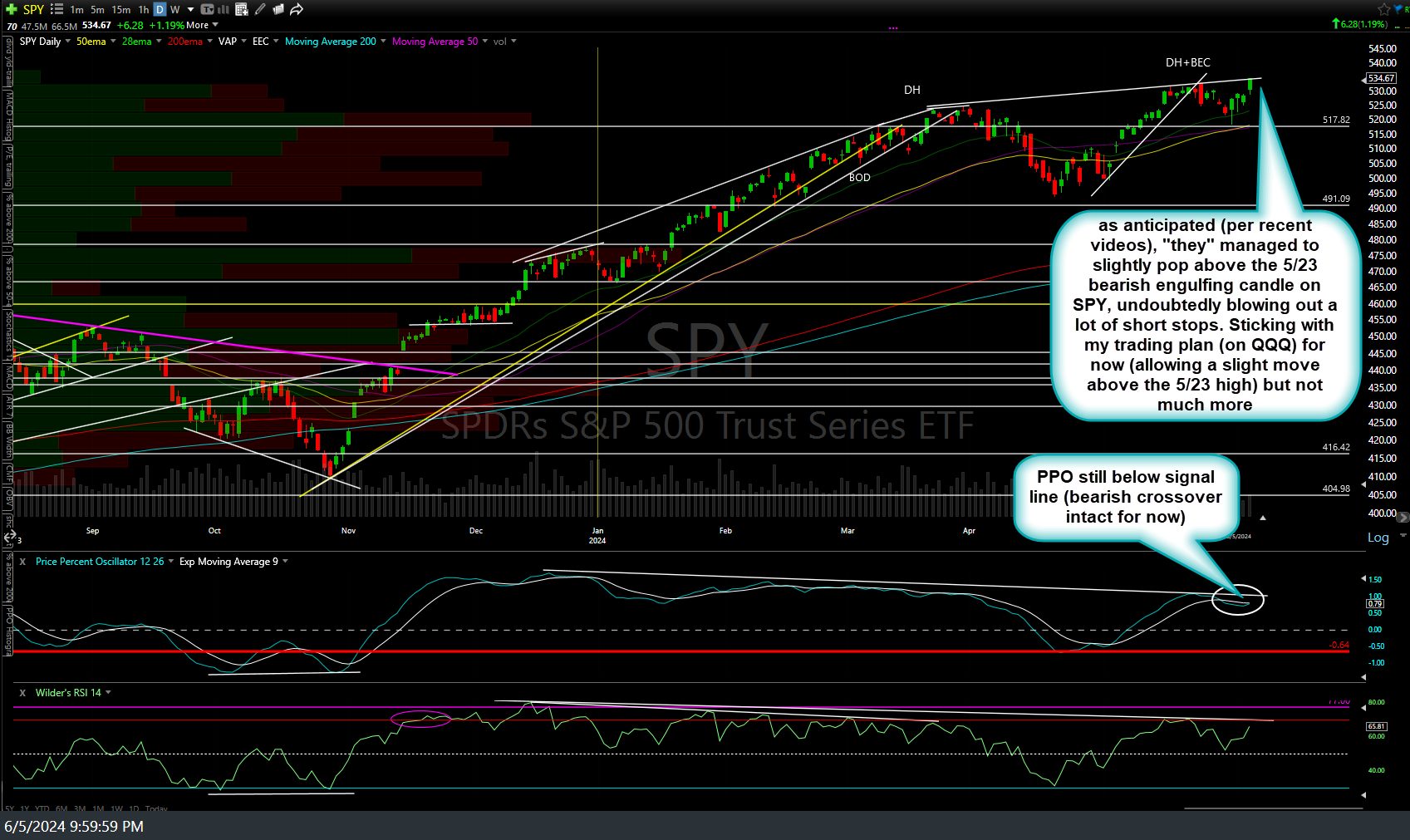

As anticipated (per recent videos), “they” managed to slightly pop above the 5/23 bearish engulfing candle on QQQ (and SPY), undoubtedly blowing out a lot of short stops. Sticking with my trading plan for now (allowing a slight move above the 5/23 high) but not much more as the PPO remains below its signal line (i.e- keeping the recent bearish crossover/trend change signal on both SPY & QQQ intact for now). Daily charts below.

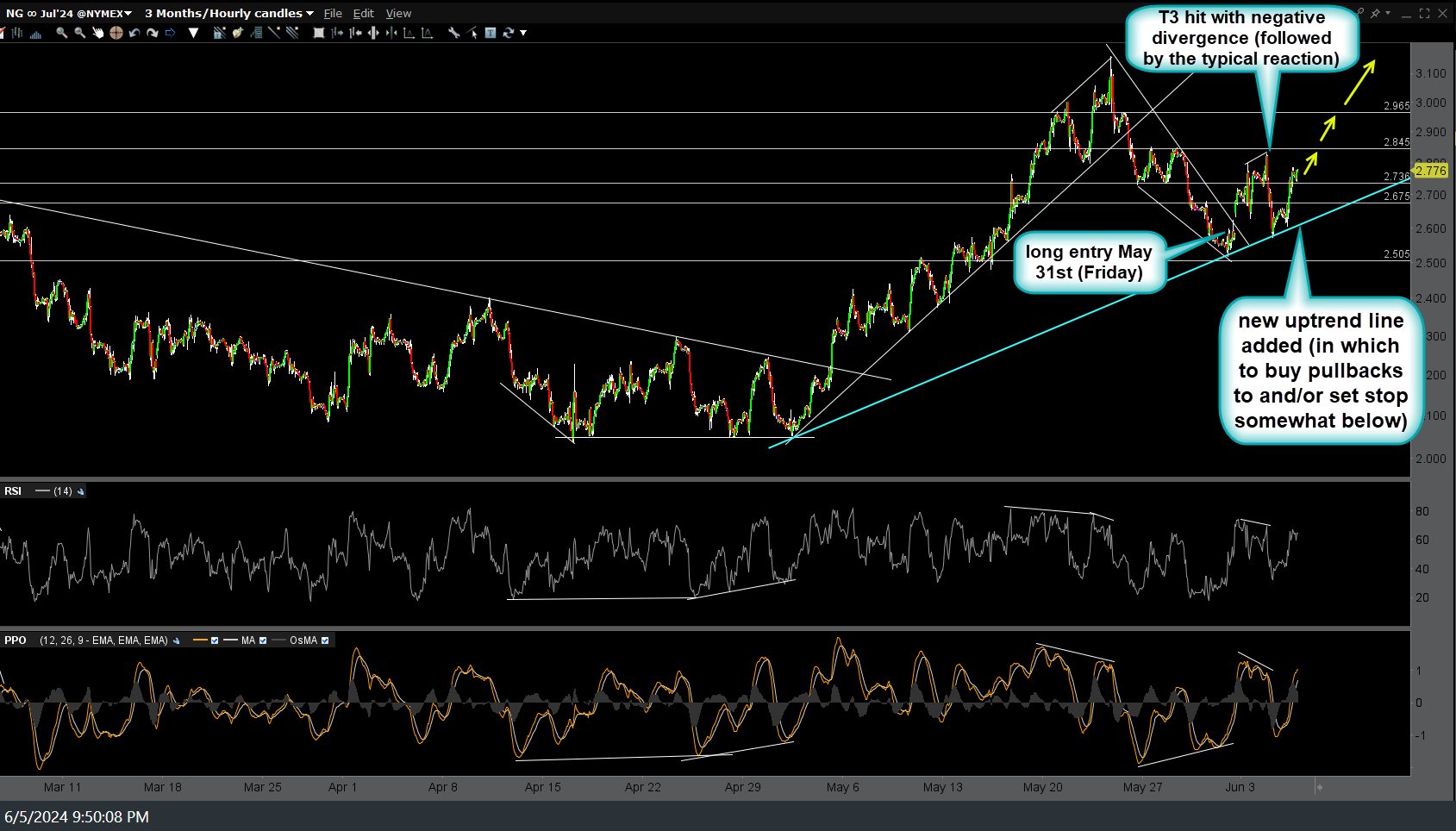

I’ve added a new uptrend line to the most recent /NG (natural gas futures, or UNG, nat gas ETN) swing trade which could be used to buy pullbacks to and/or set a stop somewhat below (ideally on a 60-minute or daily closing basis). 60-minute chart below.

/GC (gold futures) bounced as expected (as per yesterday’s video) off the drop to the uptrend line with positive divergences. Awaiting the next objective entry; short or long. Ditto for /SI (silver, which also bounced off the comparable 29.477 support it was also trading it while covered in yesterday’s video. 60-minute charts below.

It’s late here & I’ve had a long day so will follow up on the other recent trade ideas tomorrow but just glanced at the chart of WEAT (wheat ETN), which hit & closed on that key 6ish support I was looking for to re-entry so I will most likely do so tomorrow (and will post an updated chart or cover in next video) although I will most likely wait until & unless /ZW (wheat futures) can regain the 652 level (closed a hair below it today).