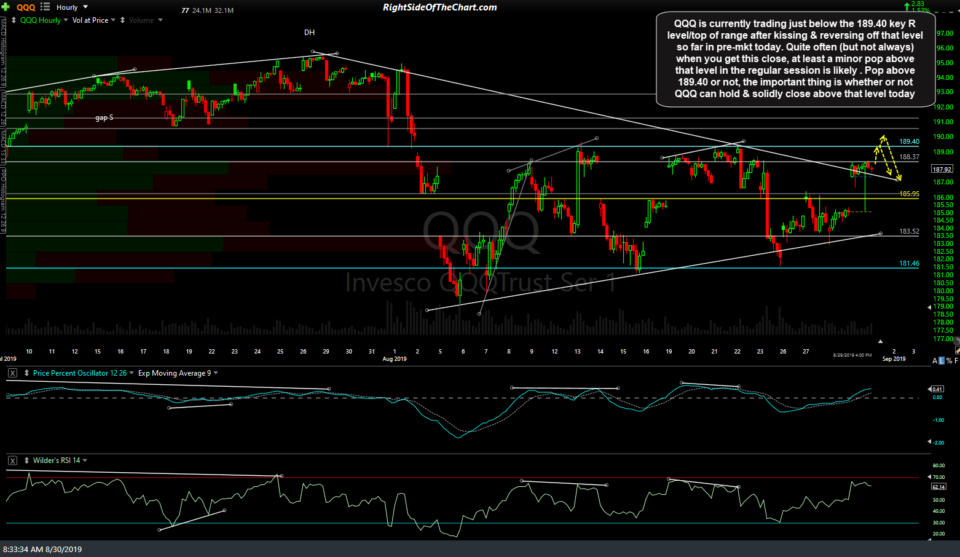

QQQ is currently trading just below the 189.40 key resistance level/top of the August trading range after kissing & reversing off that level so far in pre-market today. Quite often (but not always) when you get this close, at least a minor pop above that level in the regular session is likely. Whether QQQ pops above 189.40 or not, the important thing is whether or not QQQ can hold & solidly close above that level today.

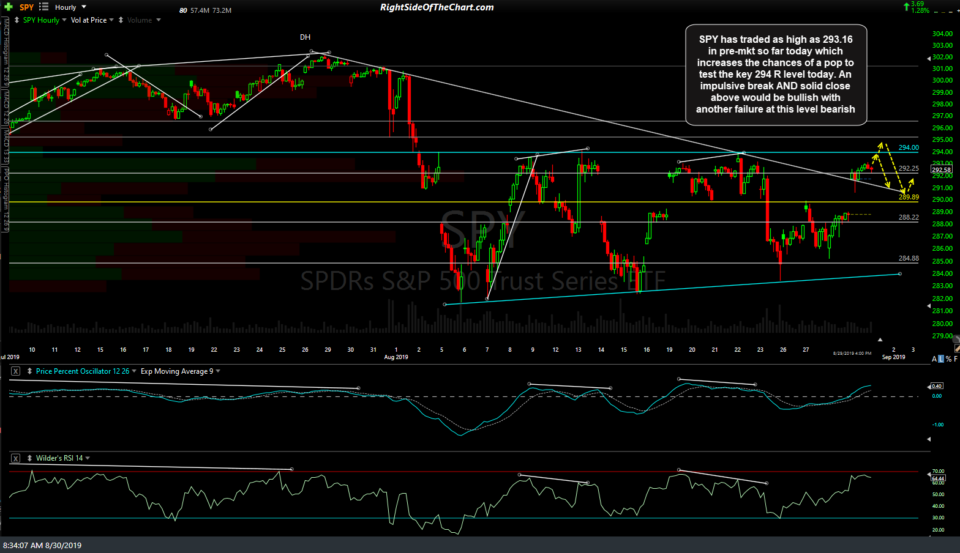

SPY has traded as high as 293.16 in pre-market so far today which increases the chances of a pop to test the key 294 resistance level today. An impulsive break and solid close above would be bullish with another failure at this level bearish.

A couple of developments which do not align with the more bullish scenario of a breakout & significant rally well-above the top of the August trading range is the fact that both of the major risk-off assets, gold & US Treasury bonds, have held up surprising well following yesterday’s breakdowns as well as the current bearish technical posture of both (divergences, overbought conditions, etc.). Maybe that changes today with a sharp drop in Treasuries & the precious metals, should the market make a convincing breakout & sustained rally above the top of the trading range but as of now, the resiliency, or more so, the outright strength, on both gold & Treasuries since their lows yesterday, does not mesh with the bullish case in equities. The charts in the ‘gallery’ format below will not appear on email notifications but may be viewed on the site.

- ZB 60-min Aug 30th

- GC 60-min Aug 30th

- SI 60-min Aug 30th

As I like to say, one day does not make a trend so let’s see how we finish the day which is also the last trading day of the month as well as the start of a 3-day weekend. As such, unless I see anything very compelling today, I plan to sit tight on my equity swing shorts & T-bond/precious metals (short) hedges over the weekend.