/GC (gold), just like the other big flight-to-safety asset, US Treasury Bonds, has been unusually resilient in light of the recent rally in equities while holding above the key 1500ish support recently with doesn’t exactly mesh with the recent return to “risk-on” trade over the past several trading sessions. Although they are opposing scenarios shown below, my convictions on which one plays out aren’t very strong right now although I’m leaning towards the bullish (green) scenario, which would most likely entail the stock market reversing & moving lower soon.

/ZB (30-yr T-bond futures) has also held up surprisingly well during the 4% rally in equities over the past 3 trading sessions, especially in light of the recent divergent high & rising wedge breakdown (i.e.- a near-term bearish technical posture & recent sell signal via the trendline/wedge breakdown). Similar to gold, which scenario below plays out will most likely depend on where the stock market goes from here.

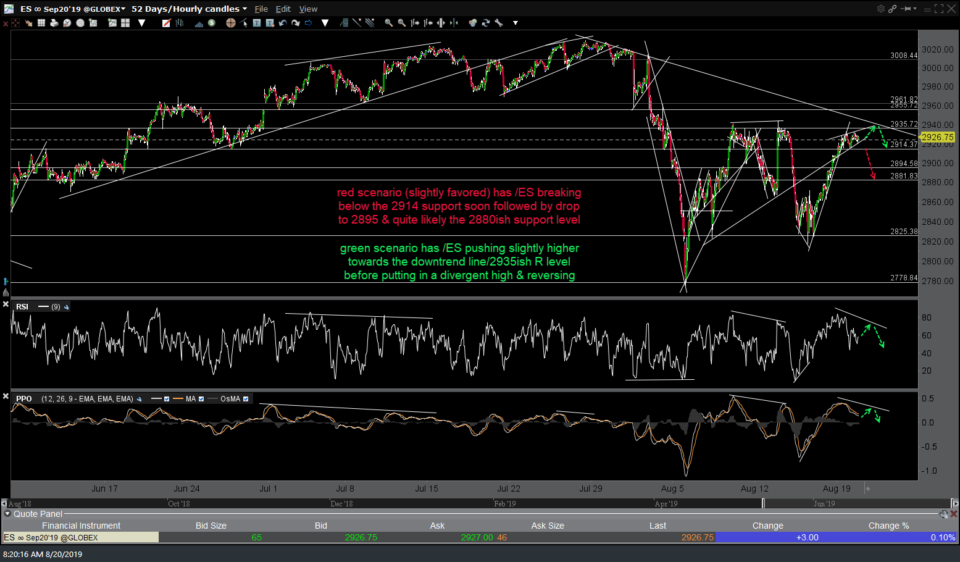

As I’ve recently stated, the fact that the stock market has now traded sideways for the past two weeks and had just made the third test of my maximum bounce targets from the Aug 5th lows 2-weeks ago vs. breaking below those lows following the initial bounce just doesn’t mesh with a typical correction with an initial impulsive wave of selling followed by a relatively brief snapback rally & then another wave of impulsive selling that takes out the previous lows.

As such, that has somewhat muddled the technical picture & dampened my convictions on the near-term direction of the stock market although I’m still leaning towards this red scenario which has /ES breaking below the 2914 support soon followed by a drop to 2895 & quite likely the 2880ish support level. The alternative, green scenario has /ES pushing slightly higher towards the downtrend line/2935ish R level before putting in a divergent high & reversing.

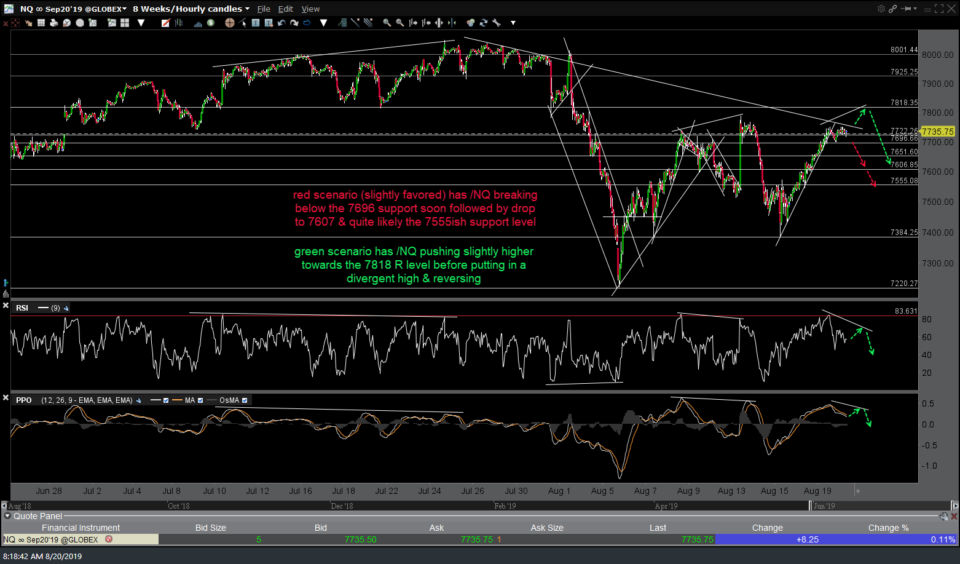

Likewise, I slightly favor the red scenario which has /NQ breaking below the 7696 support soon followed by a drop to 7607 & quite likely the 7555ish support level while the alternative green scenario has /NQ pushing slightly higher towards the 7818 R level before putting in a divergent high & reversing.