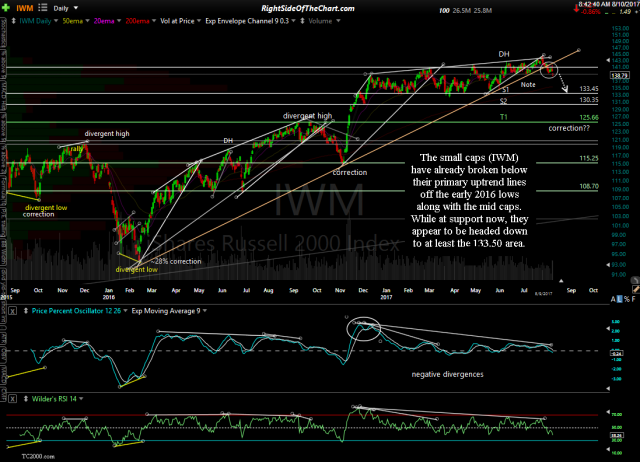

Both the small caps (IWM) have already broken below their primary uptrend lines off the early 2016 lows along with the mid caps (MDY). While both closed at support yesterday, IWM appears to be headed down to at least the 133.50 area with MDY poised to fall to at least the 305.35 area once the support levels just below give way (likely soon). Props to member @irawood for pointing out those trendline breaks in the trading room as I have been largely focused on the large caps lately, particularly the Nasdaq 100 (QQQ).

- IWM daily Aug 9th close

- MDY daily Aug 9th close

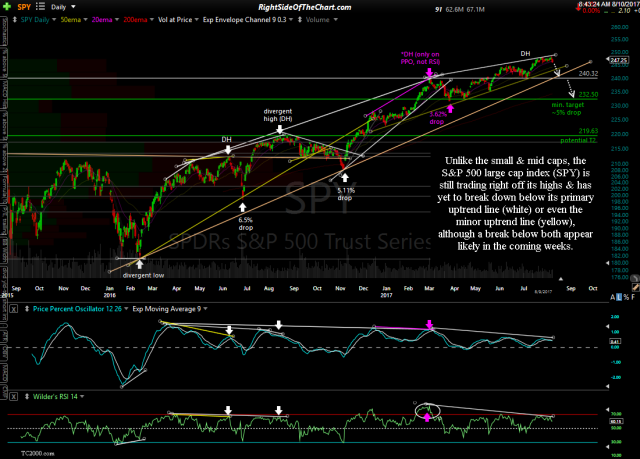

Unlike the small & mid caps, both the Nasdaq 100 (QQQ) & the S&P 500 (SPY) large cap indexes are is still trading right off their highs & have yet to break down below their primary uptrend lines (white) or even the minor uptrend line (yellow) on SPY, although a break below both appear likely in the coming weeks.

- QQQ daily Aug 9th close

- SPY daily Aug 9th close