It’s been my experience that the abbreviated trading week around the Thanksgiving holiday is more conducive to day trading/active trading than for swing or trend trading, as most stocks, sectors, indexes, & commodities tend to gyrate around as trading volumes taper off. As such, this is usually a good week to take off from typically swing trading (i.e.- refrain from taking all but the best-looking setups & maybe consider widening stops on existing positions.)

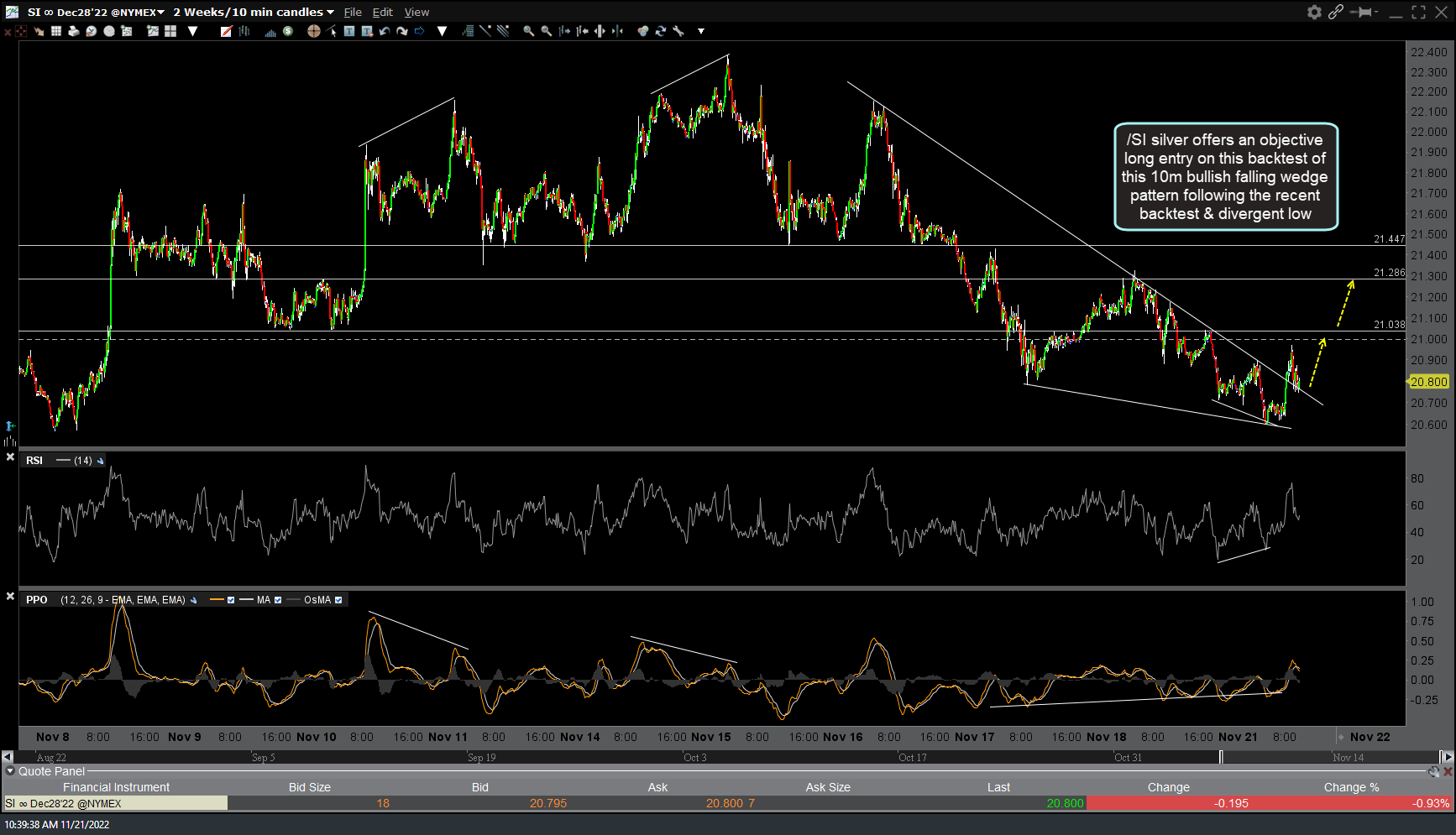

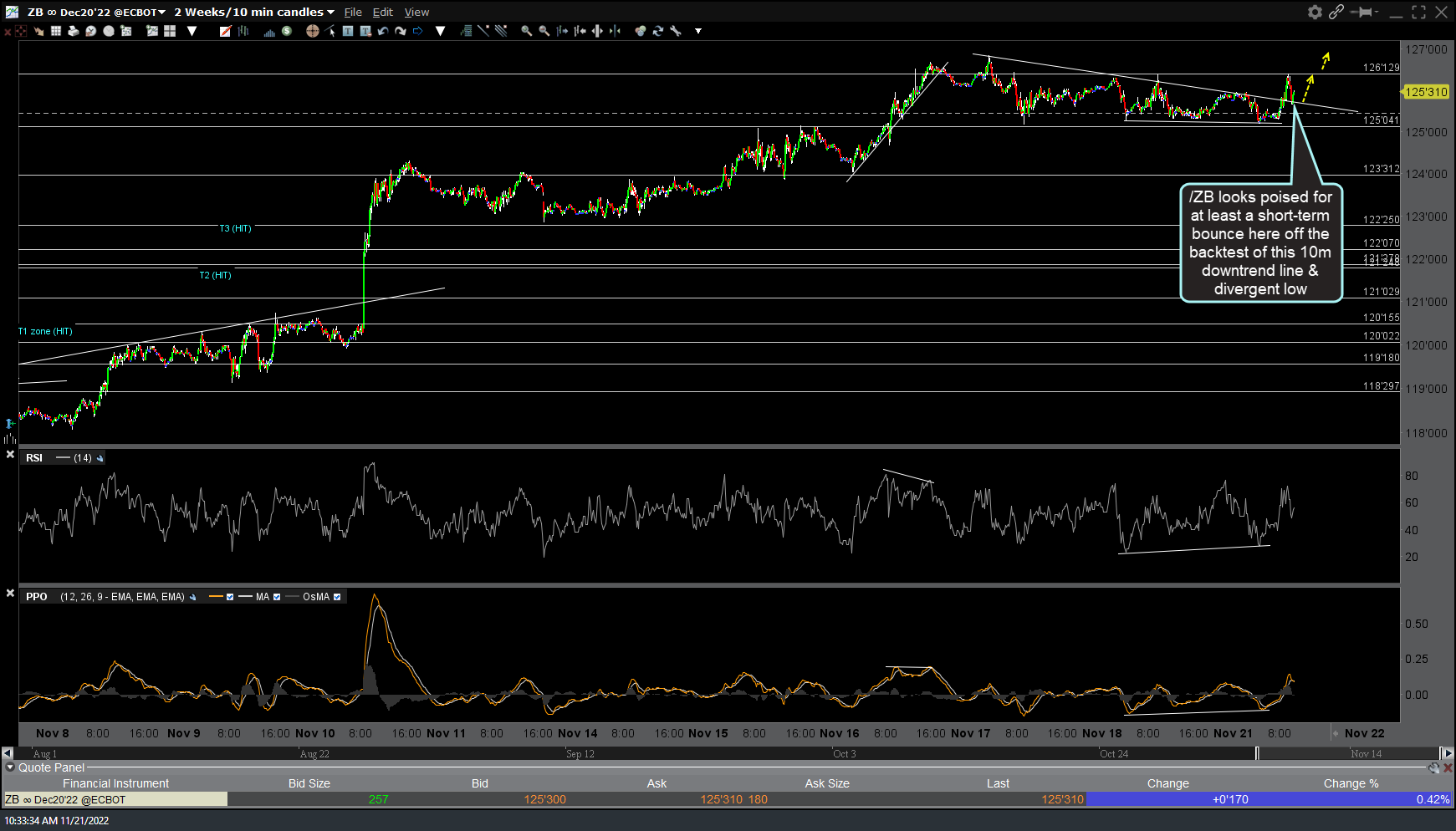

For those interested in trying to game some short-term moves using futures or their ETF counterparts, the 10-minute charts of /NQ (Nasdaq 100), /SI (silver), /GC (gold), & /ZB (30-yr Treasury bond) highlight the current objective long entries & short-term bounce targets on all.