If the rally over the past 2-day was just typical counter-trend bounce within a downtrend with more downside, this 294 resistance level/top of Aug trading range would be a likely reversal point.

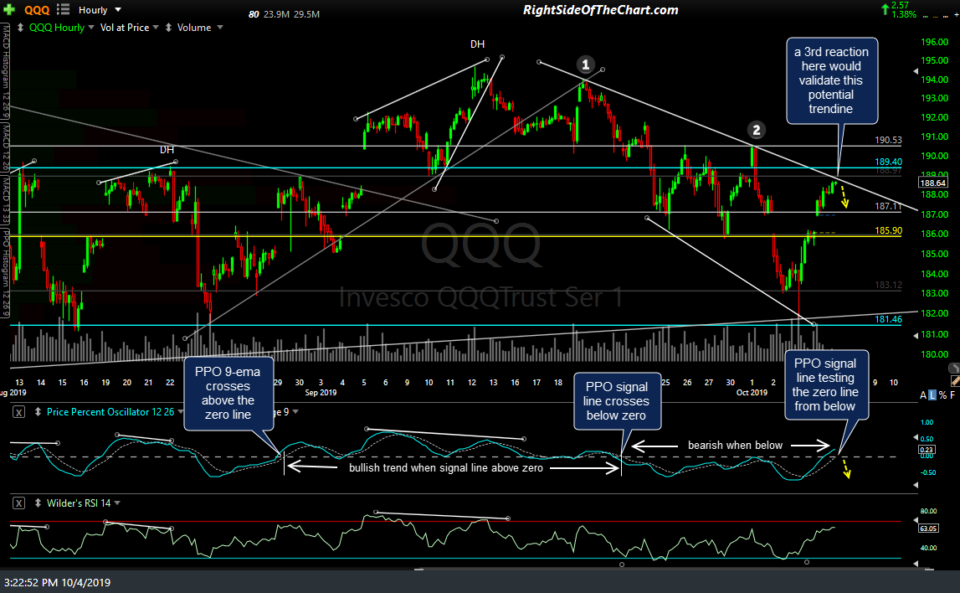

Although QQQ is still a little shy of the top of its comparable August trading range, a third reaction here would validate this potential downtrend line off the Sept 19th reaction high. A reversal here would also result in another rejection of the PPO signal line (9-ema) off the zero line from below. The PPO signal line does a decent job of defining the trend on this 60-minute time frame; bullish when above & bearish when below.

As the same time that SPY & QQQ approach potential resistance levels, the $VIX CBOE Volatility Index is backtesting the intersecting uptrend & downtrend lines just above the 16.73 support. Keep in mind that so far today, with just 15-minute left in the trading session, has been a trend day. A trend day is when the market moves steadily higher (or lower) throughout the session to close on or near the highs (or lows) of the day. As such, the odds favor more upside into the close & if that is the case, these indexes are likely to move and/or close slightly above these resistance levels but as long as it is only by a relatively slight amount, we’ll have to wait to see how the market follows through on Monday