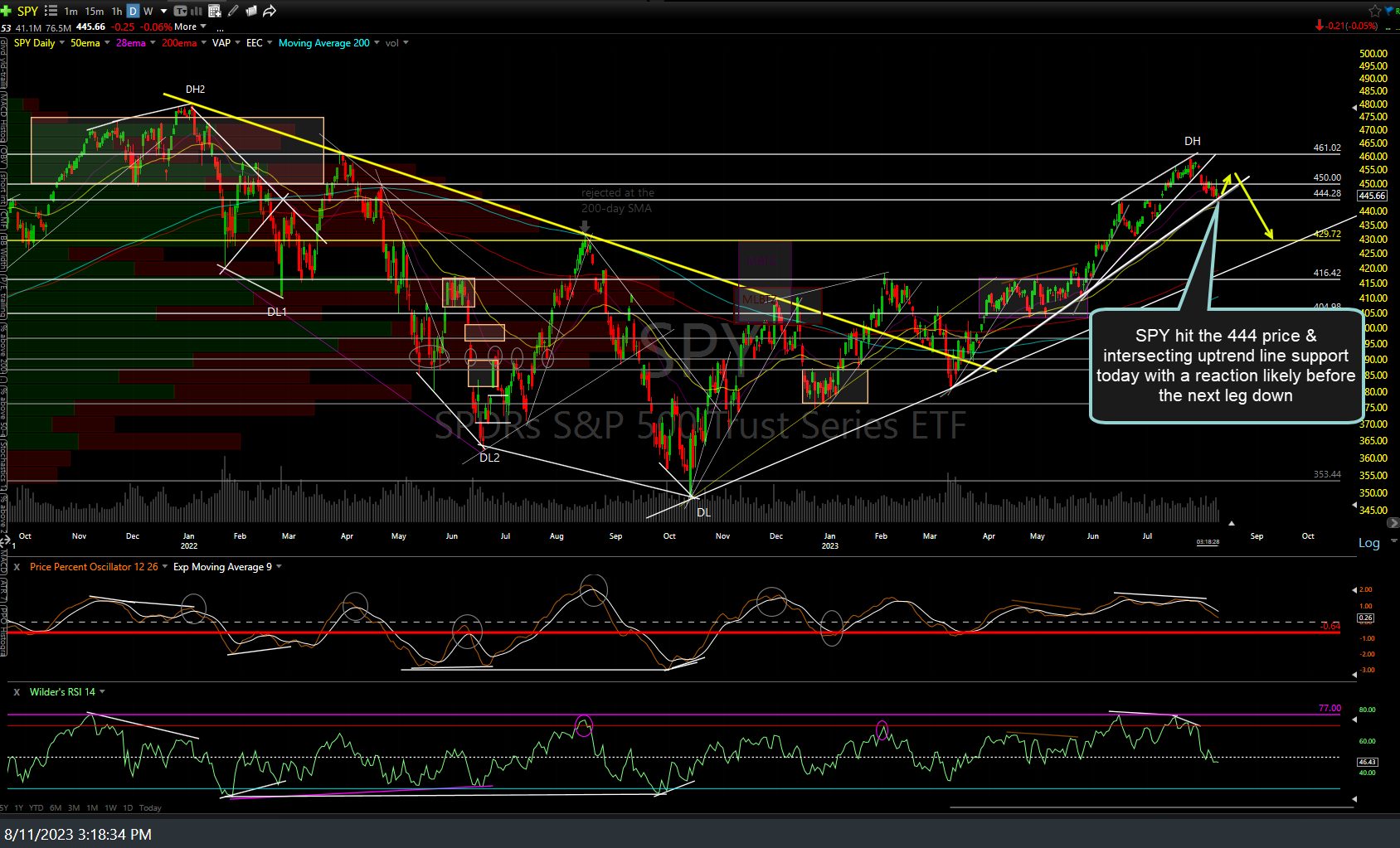

As per today’s earlier video, SPY hit the 444 price & intersecting uptrend line support today with a reaction likely before the next leg down. Daily chart below.

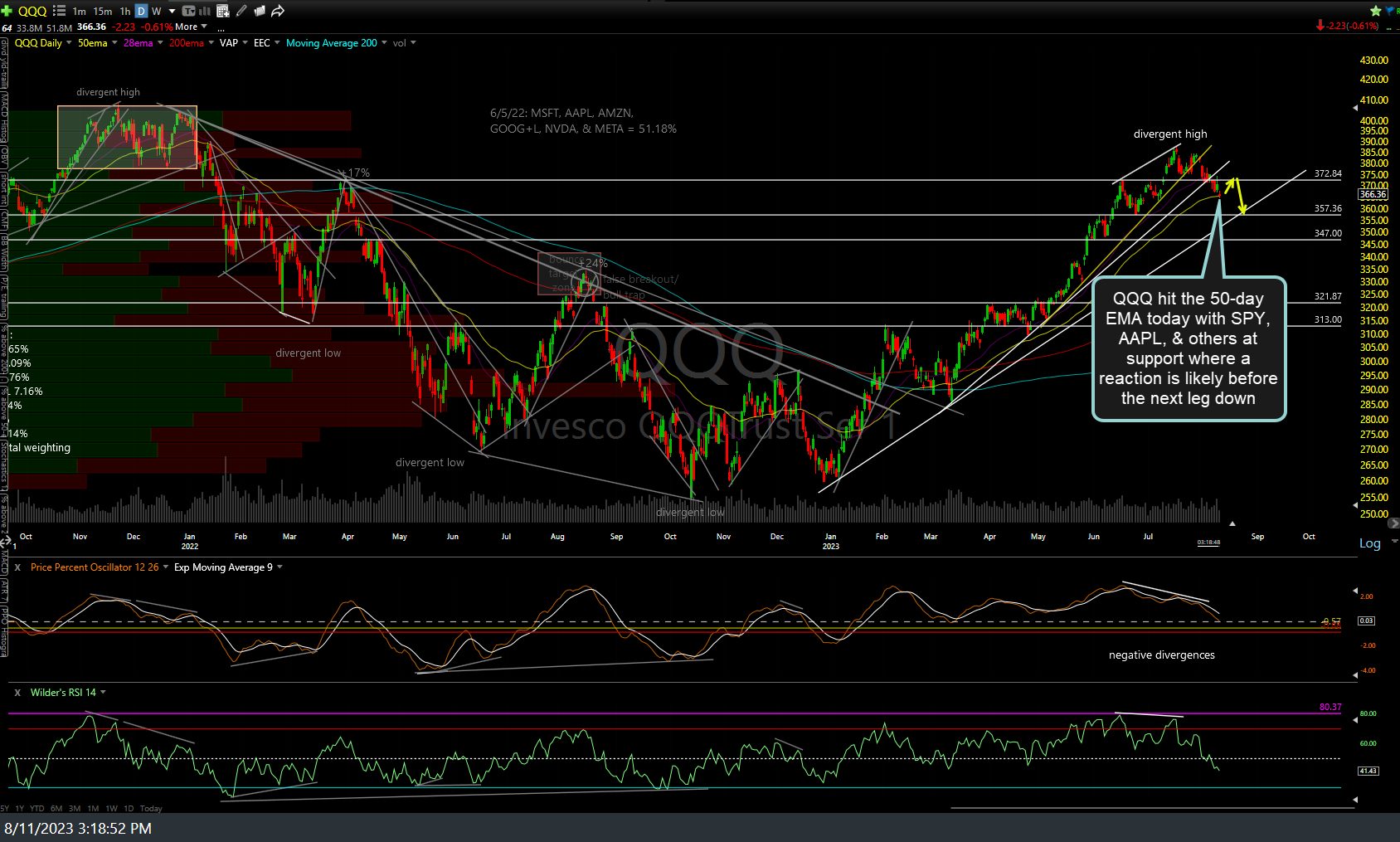

QQQ hit the 50-day EMA today with SPY, AAPL, & others at support where a reaction is likely before the next leg down. Daily chart below.

AAPL (Apple Inc.) hit my first price target today where a reaction is likely before the next leg down. Daily chart below.

Bottom line: As stated above, a reaction off this initial tag of these support levels is likely but “likely” is far from certain. With all of the bearish technical & fundamental developments that I’ve highlighted in recent weeks, it appears that the stock market has considerable more downside in the coming weeks to months although the R/R in the very near-term, i.e.- today & quite likely early next week… UNLESS these support levels are clearly taken out on a big gap down Monday…. is slightly skewed to the upside. Again, those odds can & would change quickly if the indexes & market-leading stocks clearly take out the support levels they fell to earlier today.

As such, my preference (with 25 minutes left in the trading session as I type) is to reduce short exposure in my longer-term accounts (swing/trend trades), adding that exposure back at the next objective opportunity(ies), such as a bounce into resistance or solid breaks below support (most likely next week) while either going flat or taking home relatively mild long exposure in my active trading account regarding the major stock indices as well as tech & the semis which I’ve been stating as over-weighted positions on the short side in recent weeks. Basically, a good time to harvest/protect some gains on shorts & look to add back that exposure when the R/R becomes more favorable once again.