QQQ closed the week at the bottom of the ‘most likely’ bounce target zone & primary (BOD) bear market downtrend line + intersecting 200-day moving averages; A confluence of Price, trendline, & key MA resistance.

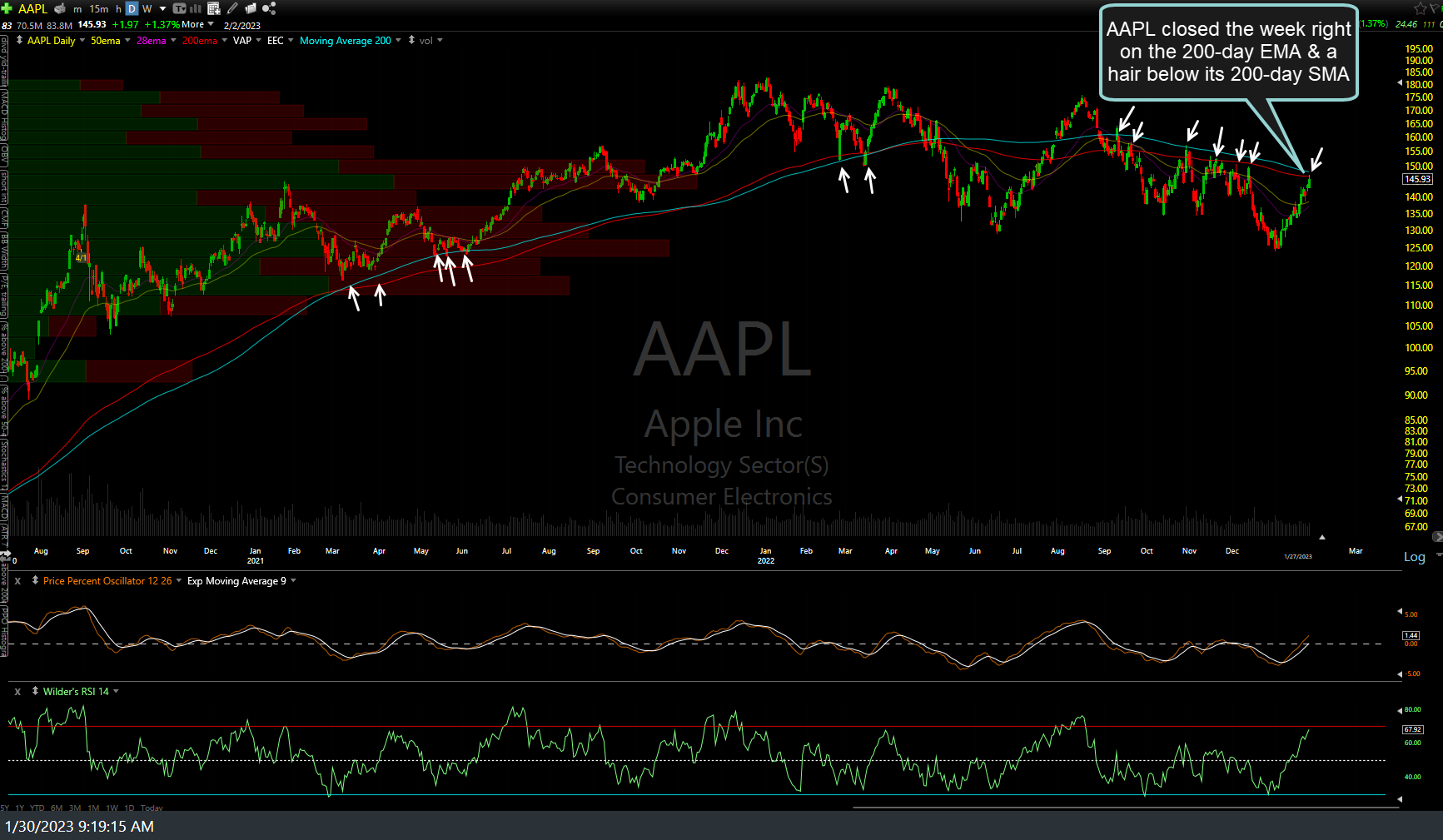

The largest component of both the S&P 500 and Nasdaq 100, AAPL (Apple Inc.), closed the week right on the 200-day EMA & a hair below its 200-day SMA.

MSFT closed the week about 2% shy of the intersecting key 200-day EMA & SMA.

GOOGL closed the week on downtrend line resistance & about 5% below its key 200-day moving averages & major 104.80ish resistance.

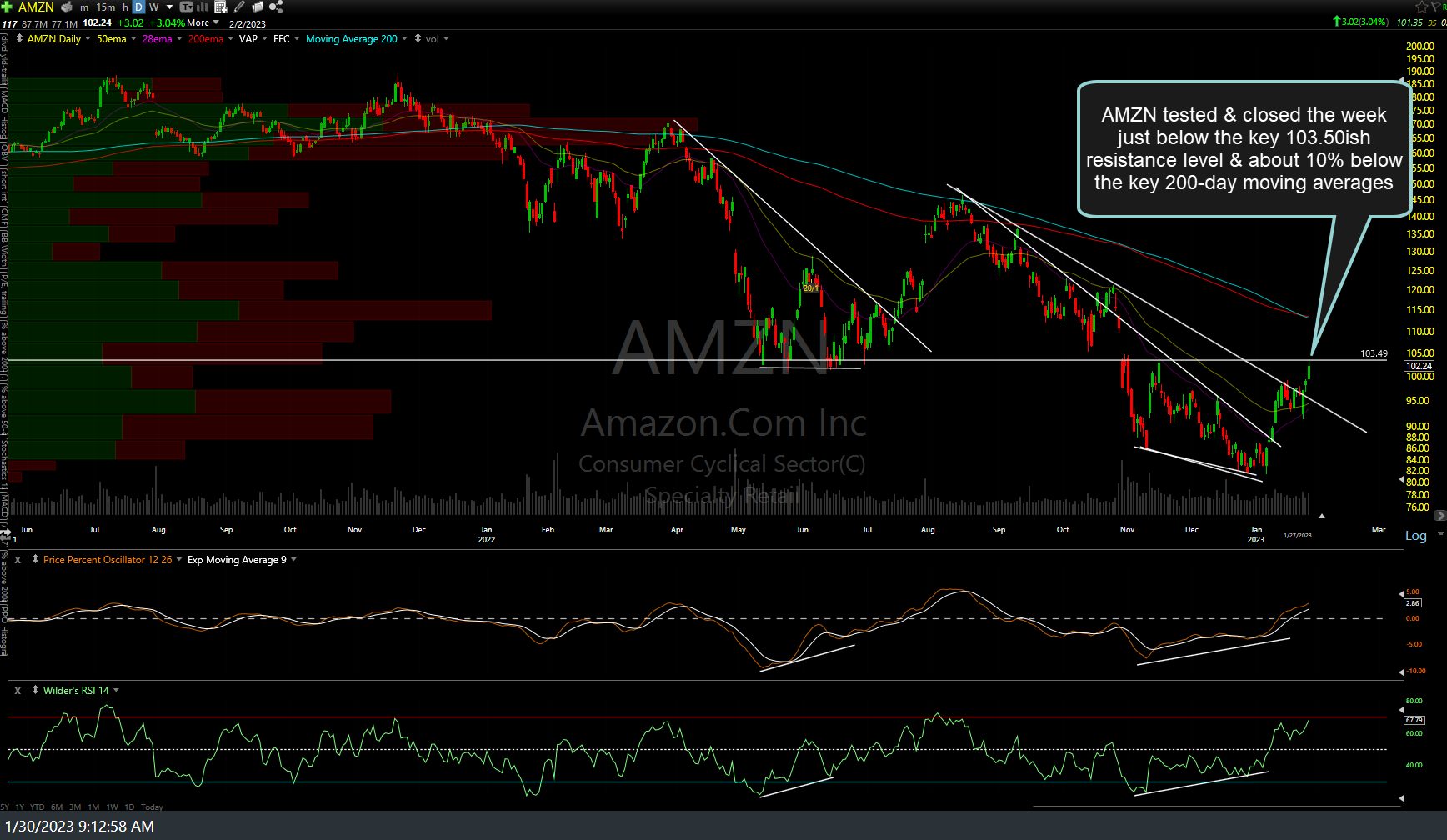

AMZN tested & closed the week just below the key 103.50ish resistance level & about 10% below the key 200-day moving averages.

META closed the week right on the key 200-day SMA & a hair below the key 156.55ish price resistance + 200-day EMA.

TSLA closed the week right on the key179.50ish resistance.

NVDA closed the week just shy of the key 209 resistance & precariously close to its extremely steep near-term uptrend line.

Bottom line: Despite the current uptrend, the R/R clearly favors being short at this time, either for a quick profit-taken pullback trade leading up to Thursday big 3 (AMZN, AAPL, & GOOGL) earnings reports and/or scaling back into swing/trend short positions for what may soon be the next leg down in the larger bear market.