SPY is trading around the 291 level in pre-market with 1-hour to go before the opening bell which still has it above the 289.90 support & downtrend line for now while QQQ is trading just above the 185.95 support but back below the downtrend line. The 60-minute charts show Friday’s closing values with the 2-minute charts showing today’s pre-market trades overlaid.

- SPY 60-min Aug 30th close

- QQQ 60-min Aug 30th close

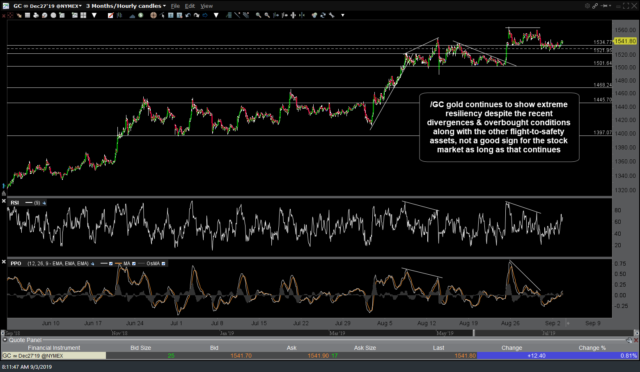

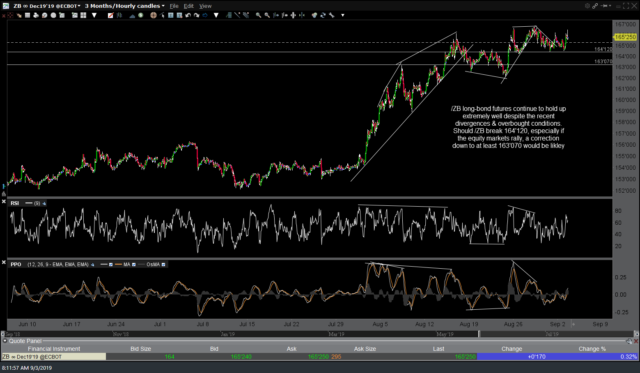

The risk-off assets such as gold, silver & US Treasury bonds continue to show extreme resiliency despite the recent divergences & overbought conditions which is not a good sign for the stock market as long as that continues. Should equities rally today and/or later this week, chances are very good that we’ll get a correction in these risk-off assets down to at least the nearby support levels shown on the 60-minute charts below. Otherwise, they are likely to continue to hold up although with the overbought conditions & current technical posture, the R/R for new long positions in the precious metals or Treasury bonds isn’t very favorable at this time IMO.

- GC 60-min Sept 3rd

- ZB 60-min Sept 3rd

- SI 60-min Sept 3rd

I’m still favoring an indirect hedge on my equity index short positions via shorts on the precious metals & Treasury bonds. While I’m leaning towards the bearish scenario on the equities (more downside this week) but the stock indices currently poised to open on or around some pretty significant support & resistance levels, I’d like to see how the market trades in the first hour or so after the opening bell today before considering whether to add to, reduce or close any of my hedges or my indexes shorts (in my active trading account, still sitting tight on my swing shorts for now).