Early today I had pointed out the Ascending Broadening Top pattern on the SPY 120 minute chart. The video below discusses a very low risk, potentially high return strategy for trading what’s referred to as a partial rise within these potential topping formations. For those who do not have the time or inclination to watch the video, this strategy essentially entails establishing a short position on a partial rise off of the last (likely) tag of the bottom of an Ascending Broadening Top pattern. While a more aggressive trader might opt to begin shorting or scaling in short around the 38.2% retracement (where the SPY is currently trading), adding up to around the 61.8% retracement, with a stop not too far above, the more conventional, lower risk strategy would be to wait for prices to start to roll over before reaching the top. If it looks like the SPY has reversed and might be headed back down towards the bottom of the pattern, one could establish a short position at that point, with a stop slightly above that last reaction high.

The video below discusses the methodology behind this trading strategy as well as the reasoning for expecting a downside break of the pattern vs. an upside breakout at this time. I have also included an updated 60 minute chart on the SPY illustrating the strategy as well as an actual example of a very successful partial rise short on GDX posted here back in early 2012 (that chart along with the entire post can be viewed here).

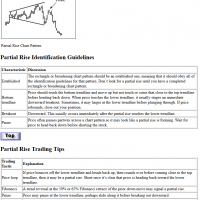

- SPY 60 min Ascending Broadening Top Strategy

- GDX 2012 Partial Rise Short Entry

- Partial Rise Trading Strategy