Over 90% of the biggest US companies report will report their quarterly earnings this week in what is expected to be the fourth consecutive quarter of declining profits. While I’ve spend the better part of the day scanning for new trade setups, it would only be prudent to hold off entering any new positions, especially individual stocks, until the flurry of earnings reports starts to wind down next week.

With such a concentrated number of the largest US corporations reporting this week, I figured that I’d add some cycle lines on a chart of the S&P 500 to see if there were any patterns that stood out in the markets during the previous key earnings weeks. The cycle lines on this 2-year $SPX chart are set 3-months (1 quarter) apart. It could be just mere coincidence that the key inflection points highlighted on this chart occurred during these previous peak reporting weeks but only time will tell.

The most important take-aways from this post would be; 1) to expect an increase in volatility, especially overnight gaps over the next week or two, with so many important companies reporting and 2) regardless of whether the bulk of companies miss, meet or exceed expectations as we get into the thick of earnings season, the important thing is how the market reacts. Do they buy bad news? Do they sell better than expected earnings?…. We’ll soon know. As of now, the potential for a major top in the $SPX (and resumption of the primary downtrend in all other indices) still exists while those potential divergent tops are still a possibility on nearly all US stock indices as well as the potential divergent low on the $VIX highlighted earlier today. On the flip side, the potential for those divergences to be burned through, should the markets continue to climb is also a very real possibility & would certain strengthen the bullish case.

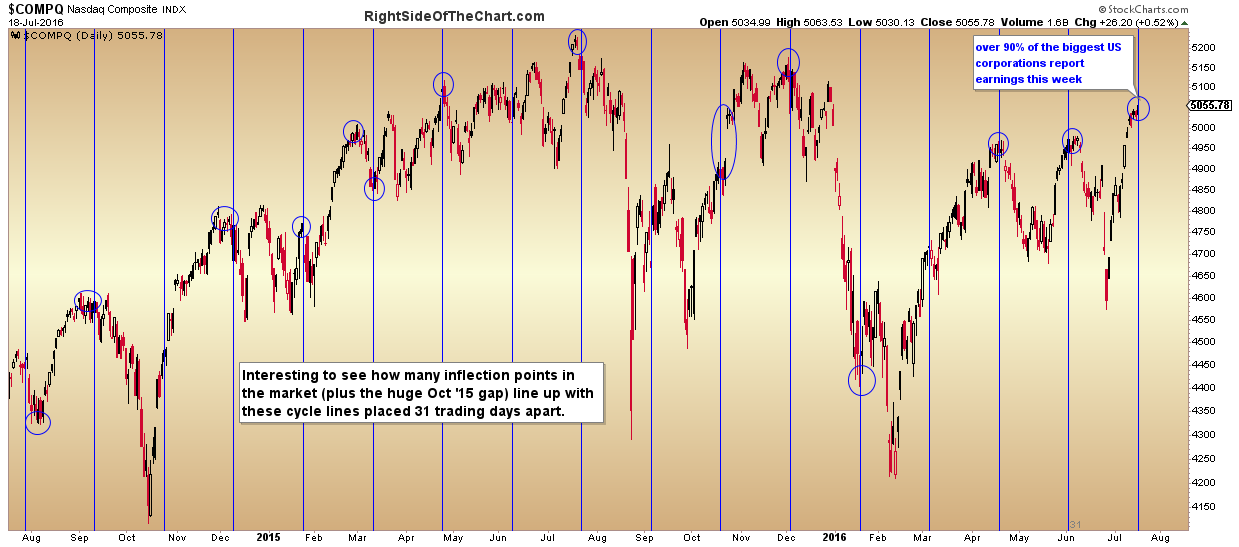

On a somewhat related note, in playing around with the cycle lines, I also added cycle lines 31 trading sessions apart on the $Nasdaq Composite & found it interesting to see how many inflection points in the market over the last couple of years line up with those cycle lines.