/NQ & QQQ are back to the resistance levels that were & still are my ‘preferred’ bounce target levels. While I am still open to the potential for more upside, based on that as well as the desire to book profits on some outsized gain following a tremendous run of profits, I’ve decided to close out all index & related (e.g.- /VIX short position) longs both last night & this morning after gaming that previous pullback (by reversing long to short & then back long again on the expected pullback).

Personally, I’d just like to sit tight as we head into the regular session today & assess the charts as they develop. I still feel this is an objective level (once again, as it was last week) for longer-term swing & trend traders to start scaling back into short positions but in my active trading account, I prefer to watch & assess for now & maybe take advantage of any potential day trading/short-term trading opps that arise.

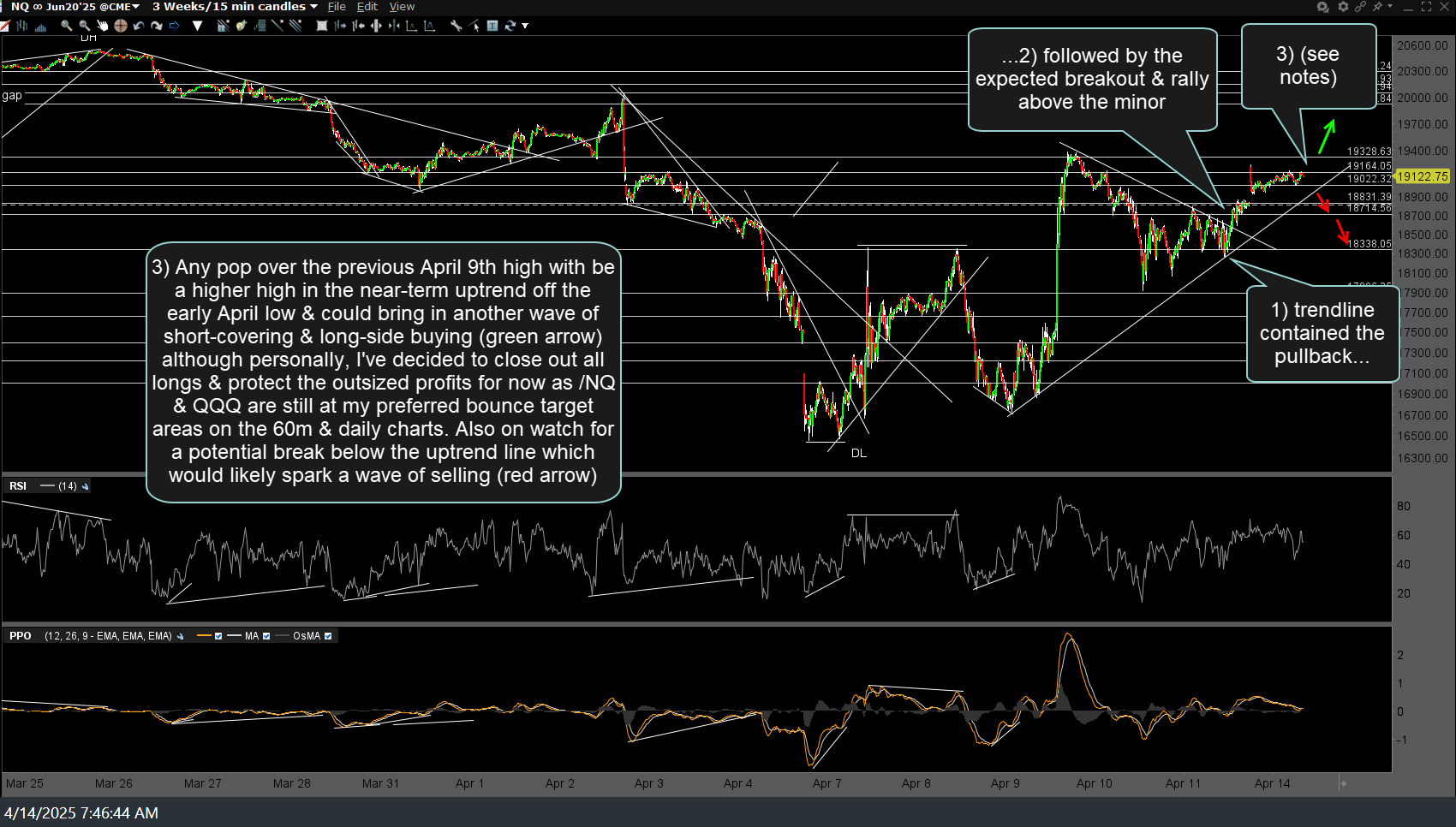

The 15-minute charts below (previously, from Friday, followed by this morning’s updated chart) below show how that scenario played out with the expected pullback down to the trendline, followed by a reversal off that minor uptrend line & a breakout above the minor downtrend line (i.e.- that triangle pattern) with a rally up to where we are now.

Again, I can easily a break & run above the previous reaction high but I can also put decent (albeit lower) odds of a breakdown below that minor uptrend line, followed by another tradable selloff. As such, my preference is to see how things look after the regular session gets underway today before engaging the market, long or short.

On the 120-minute chart, /NQ is once again back to my ideal bounce target zone of 19184-19320 with the downtrend line (resistance) just above as well. Again, a breakout & rally above that intersecting target/resistance zone & intersecting downtrend line just above wouldn’t surprise me in the least, nor would another rejection & drop off this confluence of resistance either. Hence, my preference to book profits & watch for now. Previous (both charts from April 9th) & updated 120-minute charts below.

On a somewhat related note, the /CL (crude futures or USO, crude ETN) still looks headed to T2 soon, especially if the stock market can take out last week’s highs & mount another thrust up.

/OJ (orange juice futures) is still one of my favorite longs on the ag commodities sphere while the charts of the grains (wheat, corn, & soybeans) continue to firm up.

Friday’s sell signal on gold, silver, & GDX are still intact & all 3 still look to offer objective short entries or add-ons.