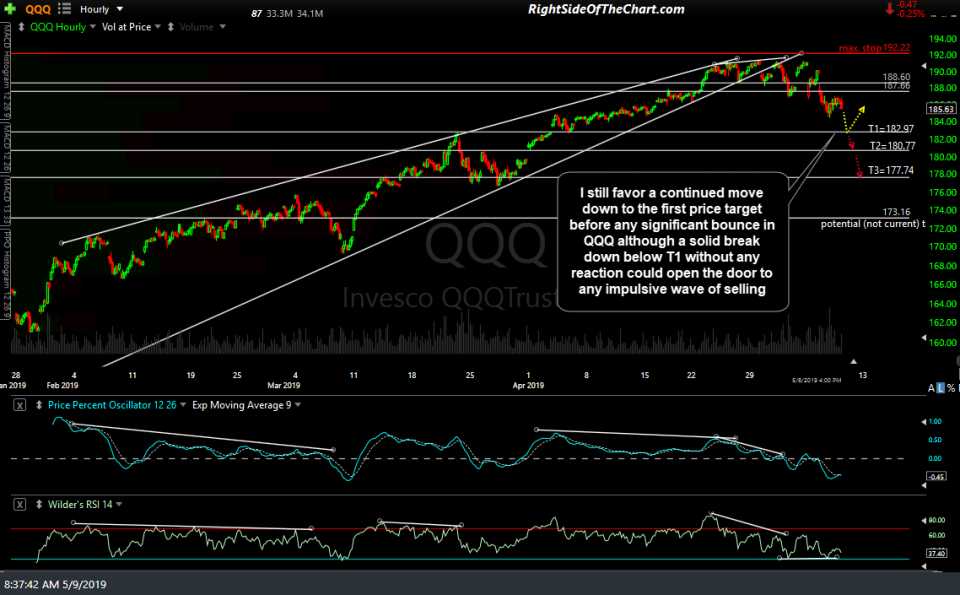

I still favor a continued move down to the first price target before any significant bounce in QQQ although a solid break down below T1 without any reaction could open the door to any impulsive wave of selling. 60-minute chart:

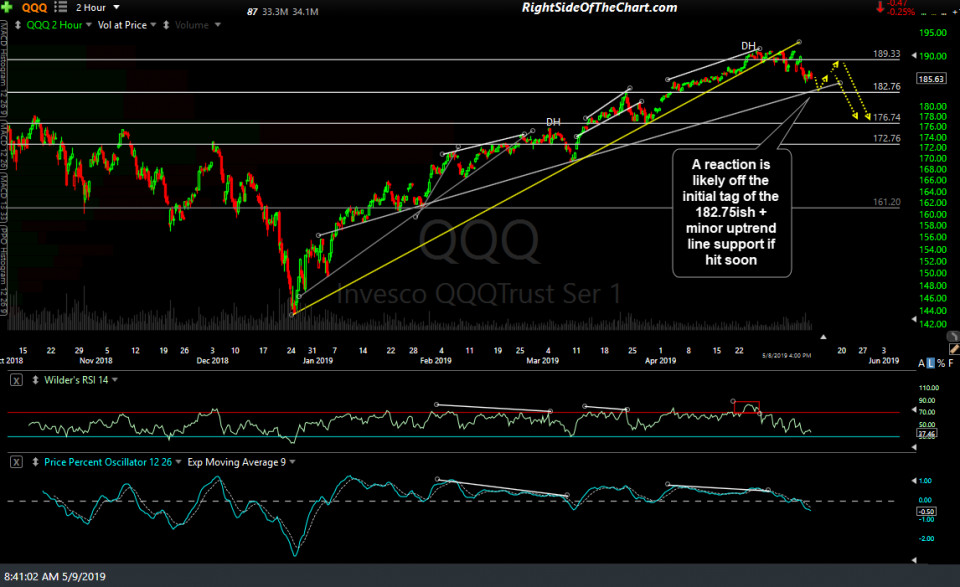

A reaction is likely off the initial tag of the 182.75ish + minor uptrend line support if hit soon on this QQQ 120-minute chart:

Likewise, SPY is likely to reverse off the 284.36 (preferred) or 282.40 support level if hit soon (60-minute chart):

To reiterate, the nearby support levels highlighted above are levels where I think a reaction is likely although the only thing that has changed since the QQQ Active Short Trade was added recently is that the case for a substantial correction & possibly more has continued to firm up. While active traders might opt to attempt to micro-manage a swing trade on the Q’s (e.g.- book profits at T1 and/or reverse to a long to game a bounce off that level & then going back short for the next leg down), typical swing traders might opt to just sit tight while lowering their stops to entry if/when T1 or T2 is hit while holding the position to let the charts play out.

Again, just because the odds favor a reaction off these support levels does not mean that it will happen, assuming that we even get there soon. One thing giving me pause on the ‘tradable’ bounce scenario off those levels is that if those supports are hit, that will most likely cause solid breakdowns below those Dec 24th uptrend lines in the top three FAAMG stocks; AAPL, MSFT and AMZN, which would have longer-term & more powerful bearish implications unless those trendlines were recovered by the close.