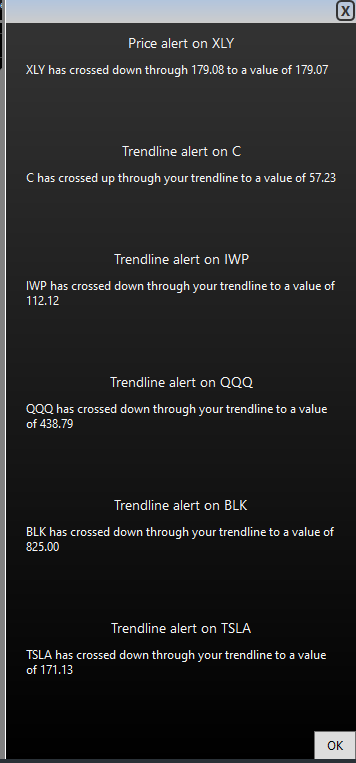

As I had mentioned, I’d be taken some time off while my kids are home for spring break & was offshore out of cell phone range all day yesterday, hence the lack of updates. Shortly after the open today I was greeted with the flurry of “pop-corn” notifications on some of the key stocks & sectors I’ve been highlighted recently popping up on my screen (in addition to several that fired off yesterday while I was out).

Additionally, the top (largest) sectors of the S&P 500 that I’ve been tracking closely have all broken down, increasing the odds that we are in the early stages of a much larger correction and/or next leg down in a bear market with a few nearby support levels just below on some as well as the yellow levels on the majority of the stocks FKA The Magnificent 7. Basically, the bulls need to step in soon to foil these recent breakdowns & defend the remaining nearby key support levels or the odds of a double-digit drop in the indexes & most leading tech stocks will quickly go from favorable to very favorable. Should be an interesting day/week. More to come later although I have to go clean the boat & fish now so back later today, probably after lunchtime.

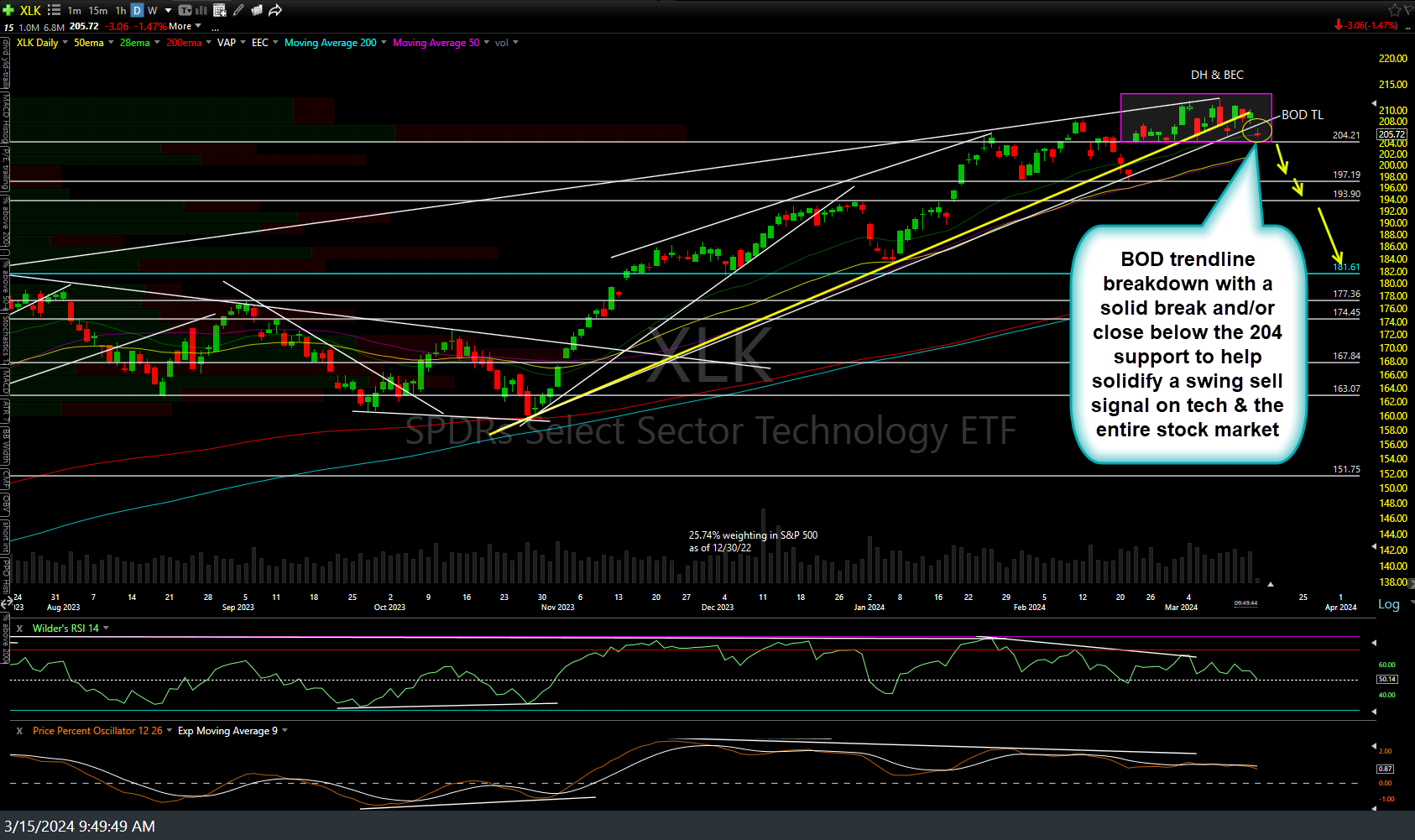

BOD (benefit of the doubt) trendline breakdown on XLK (tech sector ETF) with a solid break and/or close below the 204 support to help solidify a swing sell signal on tech & the entire stock market.

BOD trendline breakdown & following thru so far today on XLV (healthcare) following the recent primary trendline breakdown & subsequent backtests.

XLF (financials) closed below the uptrend line/wedge yesterday & following thru so far today & I had several price alerts (for breakdowns) from key financial stocks yesterday & today with some of the big ones, right on or just above support, such as JPM which is currently backtesting the rising wedge pattern (uptrend line) it just broke down below on the daily chart. As such, still can’t rule out a stick save by the bulls although I don’t expect it & I will try to cover the financials in more depth later today. XLF daily below.

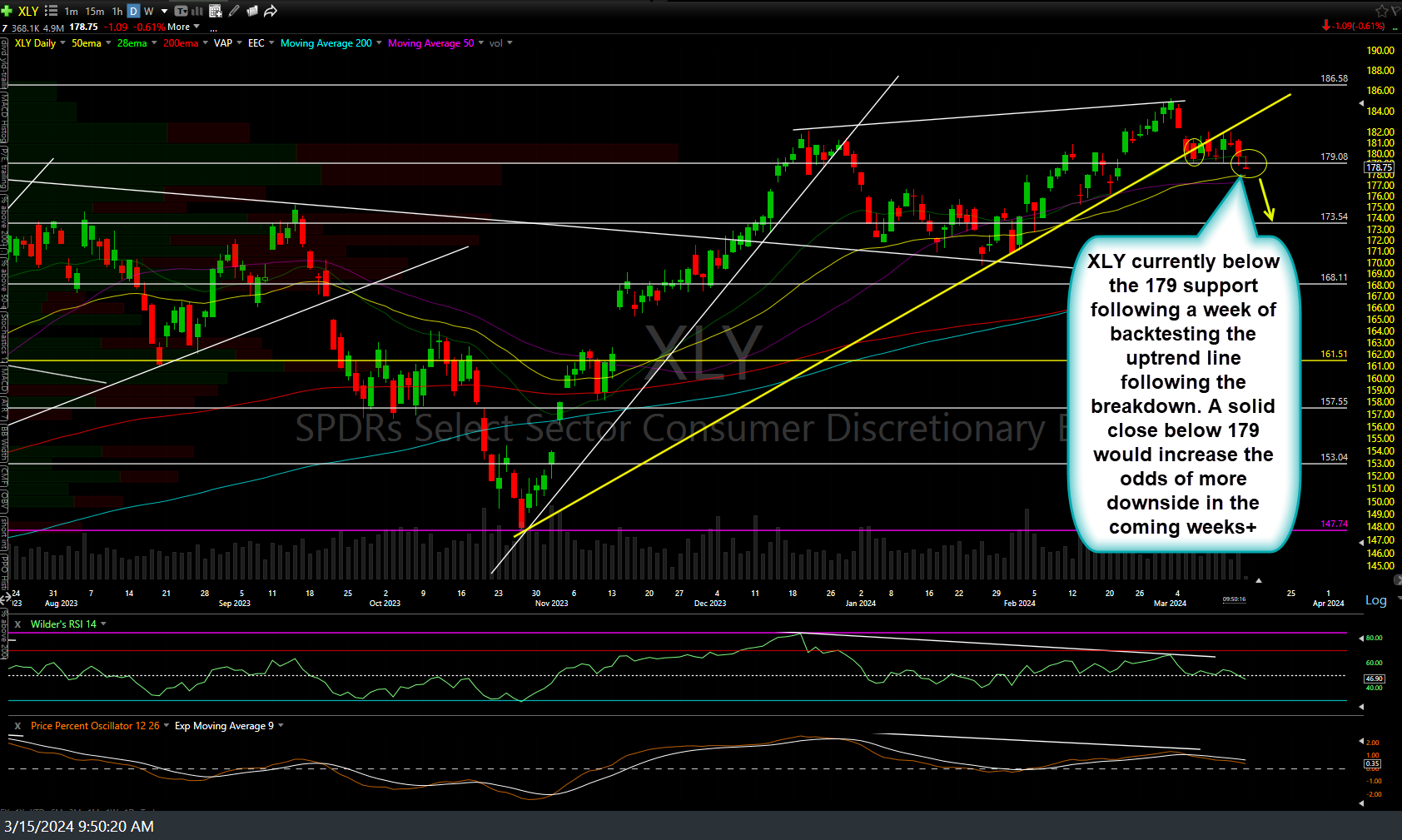

XLY (consumer discretionary sector) currently trading below the 179 support following a week of backtesting the uptrend line following the breakdown. A solid close below 179 would increase the odds of more downside in the coming weeks+.

IEF (7-10 yr Treasury bond ETF) back in the YELLOW ZONE after the rejection off the 95.40 key resistance. A drop in the ORANGE ZONE would help to firm up the recent sell signals on the stock market. 60-minute chart below.