Although the intraday trading range was somewhat higher that it has been lately with a morning dip answered by a nearly equal afternoon rip, the US equity markets essentially closed flat for the day with the large cap indices (SPY & QQQ) closing the day up 0.19% & 0.18% respectively and the small & mid-caps (IWM & MDY) closing down -0.29% & -0.18% respectively. While there weren’t any fireworks in the market today, there were a few technical events worth noting.

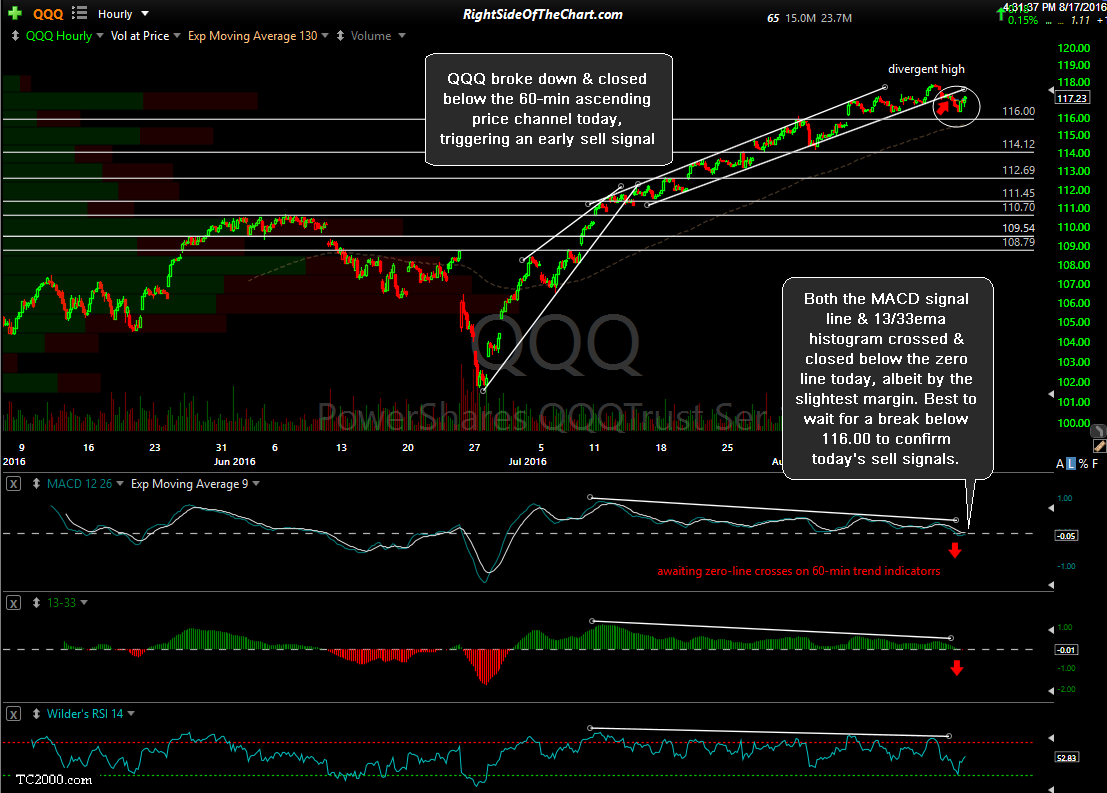

QQQ broke down & closed below the 60-min ascending price channel today, triggering an early sell signal with both the MACD signal line & 13/33ema histogram crossing & closing below the zero line today, albeit by the slightest margin. With the lack of impulsive selling, it would be prudent to wait for a break below 116.00 to confirm today’s sell signals. On a related note, AAPL also broke down & closed below the 60-minute uptrend line that I have been highlighting recently, thereby taking the last of the “Big Five” below the uptrend line support levels that I’ve been watching. Also worth noting is the fact that the 60-minute trend indicators on all of the five (AAPL, GOOG, MSFT, AMZN & FB) except AAPL are now in bearish territory.

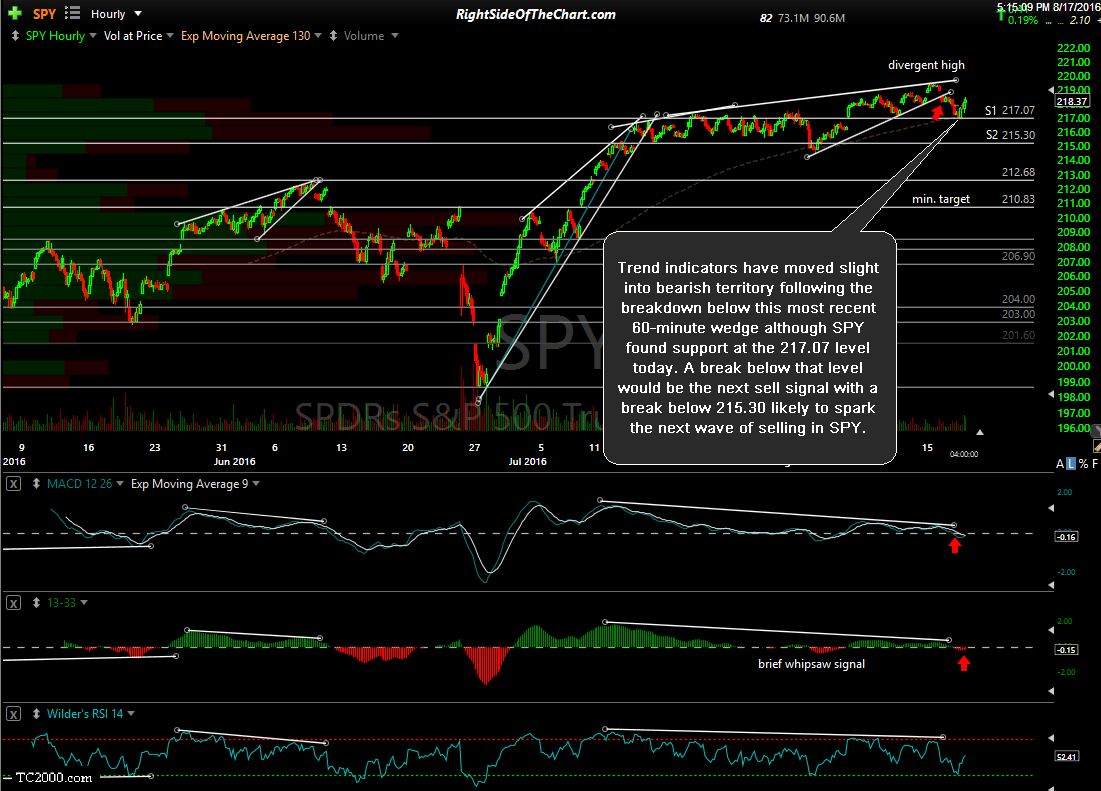

Trend indicators have moved slightly into bearish territory following the breakdown below this most recent 60-minute wedge although SPY found support at the 217.07 level today. A break below that level would be the next sell signal with a break below 215.30 likely to spark the next wave of selling in SPY.