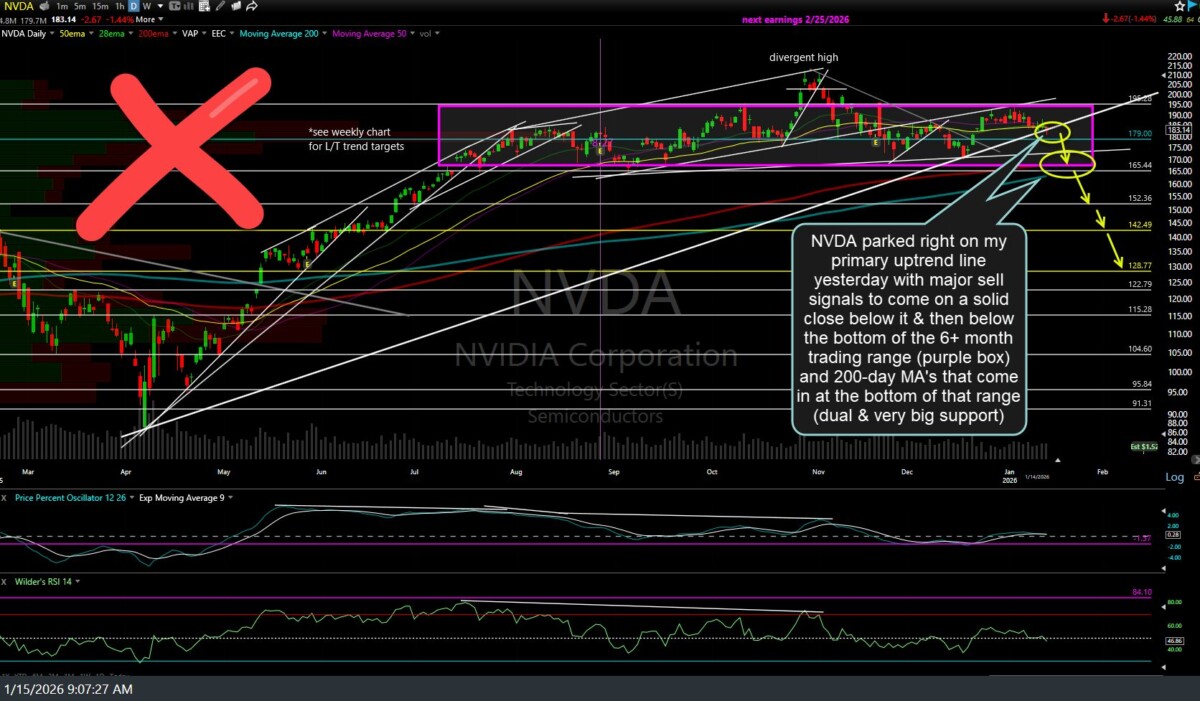

For convience, I’ve taken screenshots of each of the Magnificent 8 market-leading stocks, highlighting the sell signals, both recent and pending. For the sake of simplicity, I’ve added green checkmarks to those that have already triggered the sell signals, which I believe have solidified the breakdowns that likely confirm a significant top in those stocks, with more downside to come (counter-trend rallies aside).

As I’ve continually harped on, we need to see the majority, not one or two, of the Mag 8 stocks trigger major (not minor) sell signals to significantly increase the odds of a substantial (double-digit) correction in the major stock indices (SPY & QQQ), along with some additional support breaks in the financial sector (XLF).

Basically, I have 3 of the 8 currently on what I would consider “major” sell signals, with the majority (5) still pending, although all of those, with the exception of GOOGL (the current ‘best in breed’), have recently triggered minor sell signals on the daily and/or 60-minute time frames. When/if the majority of the Mag 8 trigger their respective check marks, that will help to confirm the case for a full swing or trend short position, assuming QQQ, SPY, & XLK have also triggered comparable sell signals.

Again, at the risk of oversimplifying things, as there are numerous variables and other technicals to consider, I believe if & when the majority of the aforementioned “check marks” are triggered, that will be an objective time to move to a full (whatever that means to each trader) short position on the Nasdaq 100, especially if confirmed by comparable sell signals in the major indices & top sectors of the S&P 500 (tech, financials, consumer discretionary, & communications).

Also, note that the charts above are posted in order of market capitalization; therefore, checkmarks on the upper charts would carry a higher weighting than those on the lower charts, due to their respective impact on the cap-weighted Nasdaq 100 and S&P 500 indices.