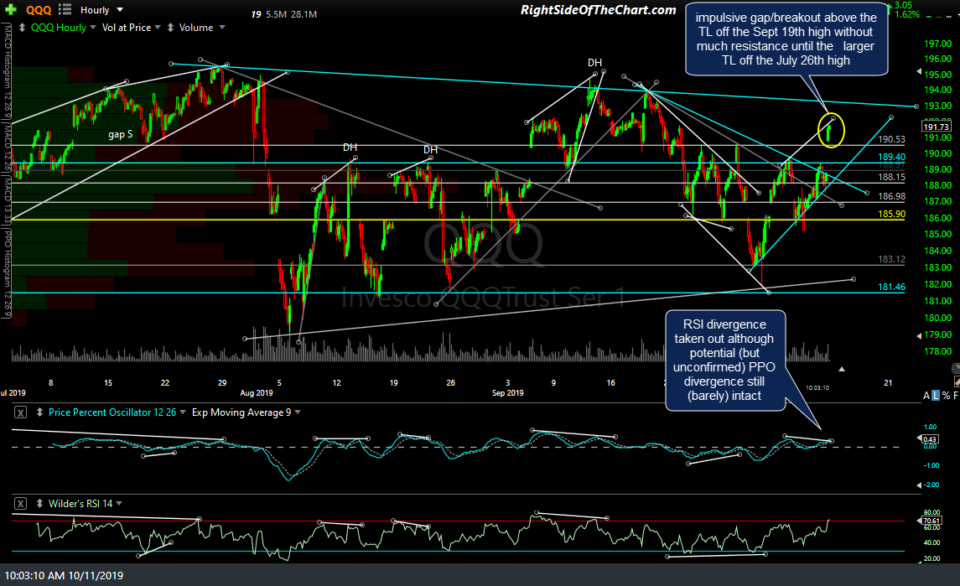

QQQ, SPY & XLK (tech sector ETF) have all made impulsive gaps above the highlighted price & downtrend line resistance levels from yesterday’s videos which is clearly bullish as long as they remain above those key former resistance, now support levels. QQQ made an impulsive gap/breakout above the TL off the Sept 19th high without much resistance until the larger TL off the July 26th high. The RSI divergence has been taken out with a higher high while the potential (but unconfirmed) PPO divergence is still (barely) intact.

We also had an impulsive gap/breakout above the key 294 level in SPY which has now rallied into the 297.86 R level. As with QQQ, the potential (unconfirmed) PPO divergences are still hanging on by a thread as the RSI divergence has been negated with a higher high.

We also had an impulsive gap/breakout above the downtrend line highlighted in yesterday’s video with XLK now trading at the more significant downtrend line off the July 24th highs. The test of that downtrend line below also correlates to a backtest of the primary uptrend line off the December 24th low on the XLK daily chart. As such, an impulsive rejection off these trendlines would be worth noting as that has the potential to confirm the divergences on the PPO of XLK (as well as those on SPY & QQQ). Basically, if today’s breakouts on the 60-minute charts are going to prove to be whipsaw signals, this would be an ideal spot for the reversal to start. However, until & unless that occurs (i.e.- a move back down below SPY 294 & QQQ 198.40), today’s breakouts can be construed as anything but near-term bullish.

/ES remains above the near-term uptrend line following the recent breakout above the downtrend line + key 2946 resistance levels while up against the 2985 resistance level now with the next sell signal still pending a break below the minor (yellow) uptrend line.

/NQ is also still above the minor uptrend line following the breakout aboe the while testing the 7885 resistance level now with the PPO divergence still barely intact for now, just as with /ES, SPY, QQQ, & XLK. So essentially, today’s breakouts are near-term bullish until & unless faded with the indexes falling back below the recent breakout levels.