Member @up requested an update on gold, silver & the US Dollar along with the key currencies that have the largest impact on the US Dollar index (which in turn, affects the price of gold & silver). My read on the charts hasn’t changed much since Wednesday’s video as well as these follow-up comments that I posted yesterday in reply to the following inquiry from @zjgolf44:

@zjgolf44: Also thanks for your recent gold video. What’s your take on EURUSD’s drop today below it’s lower ascending trend line? (USDJPY’s possible breakout) It doesn’t seem like gold is reacting correctly to todays action in the currencies. Also Gold and Silver seems to have gone in opposite directions today. Thank, Z

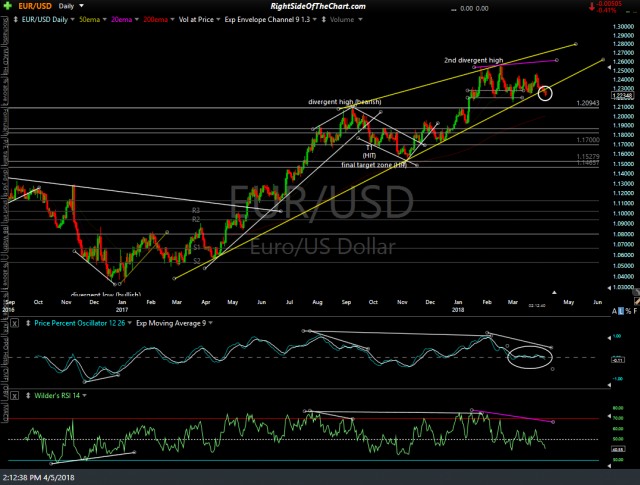

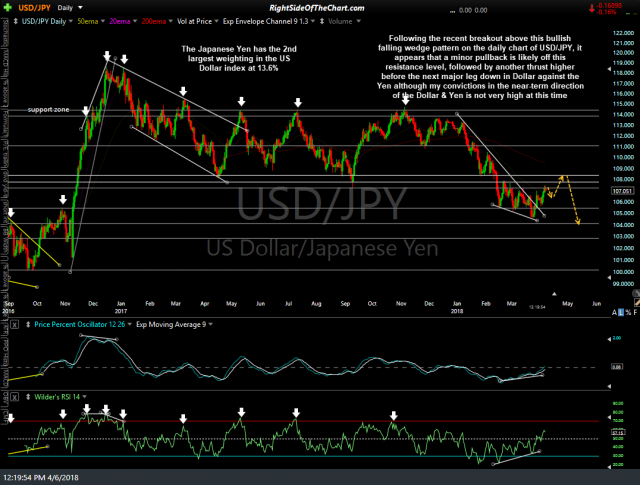

My reply with the included charts below: I noticed that breakdown in the EUR/USD earlier & while not very impulsive, we could see some follow-through the downside as the USD/JPY also recently broke out. The Yen is the 2nd largest component in the $US Dollar index & looks to be headed higher as well (note: EUR/USD down means the US dollar is rising against the Euro whereas USD/JPY down means the dollar is falling against the Yen & vice versa).

The thing is that gold is still stuck smack within the middle of that sloppy trading range as is silver. Since I usually don’t trade currencies, preferring to use them to confirm or refute a trade setup in gold & GDX, I’m just standing aside watching the currencies for now.

Also, note that this could be one of those periods where we get a temporary disconnect of the inverse correlation between gold & the $USD. Maybe a trade to be made in gold soon, maybe not. I also wouldn’t be overly concerned with the fact silver is up today while gold is down as the moves aren’t very large.

- EUR-USD daily April 5th

- USD-JPY daily April 5th

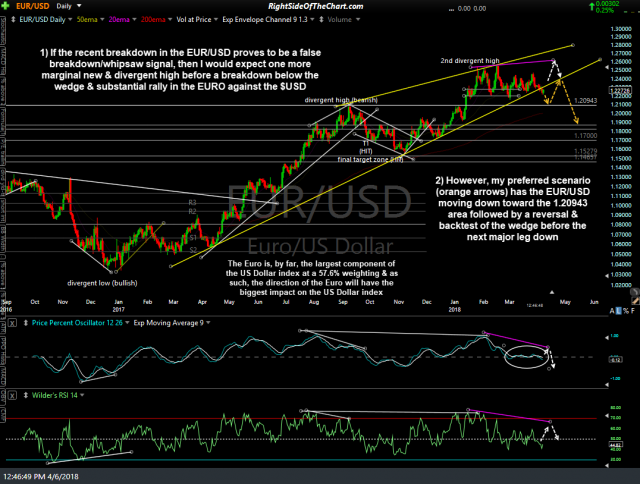

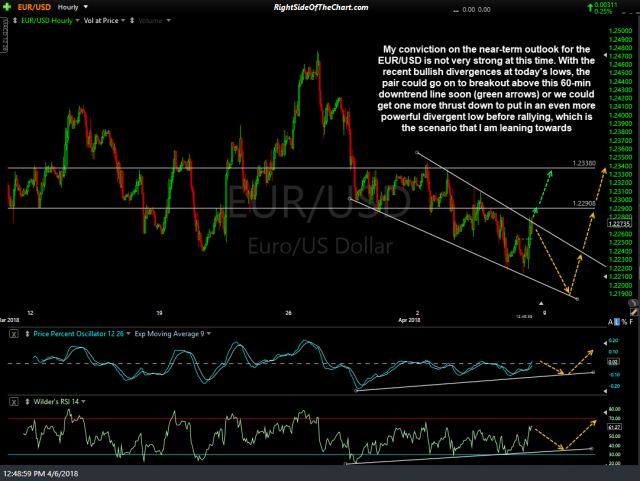

Essentially, both gold (GLD) & silver (SLV) remain locked in a sideways consolidation range which, far from coincidence, coincides with the recent sideways trading range in the US Dollar index. Therefore, I continue to refrain from any trades on gold, silver or the mining stocks & will continue to do so until the next major trend in the US Dollar starts to become more clear. The charts below highlight some of the key support & resistance levels on GLD, SLV, EUR/USD & USD/JPY along with some potential scenarios.

click on the first chart to expand, then click anywhere on the right of each expanded chart to advance to the next image or pinch-zoom on mobile

- GLD daily April 6th

- SLV daily April 6th

- EUR-USD daily April 6th

- EUR-USD 60-min Jan 6th

- USD-JPY daily April 6th

- USD-JPY 60-min April 6th

Bottom line: The second mouse gets the cheese & in the case of the next tradable trend in gold, silver & GDX, I’d rather wait for the charts to confirm a high-probability entry than try to get in front of this one & risk getting caught in any additional sideways chop or worse, the trade going against me & stopping out for a loss.