The precious metals trades are in solid rally mode today with /PL (platinum futures) up nearly 5% on the day following the breakout of the primary downtrend line & up over 14% from the recently highlighted bullish falling wedge/minor downtrend breakout & buy signal. PPLT is the platinum ETF proxy for this trade. 120-minute chart below.

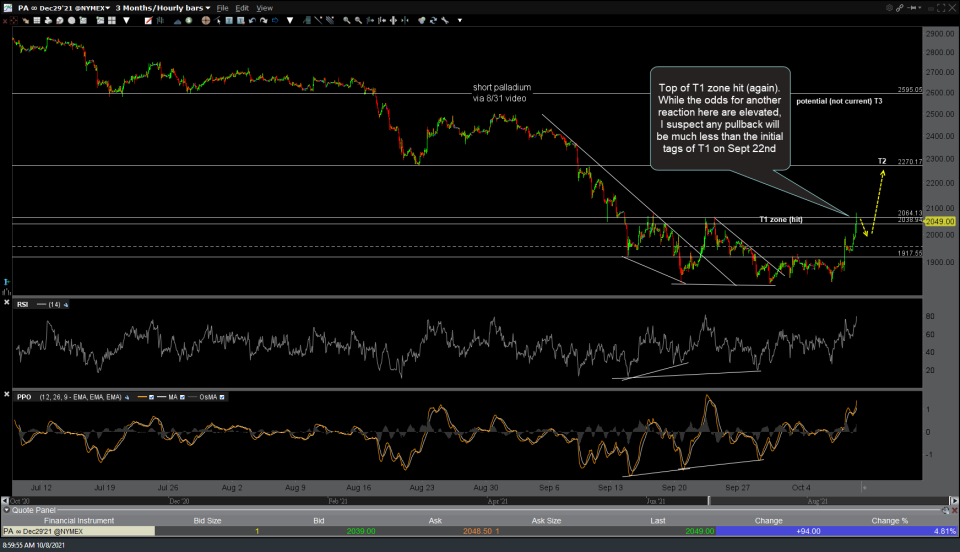

/PA (palladium futures) has hit the top of T1 zone (again). While the odds for another reaction here are elevated, I suspect any pullback will be much less than the initial tags of T1 on Sept 22nd. PALL is the palladium ETF proxy for this trade. 60-minute chart below.

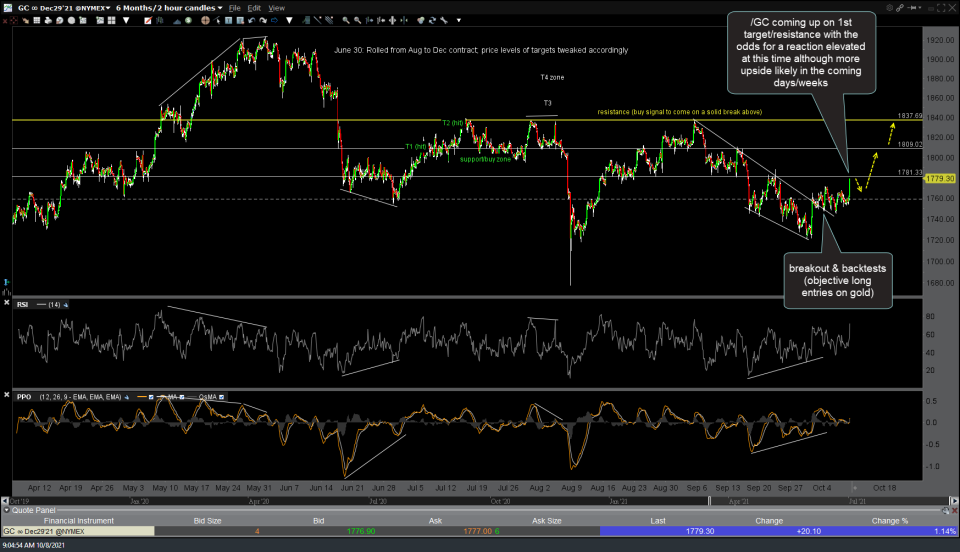

/GC (gold futures) is coming up on the first target/resistance level with the odds for a reaction elevated at this time although more upside likely in the coming days/weeks. GLD (gold) and/or GDX/GDXJ (senior & junior gold miners) are the ETF proxies for this trade. The 120-minute chart below is a “less busy” version of the 60-minute chart that I’ve been highlighting in recent videos with some near-term swing targets shown at the marked horizontal resistance levels.

/SI (silver futures) has hit the 23ish price target with a decent chance of a reaction here. Reaction or not, silver still appears to have more upside in the coming days, weeks, & quite possibly, months. SLV (silver) and/or SIL/SILJ (senior & junior silver miners) are the ETF proxies for this trade. 120-minute chart below.

On a related note, /DX ($US Dollar futures) has fallen to just above the uptrend line (support) highlighted in recent videos while /E7 (Euro futures) has rallied right up to its comparable downtrend line (resistance), hence, my expectation for at least one last reaction on both before a more powerful buy signal on gold, if & when both the $USD & Euro make solid breakouts.