Member @dpatel inquired about my thoughts for the precious metals & mining stocks. As I believe that any analysis on gold & silver isn’t complete without including the outlook for the US Dollar, let’s start there. My preferred scenario has the US Dollar Index continuing down to the 93ish level followed by a bounce & at least one more thrust down towards the 89 area. If so, that would likely add a tailwind to a potential rally in gold & commodities in the coming months. I would also be remiss not to point out the bullish divergences on the daily times frame in the US Dollar as they can certainly play out for a decent rally. However, my analysis indicates a continuation of the current downtrend in the dollar until at at least the 93ish area, barring the usually counter-trend rallies along the way.

- DXY0 weekly July 13th

- DXY0 daily July 13th

- UUP daily July 13th

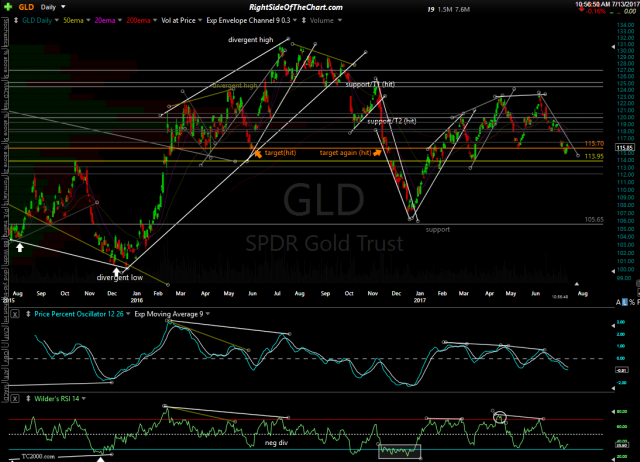

Moving on to the precious metals, SLV (silver ETF) looks a little better than GLD (gold ETF) as it experienced a deeper correction on the recent leg down, becoming quite oversold & putting in solid positive (bullish) divergences on what appears to be a potential selling climax. GLD also had a pretty healthy correction, also reaching oversold levels (RSI readings of 30 or below) although it just slightly missed putting in a divergent low as both the RSI as well as the PPO & MACD just barely made slightly lower lows on the recent lows in GLD. Regardless, GLD did manage (so far) to regain the 115.70 support level which was something that I recently stated that I’d be watching for as a potential bullish development (a flush-out move below 115.70 followed by a recovery of that significant support/resistance level). Now watching for a breakout above the steep downtrend lines in both GLD & SLV for potential buy signals.

- SLV daily July 13th

- GLD daily July 13th

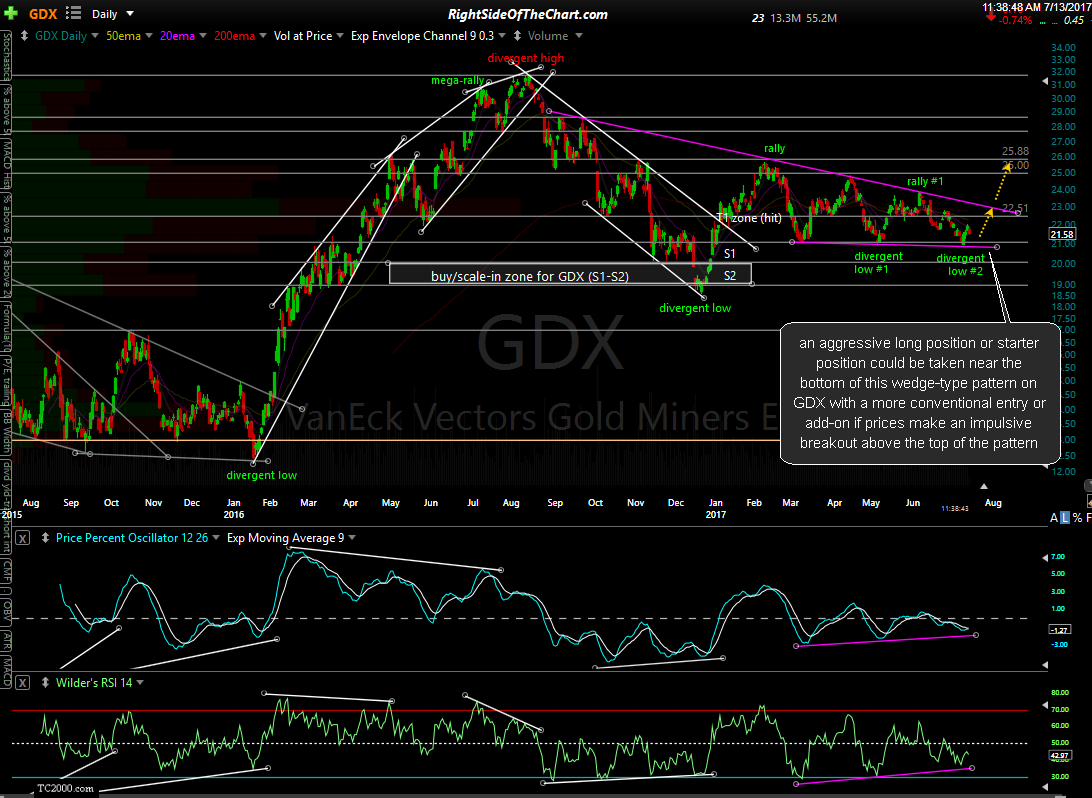

GDX (gold miners ETF) has held up surprising well during the recent correction in gold & silver & appears to be setting up for the next major leg up following many months of consolidation. An aggressive long position or starter position could be taken near the bottom of this wedge-type pattern on GDX with a more conventional entry or add-on if prices make an impulsive breakout above the top of the pattern.