With the stock market trading mostly flat today, there aren’t any significant technical developments worth noting. However, I do believe it is worth pointing out the divergences building on the US Dollar & Euro on the 60-minute time frames, especially as they could prove to be the catalyst to spark a rally in gold & silver with the potential to pull both out of their recent trading ranges.

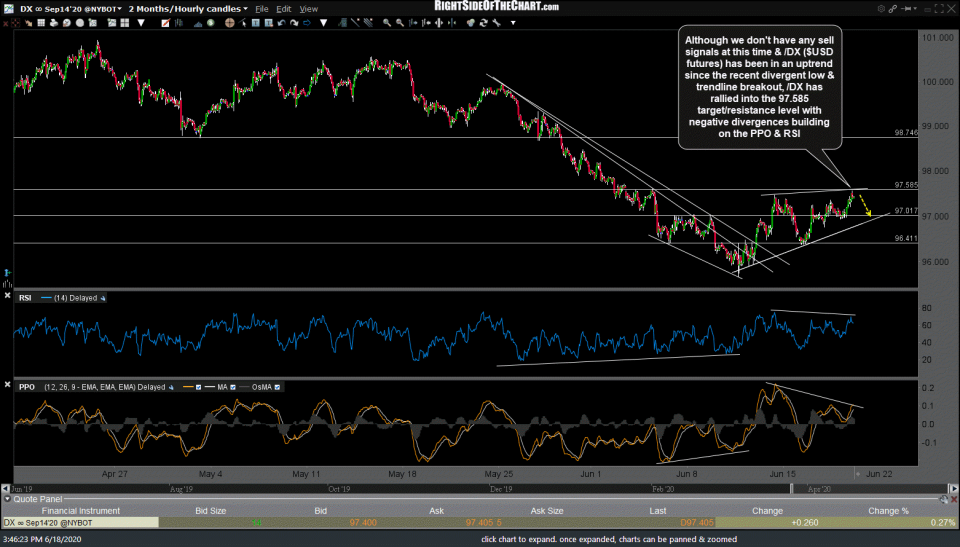

Although we don’t have any sell signals at this time & /DX ($USD futures) has been in an uptrend since the recent divergent low & trendline breakout, /DX has rallied into the 97.585 target/resistance level with negative divergences building on the PPO & RSI.

/E7 Euro futures have fallen to the 1.1209 target/support level following the recent divergent high & breakdown below the uptrend lines. Should the Euro hold & reverse off this support, a rally back up to the downtrend line (a likely target) would most likely correlate with a pullback in the US Dollar.

A buy signal on /SI (silver futures) and SLV (silver ETF) would come on a solid break above this downtrend line, especially if the $USD & Euro reversal off their current resistance/support levels.

Likewise, should the US Dollar pullback soon, a buy signal on /GC (gold futures) and GLD (gold ETF) would come on an impulsive break above this downtrend line + 1757ish resistance level just above.

Should aforementioned buy signals on gold, silver & the Euro (as well as a reversal in the $USD) occur, I’d be partial to letting any long positions on the precious metals run for the time as a breakout above the 2½ month sideways trading range in gold could have the potential to trigger the next bullish uptrend in gold. First things first, and that would be to see a solid reversal in the major currencies as well as breakouts above those downtrend lines on the 60-minute charts of gold & silver above.